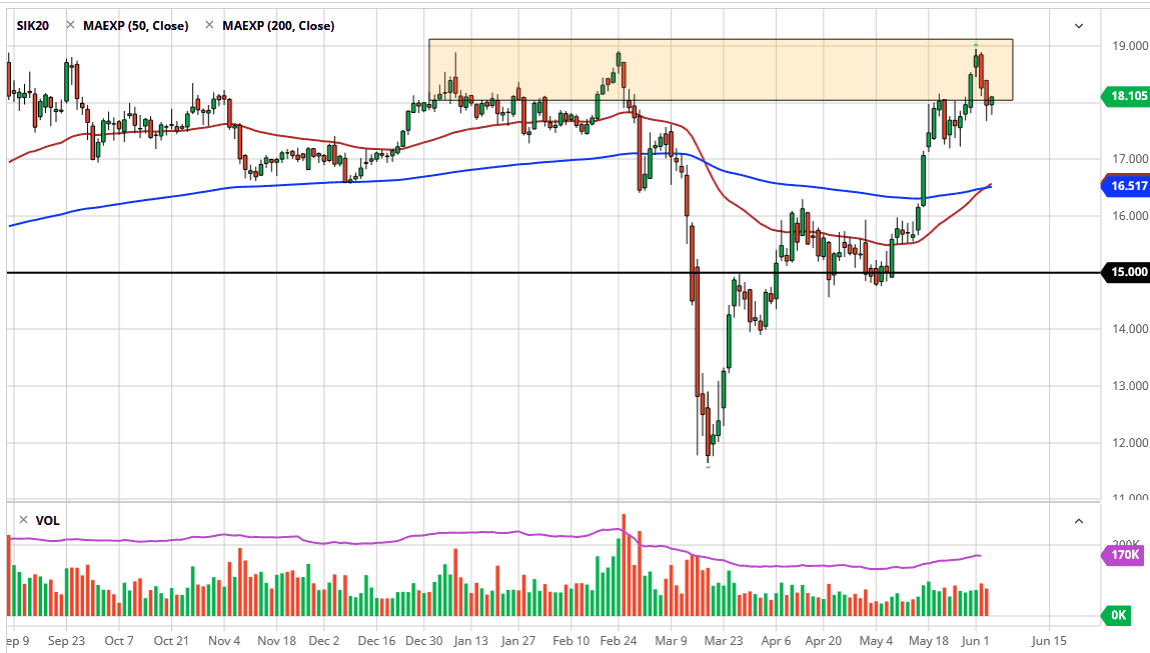

The silver markets initially fell during the trading session on Thursday but found buyers underneath to turn things around. This was interesting considering that the recovery in silver after the selloff was not necessarily influenced by the US dollar, which had been crushed. This is because silver was falling while the US dollar with being crushed, so I think we are just looking at old-fashioned support and resistance here. After all, the $18 level being broken to the upside as shown quite a bit of interest, and then a pullback from there shows a lot of market memory.

Looking at this chart, you can see that there is a lot of support extending all the way down to at least the $17.20 level, perhaps even the $17 level in the short term. Underneath, the 50 day EMA is starting to reach towards this area, and that is something worth paying attention to. That for me is going to be the “floor” in the marketplace. With this being the case, the market is likely to see a lot of buying pressure in this area in the fact that the jobs number is coming out on Friday, that will continue to push money around in the markets as well due to the fact that it will move the US dollar. The effect that the currency markets have on precious metals cannot be understated, so if the US dollar continues to get annihilated, that could push the precious metals markets higher, and with silver being much less liquid than gold, it could jump quite drastically.

To the upside, I believe that the $19 level is going to offer quite a bit of resistance, so at this point I think breaking above there is going to open up the door to the $20 level which will be rather interesting. That is an area that will have a lot of psychological resistance attached to it, and therefore it makes sense that sellers will come in right there. If we can break above the $20 level, then it is likely that the market will go much higher, given enough time. I think that does happen, but in the short term it is probably going to be exceedingly difficult. In other words, we have a lot of work to do in order to make that move, but once we do it could be rather explosive. Until then, expect to see a lot of choppy in back-and-forth.