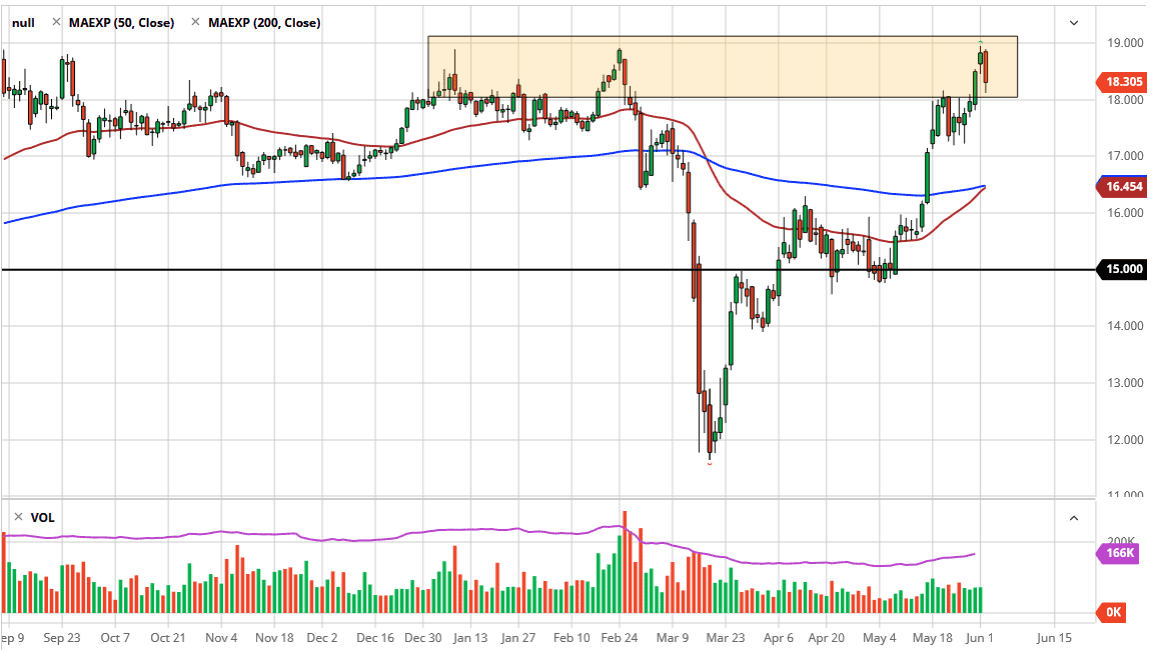

The silver market had a rough trading session on Tuesday, as the $19.00 level continues offer massive resistance. We cannot break above this level with any type of ease and have tested it multiple times over the last several months. The fact that we pullback during the trading session on Tuesday is not a huge surprise, especially considering that silver does not necessarily move like gold, in the sense that it has a lot of industrial uses, and therefore it gives you more of a reaction like base metals will at times.

However, there is a little bit of precious metals aspect to it as well, sure therefore sometimes people will buy it when the US dollar picks up. That does not seem to be the case right now, because even though gold fell, it did not fall anywhere near as much as silver did. Silver is extended at this point, so it does make sense that we would pull back from this crucial level. I believe that there is quite a bit of noise at $19 but if we break above there then it opens up the possibility of a move to the $20 level.

As far as the $20 level is concerned, it makes sense that there would be a lot of resistance in that region, due to the fact that it is a large, round, psychologically significant figure, and of course will attract a lot of headline attention. Quite frankly, the $20 level will probably bring in a lot of fresh profit-taking by professionals. Longer-term, I do think that silver breaks above the $20 level, due to the fact that central banks around the world cannot stop printing money at this point. Having said that, buying silver in that theory is more of a longer-term “buy-and-hold” scenario, which is something that you need to do with extraordinarily little leverage.

If we break down below the $18 level, then it is likely that we go to the $17.25 level. That is an area that has been supported lately, and if we break down below there then we could go looking towards the 50 day EMA. Ultimately, looking at the candlestick for the session on Tuesday tells me that we probably have a bit of a pullback coming. That is healthy for the longer-term move, sell I am bullish, but I also recognize that you need to get a decent price when you jump into the market.