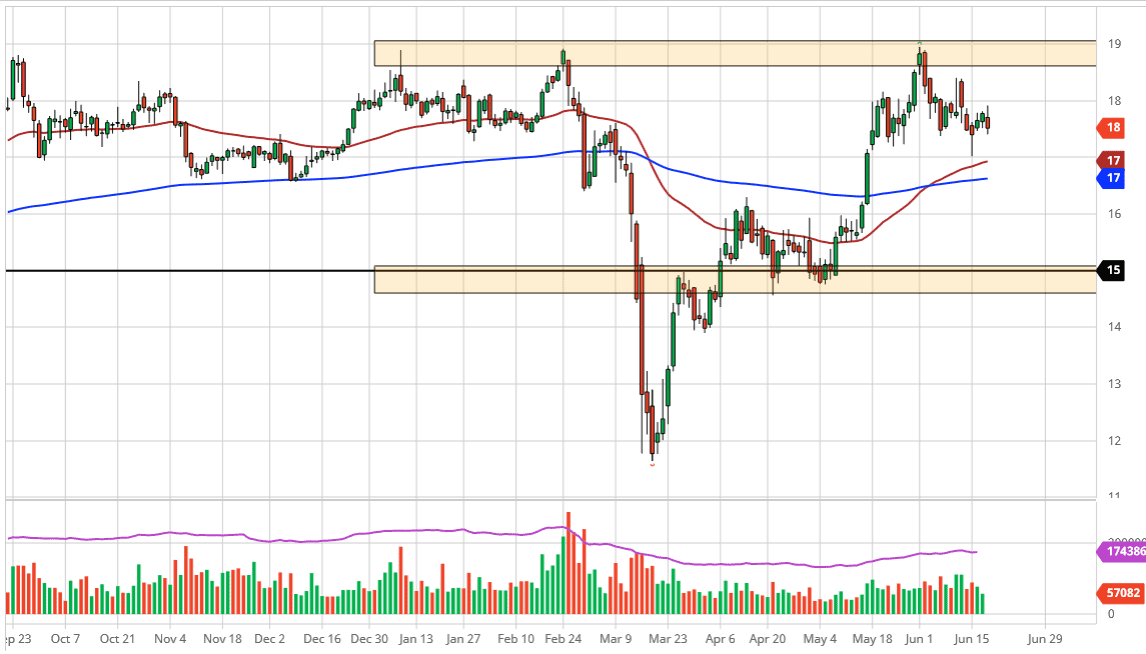

The silver markets have gone back and forth during the trading session on Thursday as the $18 level was tested before pulling back towards the $17.25 level. At this point, it is obvious that silver markets are trying to figure out where they are going next, so I think if we can break above the $18 level it is likely that we could go to the $18.50 level next, and then eventually the $19 level. On the downside, the $17 level will offer plenty of support, based upon the fact that it has previously been supportive and has been the scene of the 50 day EMA, and it looks to me like we are going to find buyers in that area based upon that well followed technical indicator. Furthermore, we have already seen it offer significant support recently.

On the upside, I believe that the $19 level is extraordinarily resistive, so if we were to break above there then it could open up the door to the $20 level. With that being the case, the market would then be starting to look a lot like a market that was trying to break out to the upside and maybe make a move as it did several years ago when silver reached towards the $50 level. It certainly looks as if silver is trying to wind itself up to do something like that, but that does not mean we can do it right the second.

On the downside, the $16 level underneath is a significant amount of support just waiting to happen as it was previously resistant. At this point, it is likely that we will see it as support. In fact, there is a lot of noise between $16 and the $15 level underneath. The $15 level needs to hold otherwise the silver markets will come undone, but I cannot imagine a scenario where we are so suddenly “risk-on” that we start shorting precious metals drastically.

Yes, I know that there is an industrial component to this market, but at the end of the day it turns that the market will see the precious metals argument come to the forefront. The gold market will probably outperform though, so keep that in mind. Nonetheless, when gold rallies it tends to drag silver right along with it.