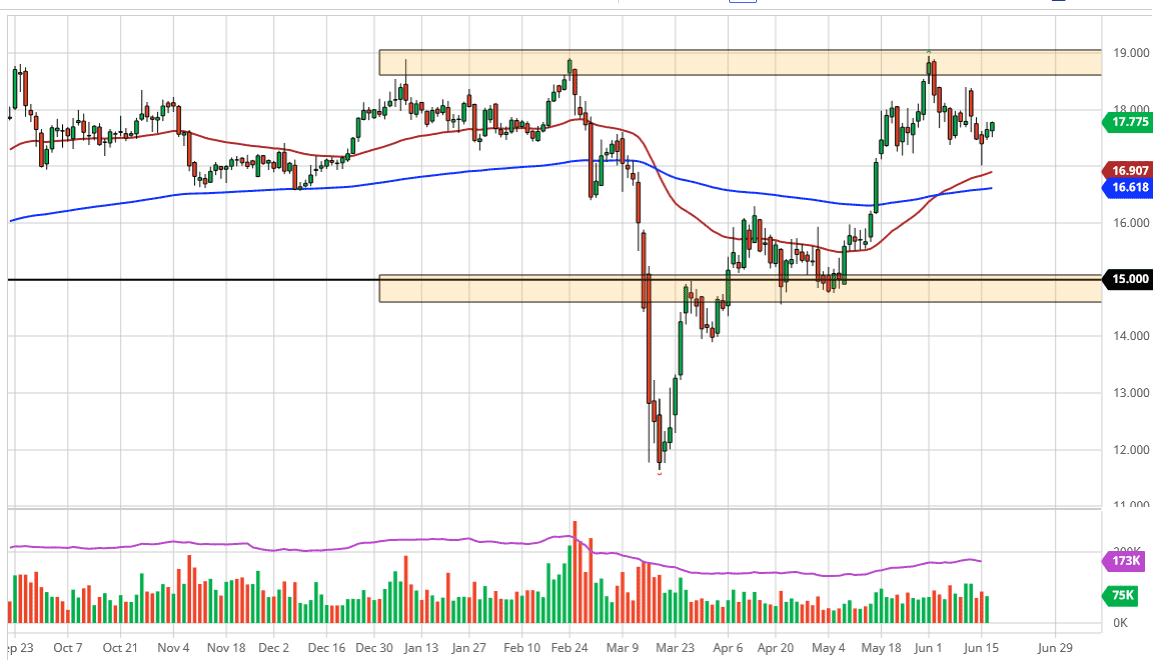

Silver markets have initially fallen a bit during the trading session on Wednesday but found buyers underneath near the $17.50 level. At that point, the market then turned around completely to recapture those losses, and then even went further. By the time the silver pit closed, we were right at the $17.80 level. If we can break above there, then the market is likely to go looking towards the $18 level next, and then the $18.50 level.

When you look at the chart, you can see that the $17 level as a bit of a floor, but what is even more interesting is the fact that the 50 day EMA is sitting just below that level, so I think there will be plenty of buyers in that general vicinity. The hammer from the Monday session when we tested that level is an incredibly supportive looking candlestick, so I do think that it is only a matter of time before we continue to find buyers looking to reach higher. When I look at the longer-term chart, the $19 level is obvious resistance, and we have tried to get there several times but have failed to break through it time and time again.

If we were to break above the $19 level, then it is likely that the market is going to go towards the $20 level, and at that point, we would then have to ask questions about whether or not we can continue. If we can, then it is a longer-term move towards the $50 level but that is going far out into the future.

On the downside, even if we do break down below the 50 day EMA I believe that the 200 day EMA is sitting close to the $16.60 level, and then we are looking towards the $16 level. Between $16 and $15 there is a ton of trading action, so I think that level will offer another buying opportunity if we do pull back towards it. In other words, even though I do not necessarily think that we are going to break down in the short term, I do not want to sell silver because eventually, we could get a very explosive move to the upside and even if we do not, it is likely that the buyers will continue to look at this market as one that you can pick up “cheap silver” on every significant pullback.