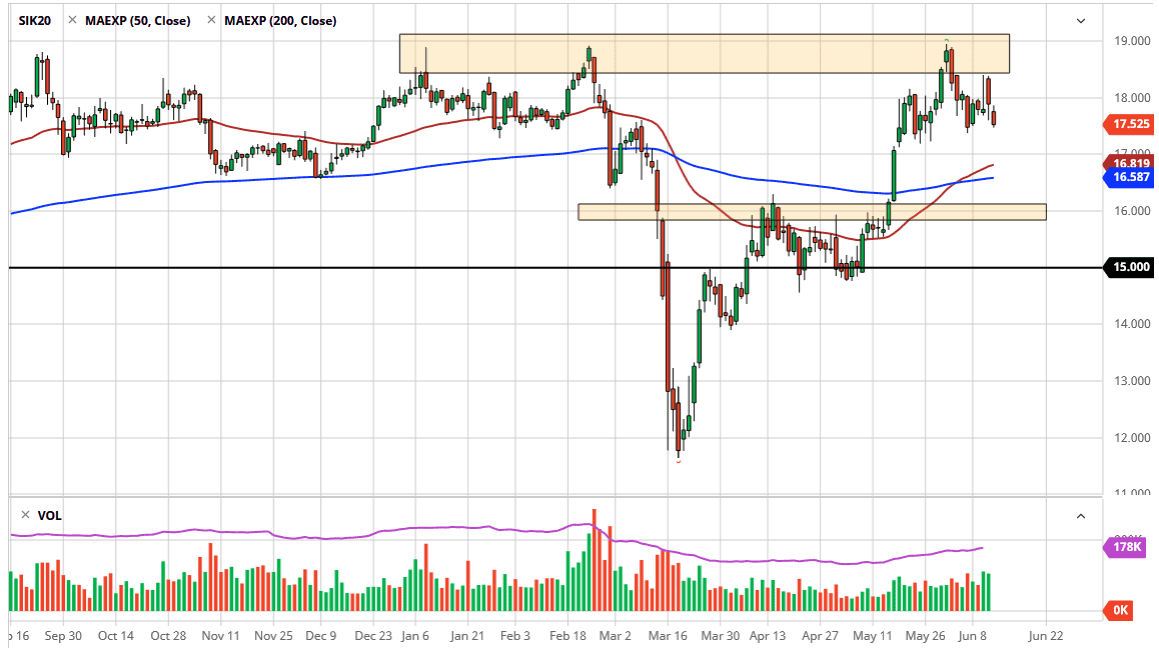

Silver markets have pulled back slightly during the trading session on Friday, reaching down towards the $17.50 level, an area that begins a supportive level down to the $17.25 level, possibly even as low as $17.00 underneath. At this point, it is simply a matter of looking for an opportunity to pick up value, as silver has been in such a strong move to the upside. However, you can make an argument for an exceedingly small head and shoulders. The head and shoulders pattern is negative so if we were to break down below the $17 level, to reach down towards the $16 level, I see this as being incredibly supportive.

The question now is why would silver fall? Well, the main reason would be the fact that the industrial demand will be next to nothing as there has been a lot of demand destruction when it comes to industrial usage. Having said that, the silver market also has the aspect of the precious metals, so if the Federal Reserve is going to continue to throw money into the market, that devalues fiat currency and therefore a lot of precious metals traders will use the silver and gold markets as a way to hedge currency risks.

All things being equal, this is a market that is going to be very choppy but is nothing new as silver is extraordinarily noisy. I like the idea of buying pullbacks, especially closer to the $16.00 level, but I think at this point there will be plenty of buyers looking to pick up silver based upon value. This is assuming that we even get down to that level. All things being equal, I do like the idea of silver going higher, but this is a longer-term perspective that I am looking at, not a short-term perspective. If we start to rally from here, then a short-term run towards the $18.50 level could be targeted yet again, as we continue to see a lot of choppy behavior back and forth. Silver probably underperforms gold going forward though, so if you are looking to take the precious metal trade, I still think that gold is the best way to go. That being said, if gold does break out to the upside it will probably drag silver right along with it. The market breaking above the $19 level opens up the possibility of a move the $20 which of course is a significant barrier.