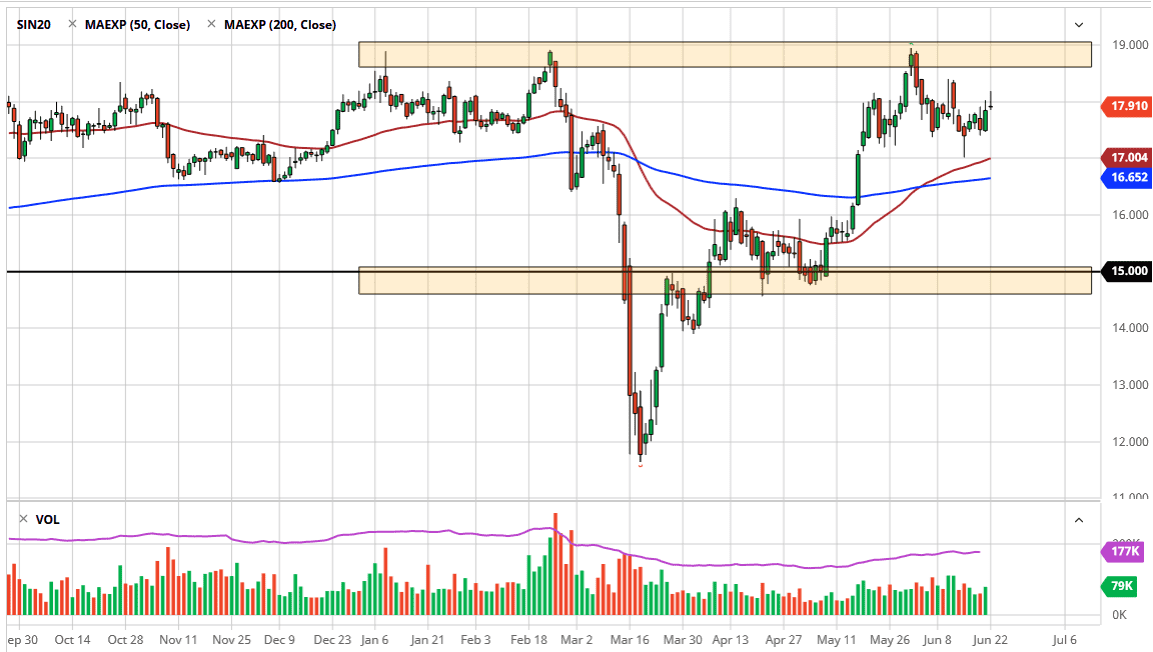

The silver markets initially tried to rally during the trading session on Monday as traders get back to work, but the $18 level has proof of supply, as we have pulled back quite a bit and shown quite a bit of resistance. Above the $18 level there is also the $18.50 level, which is an area we have seen the market pull back from previously as well. Beyond that, the market also has the looked at the $19 level, as a potential selling opportunity as well. Nonetheless, the market looks likely to continue finding buyers on dips and therefore I am going to look at this market as one that you can pick up “on the cheap” occasionally when it pulls back.

I look at the 50 day EMA, currently sitting at the $17 level, as a significant support level. At this point, the market would find plenty of buyers based upon the large, round, psychologically significant figure and of course the 50 day EMA. Underneath there, the market is likely to go looking towards the $16.50 level, and then the $16 level after that. At the $16 level, it is likely that we are going to continue to see buyers because it was previous support and if you look at the chart down to the $15 level, there are plenty of buyers back and forth in that general vicinity, so, therefore, it is likely that the market will find buyers. I would be more than willing to buy in that area because there should be plenty of buyers.

However, if we break above the candlestick for Monday’s session, that would be a very bullish sign and at that point, I think we would more than likely go looking towards the $19 level given enough time. I think silver gets a bit of a boost regardless, mainly due to the fact that central banks around the world continue to crush their currencies as they continue to see quantitative easing as the way out of the economic situation that the market has found itself in after the coronavirus outbreak. Considering that the central bank participants all were looking to do quantitative easing before the pandemic, it will essentially be on steroids at this point, and that is very bullish for precious metals in general, although I am the first to admit that gold will probably outperform silver in that environment.