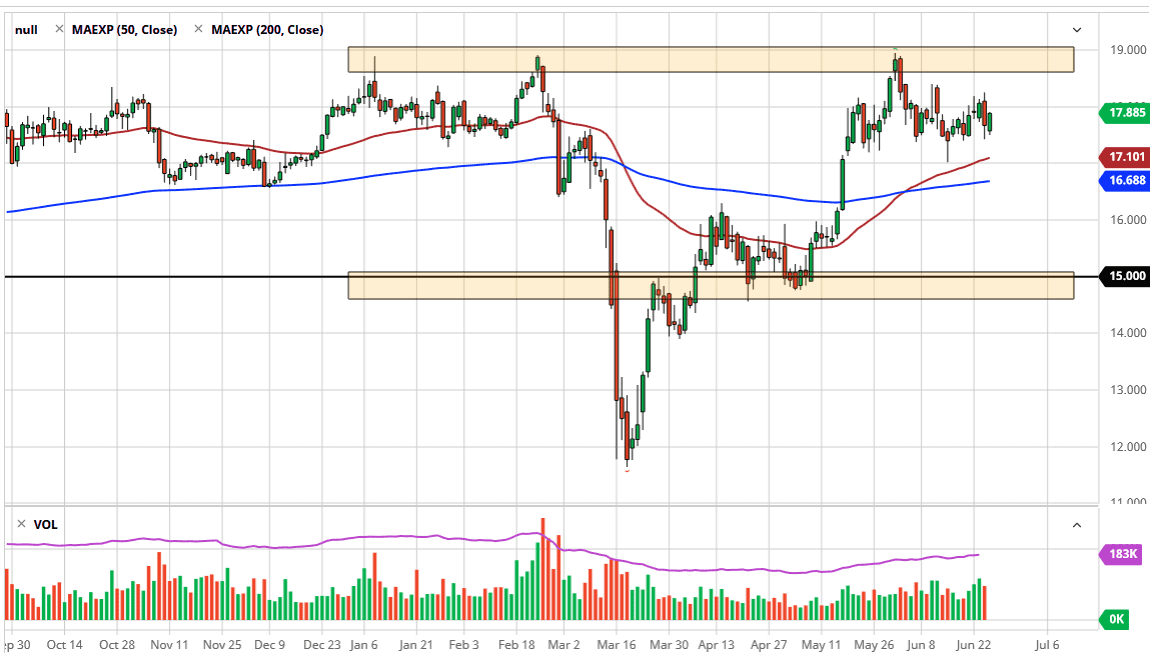

The silver markets have rallied a bit during the trading session on Thursday again, as we continue to see buyers every time this market dips. Looking at this chart, the $17.50 level is an area that shows signs of support, but at this point in time it is likely that we will continue to see buyers continue to chop back and forth as the support zone extends from the $17.50 level to the $17.00 level underneath. Beyond that, the 50 day EMA is breaking through the $17.00 level, and therefore it should continue to come into play as well. The 50 day EMA broke above the 200 day EMA previously, which is the “golden cross” that people pay attention to for longer-term moves.

To the upside, the market does see the $19.00 level as a major resistance barrier, so we can break above there it is likely that the market will go looking towards the $20.00 level. That has been a major inflection point in the past, and during the Great Financial Crisis 12 years ago, silver markets broke above there and then shot towards the $50 level. I think that is what we are going to see given enough time, but we need some type of catalyst to make it happen.

I look at this market as being very bullish, because the precious metals markets react positively to dollar devaluation, something that the Federal Reserve is on fire to do right now. The Federal Reserve has been engaging in massive quantitative easing, and therefore it makes sense that we would see precious metals rally, but I think at this point the gold market is going to lead the way. If gold does break above the $1800 level, then the silver market would continue to go higher in a game of “catch-up”, which is something that we see quite often. The market has been very noisy as of late, but I think we are trying to break out to the upside. If we do break down below the $17.00 level, then the $16 level underneath could be the next major support level. That extends down to the $15 level, and therefore I think that the market breaking below there would be a catastrophic sign for silver going forward. The central banks around the world engaging in such quantitative easing will continue to be bullish for this market. That does not look like it is going to change anytime soon, so I think this is a great investment opportunity as well.