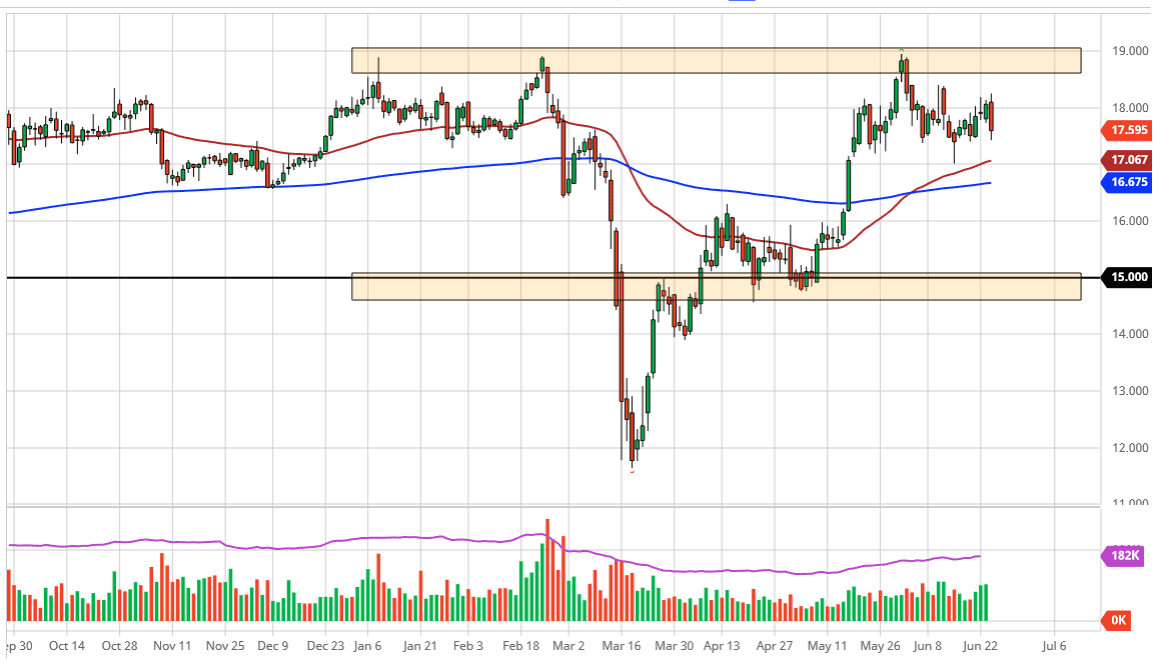

Silver markets fell hard during the trading session on Wednesday, reaching down towards the $17.40 level, but have recovered slightly showing signs of support again. This is a market that I think is very bullish and given enough time we should see buyers jump into the market and try to push to the upside. At this point, the market is likely to see a lot of volatility, and I think that underneath we not only have seen quite a bit of buying pressure, but we also have the 50 day EMA near the $17.00 level.

If we were to break down below that level, it is likely that we could go down to the 200 day EMA which is closer to the $16.60 level. At this point, I think it is only a matter of time before we see buyers jump in that area as well. Even if we were to break down below there, I see a huge block of buying pressure between the $16 level and $15. I believe that the $15 level is essentially the “floor”, and I do not think that we will see the market break down below there. I think we are trying to build up enough momentum to finally break out to the upside, perhaps to the $19 level.

With this being the case, I think it is only a matter of time before we break above the $19 level and go looking towards $20 level. The $20 level is a key level from a historical standpoint, as the market breaking above there opened up the door to the $50 level during the great financial crisis about 12 years ago. I think that is eventually going to happen, but it has got a lot of work to be done between now and then before it happens.

The 200 day EMA obviously attract a lot of attention. The 200 day EMA has been crucial for this pair for quite some time, and as a result, it is always worth paying attention to. It should be noted that we are starting to see the 200 day EMA drift a little bit higher. For those of you who are even longer-term traders, the “golden cross” happened a couple of weeks ago, so some of those people will probably purchase over in a physical form, but for those of you trading levered products, you need to look at pullbacks like we have just seen as potential buying opportunities in little bits and pieces.