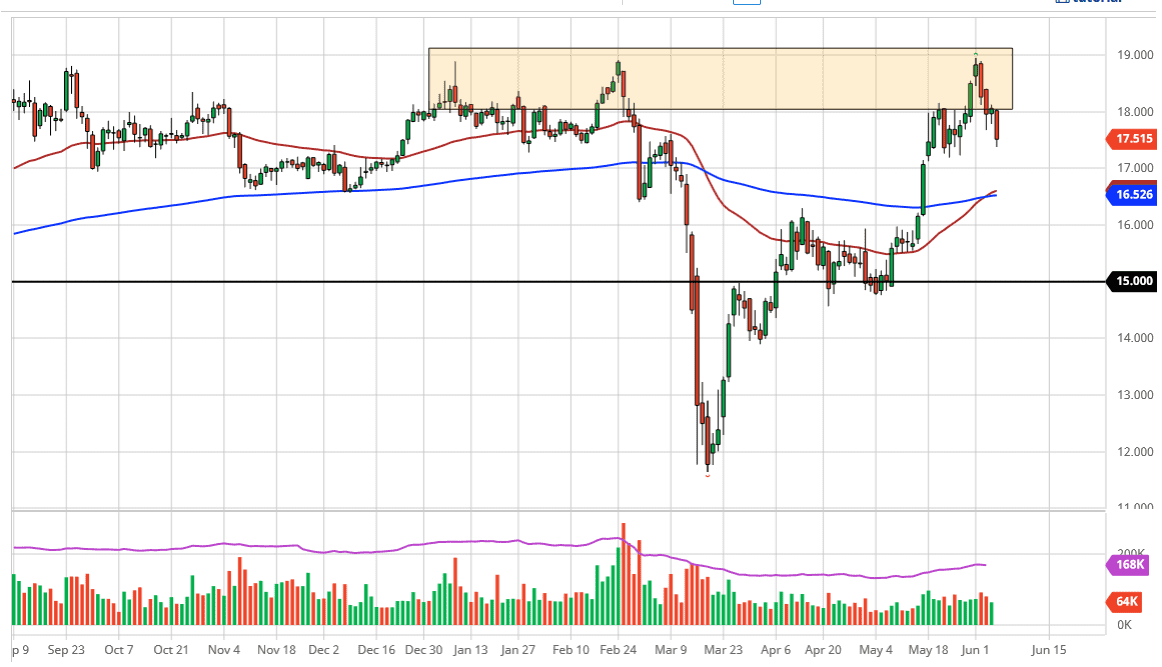

Silver markets have fallen during the trading session on Friday as the US jobs number was much better than anticipated. This had a lot of “risk on” trading, showing that people were willing to jump away from precious metals. It was not just the silver market; it was also the gold market. The market has tested the $17.50 level by the end of the day, and of course has support underneath at the $17 level. I do think that the buyers come back given enough time and a bounce could offer the opportunity for traders to get back in as we have clearly seen a lot of bullish pressure.

To the upside, the $19 level courses significant resistance, and therefore I think that if we were to break above there it would be a huge sign in the fact that we are going to go looking towards the $20 level. That is a large, round, psychologically significant figure, and if we can break above there it could start a massive explosion to the upside. Ultimately, if we can break above there then it will probably be a massive run on silver just waiting to happen. We have seen this before, but I do not think that happens quite yet.

To the downside, if we break down below the $17 level, then we will break down below the 200 day EMA. If we break down below there, then it is likely that we go looking towards the $16 level. A pullback would make some sense if traders are a little bit happier about life in general and judging by the US stock markets, they certainly seem to be. Furthermore, the US dollar seems to be strengthening towards the end of the session, and if the US dollar strengthens it will more than likely work against the value of precious metals as they are priced in that.This is a market that I think continues to see a lot of volatility and therefore it is probably going to be one of the scenarios where we have to look for value underneath. Silver is also an industrial metal, so that of course causes a lot of headaches as well. Keep your position size small, because silver tends to move very rapidly when it decides to move in one direction or the other, something that we could be seeing rather soon.