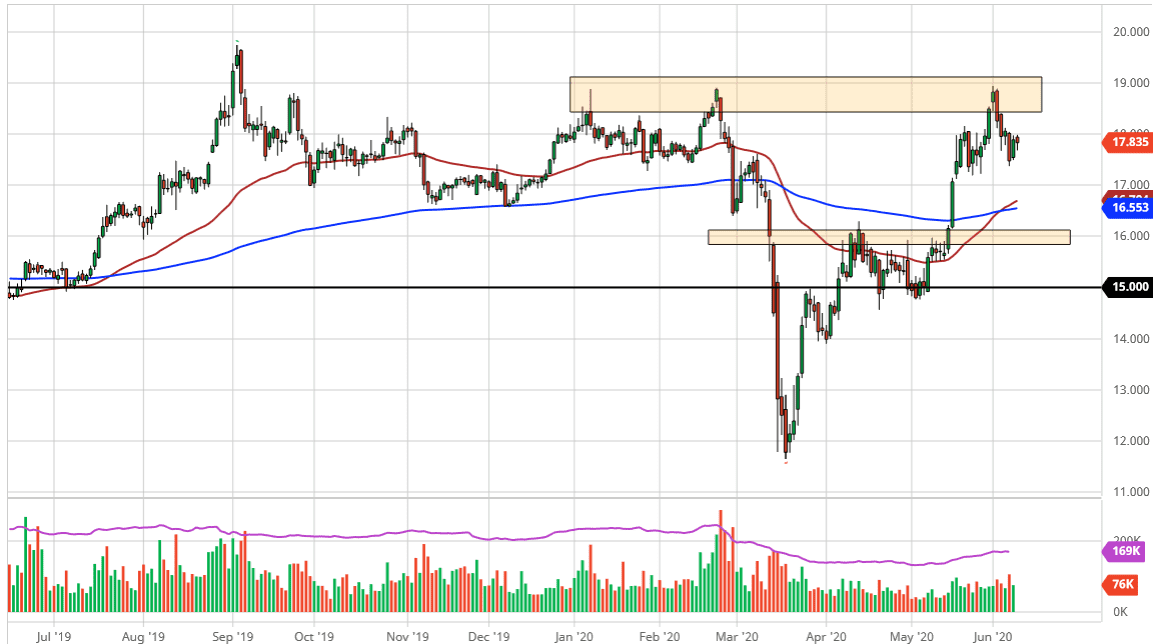

Silver markets have pulled back just a bit during the trading session on Tuesday but found plenty of buyers underneath to turn around and form a bit of a hammer-like candlestick. This is a market that I think will continue to get a bit of a boost due to the fact that the Federal Reserve is almost certainly going to do whatever they can to telegraph to the markets that they are going to throw a ton of liquidity into the marketplace. This market should be looking towards the $19 level, but it is the area that the market cannot seem to get over quite yet.

The $17.20 level underneath will offer a significant amount of support that extends down to the $17 level at the very least. That is the immediate short-term floor the market, and the 50 day EMA coming into that area should also attract a lot of attention as well. If that is going to be the case, then it is highly likely that we will continue to see volatility with an upward slant to it. The market should continue to see a lot of buying on the dips, as the move has been so explosive to the upside. Furthermore, with the Federal Reserve looking to liquefy markets, this will boost precious metals overall.

The US dollar has been getting sold off, so that also helps silver as it is priced in that very same currency. Having said that, I do not necessarily look for any type of major move on the upside. It is going to be more or less a grind and I think it is going to take quite some time to finally break through the $19 level. In the meantime, the $17 level offers that floor I talked about, but I also think that the $16 level is even more crucial. I think given enough time both of these would lift the markets so I have no interest in getting cute and trying to short the silver market, because I do not like fighting this type of trend. There is also the potential of industrial demand picking up if the recovery of the economy is anywhere near what people pretend it is going to be. If it is close to that, demand for silver will pick up and therefore we could have another reason for the markets to continue climbing.