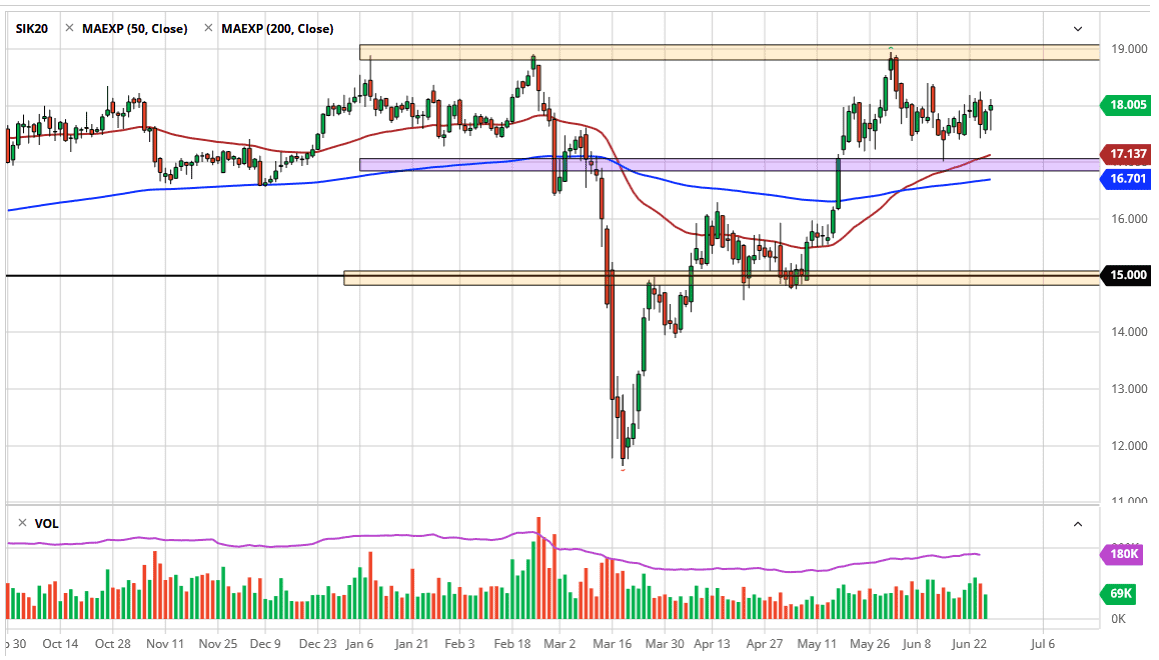

The silver markets fell during the majority of the session on Friday but started seeing buyers get involved later in the day. By doing so, the market looks as if it is ready to continue grinding higher and trying to break out. The $17.50 level has offered plenty of support as we turn right back around to show signs of life again. The candlestick for the day is a hammer, and that of course is a very bullish sign. That being said, the market is likely to see a lot of volatility more than anything else and now silver tends to be choppy regardless.

The 50 day EMA is currently sitting at the $17 level, an area that is a large, round, psychologically significant figure, and the midway point between the larger supporting resistance levels at the $15 level and the $19 level. When looked at through the prism of longer-term trading, the $17 level is crucial, and essentially “fair value” for the last several months. This market is likely to see a lot of noise due to the fact that silver moves not only based upon central bank actions when it comes to liquidity measures, but also industrial demand which can rotate quite drastically.

Silver is extraordinarily volatile, to say the least, and in this environment, it is going to continue to be so. The market will find plenty of value hunters underneath, as we have seen more than once. The silver market is one that tends to be extremely dangerous if you are not careful about the trading position that you have on. Small positions over the long term are much more favorable than trying to go “all in” right away.

To the upside, if we were to break above the $19 level, it could open up a move towards the $20 level, which is the gateway all the way to the $50 level based upon how silver markets rallied after the Great Financial Crisis. All things being equal, I believe that you need to continue to look for value in this market, as it will present itself from time to time. The shape of the candlestick is rather bullish, just as the 50 day EMA is starting to grind higher which adds even more credence the idea of a continued rally.