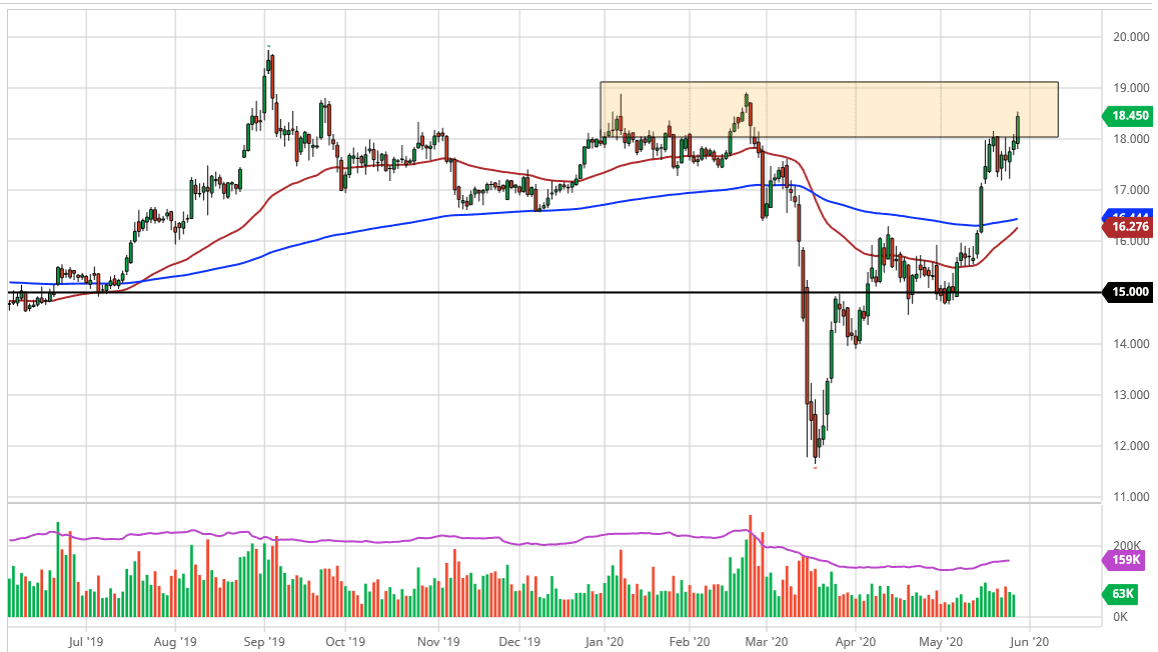

The silver markets have rallied significantly during the trading session on Friday, breaking above the $18 level. By doing so, the market has broken into a new range of resistance, and now I think we have several different things going on at the same time. After all, the silver markets are not only a precious metal but there also an industrial metal. The question now is not so much whether or not metals are going to go higher but it is probably more or less what is going to be from an industrial standpoint. Are we going to have enough industrial demand out there to drive up the price of silver from a sustainable point of view? I doubt it, but there is also the precious metals trade and that is probably what we are looking at more than anything else.

The precious metals market continues to see a lot of money flow into a bit if you are looking to take advantage of precious metals in general, gold is going to be the way to go. Silver will cause a lot of headaches, due to the fact that it is very volatile and the fact that the market will sometimes focus on the precious metals factor, sometimes the industrial factors. Clearly, it acts more along the lines of a base metal than anything else, so a lot of times it will move with copper as well.

Currently, I think the $19 level is going to be difficult to break above, and I would expect a lot of resistance there. I think ultimately this is a scenario where we will probably see that area caused resistance yet again, because quite frankly we have gotten here far too quickly. If we do break above the $19 level it would obviously be a massive bullish signal and at that point, I think we would then go to the $20 level. The $20 level of course offers a lot of psychological noise and headlines, so that could take quite a bit of steam at the market as well. All things being equal though, the market looks like it will continue to attract plenty of buyers on dips and that is probably the best way to look at it. The US dollar has taken a bit of a beating against the Euro, which tends to move along with this market as well so keep that in mind.