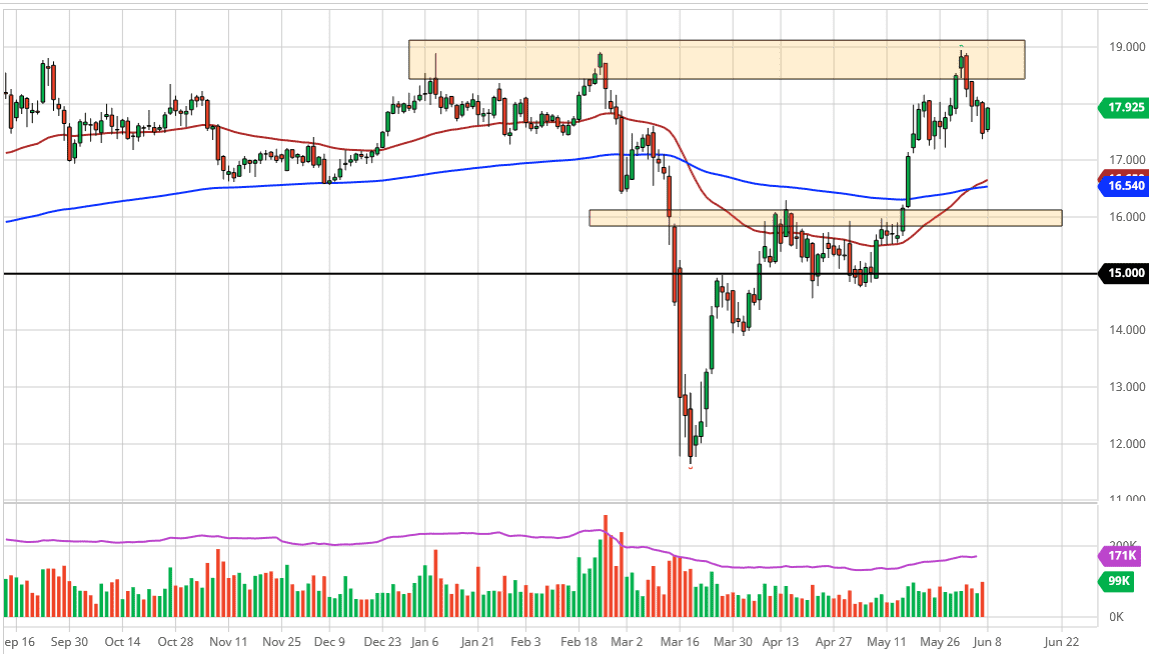

Silver markets rallied a bit during the trading session on Monday to kick off the week, reaching towards the $17.95 level. The $18 level above is an area that will come into play, and it is a large, round, psychologically significant figure that will capture a lot of attention. Ultimately, I do think that the market is likely to see that happen, and then a push towards the $18.50 level, perhaps even a run towards the $19 level, as it is a continuation of the bullish trend that we have seen for quite some time.

If we were to break down from here, the $17 level is massive support, and of course the 50 day EMA is closer to that area, so I think it is only a matter of time before the buyers would step in based upon that. Furthermore, even if we dropped below there at the $16 level, a lot of structural buying there, so I think at that point a lot of demand comes into play. That demand should continue to attract a lot of attention, and therefore value hunters will jump into the silver market.

Do not forget, silver does have a bit of a precious metal attitude built in, as the US dollar has gotten crushed. Then again, central banks around the world continue to do everything they can to boost their support for local economies, thereby devaluing the idea of currency. When that happens, commodities tend to get a little bit of a boost, and it can even get more of a boost due to the fact that the trading community start to look for safety and “hard assets” such as metals or oil.

From a technical analysis perspective, this is still a very bullish market and I do think that we will make another run towards the $19 level. Albeit, it may be more of a grind than anything else. Looking at pullbacks continues to be the best way to pick up a bit of value, as the silver markets have gotten a bit stretched. Longer-term, it is only a matter of time before we break out to the upside but that could be weeks, if not months. With that, I am building up a larger position based upon small bits and pieces along the way. This not until we break down below the $15 level that I would be concerned from a longer-term trend perspective.