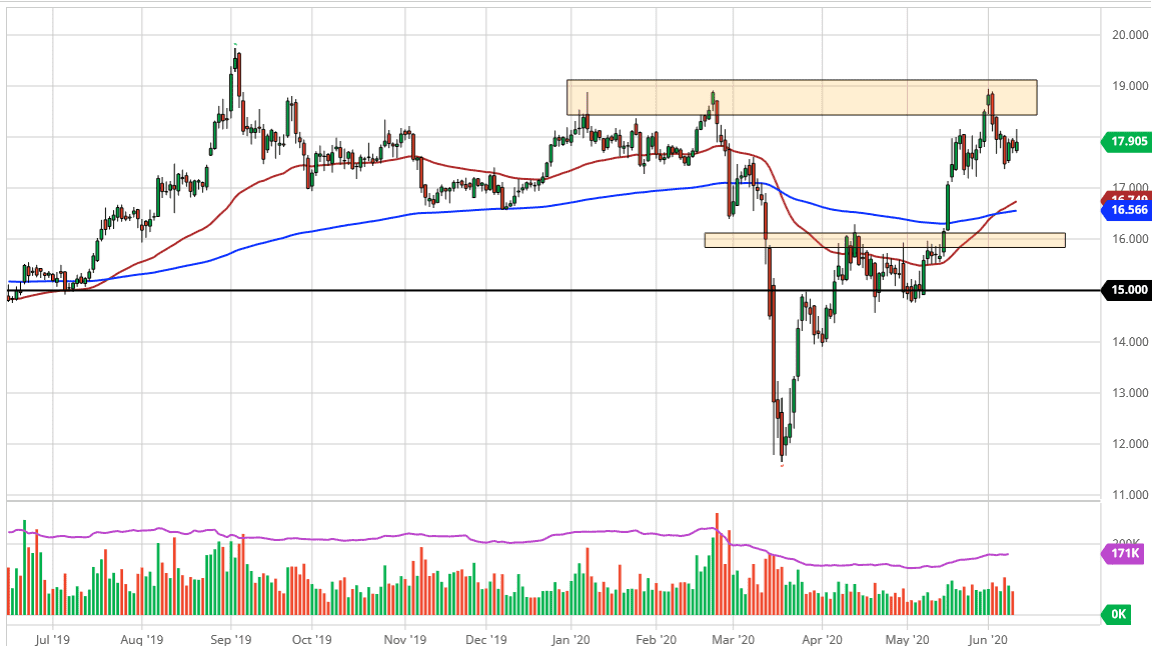

The silver markets rallied a bit during the trading session on Wednesday, breaking above the crucial $18 level again as the US dollar has weakened. This is a very bullish move for silver, and thereby I suspect that there will be a lot of traders looking to test the highs again. The highs, in this case the $19 level, have been tested multiple times and have held so far. Having said that, the market has found buyers on dips at much higher levels this time, so I think we may be building up enough momentum to finally break out.

Obviously, that’s something that we have to wait and see whether or not happens, but if it does, then I think it is a pretty safe bet to think that the silver market will be looking towards the $20 level. This shows the $20 level that serious questions need to be asked, as a break above there could signify some type of massive “melt up” like we have had in the past, during the Great Financial Crisis. Back then, silver shot all the way up to $50 and we could see a repeat of that if this does in fact happen.

Looking at the chart though, I think it is much more likely that we simply grind back and forth between here and $19 until we figure out exactly where we want to go. Pay attention to the US dollar, because if it continues to get absolutely hammered that should help silver based upon the precious metals trade. However, if the US dollar certainly strengthens, unless it has something to do with some type of massive influx into the industry, silver will more than likely selloff as a result. Remember, silver is not only a precious metal, but it is also an industrial one. It is because of this that silver tends to be much more volatile than gold, and therefore you need to be overly cautious about position size you are using.

All things being equal though, silver does tend to move in the same direction as gold longer term, so make sure to check that market as well, as it can keep you in sync as far as the precious metals part of the trade is concerned. If the industrial demand for silver picks up, that is obviously a good sign as well, so this point I think the odds are much more likely we rally then fail. However, if we do pull back, I think the $17 area is massive support.