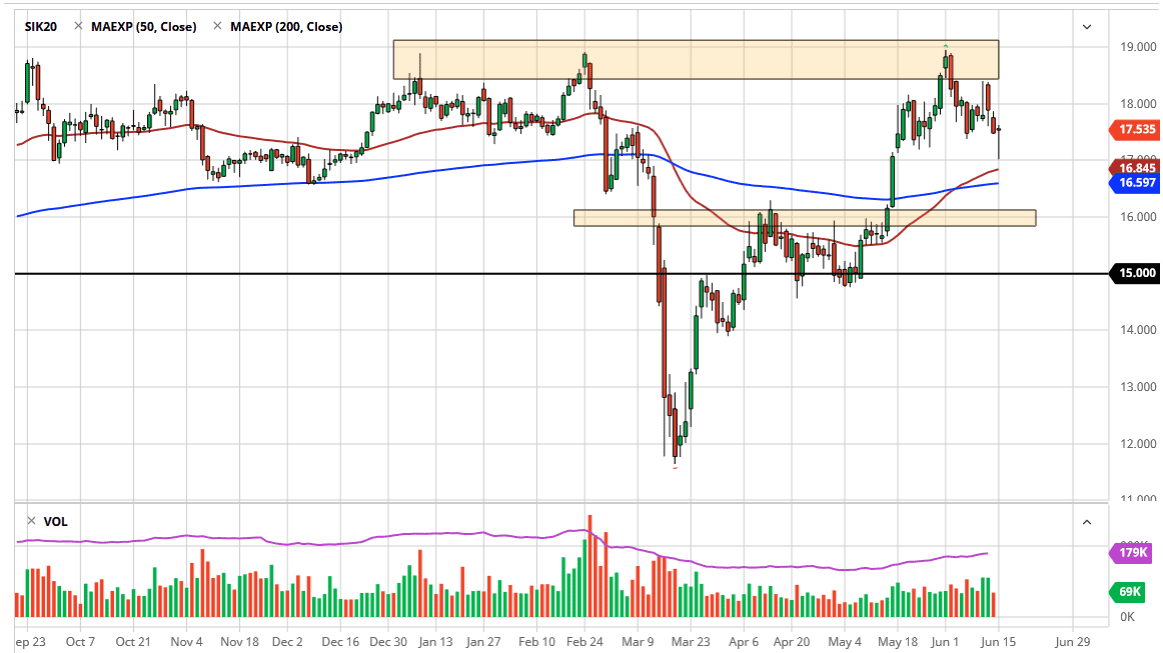

Silver markets fell significantly during the trading session initially on Monday but found enough support near the $17 level to turn around and form a massive hammer. This was in reaction to the Federal Reserve which is stepping out and buying significant amounts of corporate bonds again but looking at significant expansion and individual bonds.

At this point, the market is sitting just above the 50 day EMA at the bottom of the range, so therefore it makes quite a bit of sense that we saw buyers come in and pick this up. Furthermore, as the Federal Reserve tries to kill the US dollar, the silver markets recover as far as the “precious metals trade” is concerned. I do think that we will continue to see upward pressure in general, as the central banks around the world do everything to bring down the value of currencies.

Now that the market has bounced the way it has, I anticipate that the market is going to go back and forth in this general vicinity again, as we could not selloff the way we had previously. The market will more than likely continue to look at a range between $17 on the bottom and $19 on the top. If we can break above the $19 level, then it is likely we will go looking towards the $20 level above which is a large, round, psychologically significant figure, and one that will attract a lot of headline attention. If we break above there, then the market is free to go much higher like it did back in 2008.

On the other hand, if we break down below the lows of the trading session on Monday, then it opens up a move towards the 200 day EMA and then eventually the $16 level. There is a lot of noise between $16 and the $18 level underneath, which is a huge area of previous noise. When you look at the $15.00 level underneath, you can see that it has been important more than once so pay attention if we do get down there. Breaking down below there would be catastrophic for silver but I do not expect to see that happen anytime soon. Expect volatility, but in the end, I think that the market is likely to continue to see a lot of upward pressure overall.