The New Zealand dollar had been a highflyer until the last couple of weeks, which suggests that perhaps it has run out of momentum. It appears at this point that there is a certain amount of resiliency in the currency though, and that is worth paying attention to. After all, New Zealand is one of the few places on the planet that have essentially eliminated the coronavirus infections. This of course does not bode well for New Zealand itself, but the question is whether or not it will present itself in the currency?

Unfortunately for the New Zealand dollar, it is not just about New Zealand. Think of it this way: if most of its customers are buying less, then there is going to be less demand for the New Zealand dollar, which is by far the smallest of the major currencies. (Yes, I know that some people do not consider the major currency, and some do. For the purposes of this article, it is.) Because of this, the New Zealand dollar does tend to be a bit more volatile than some of the other currencies that we trade and can be moved by external factors much more quickly than others.

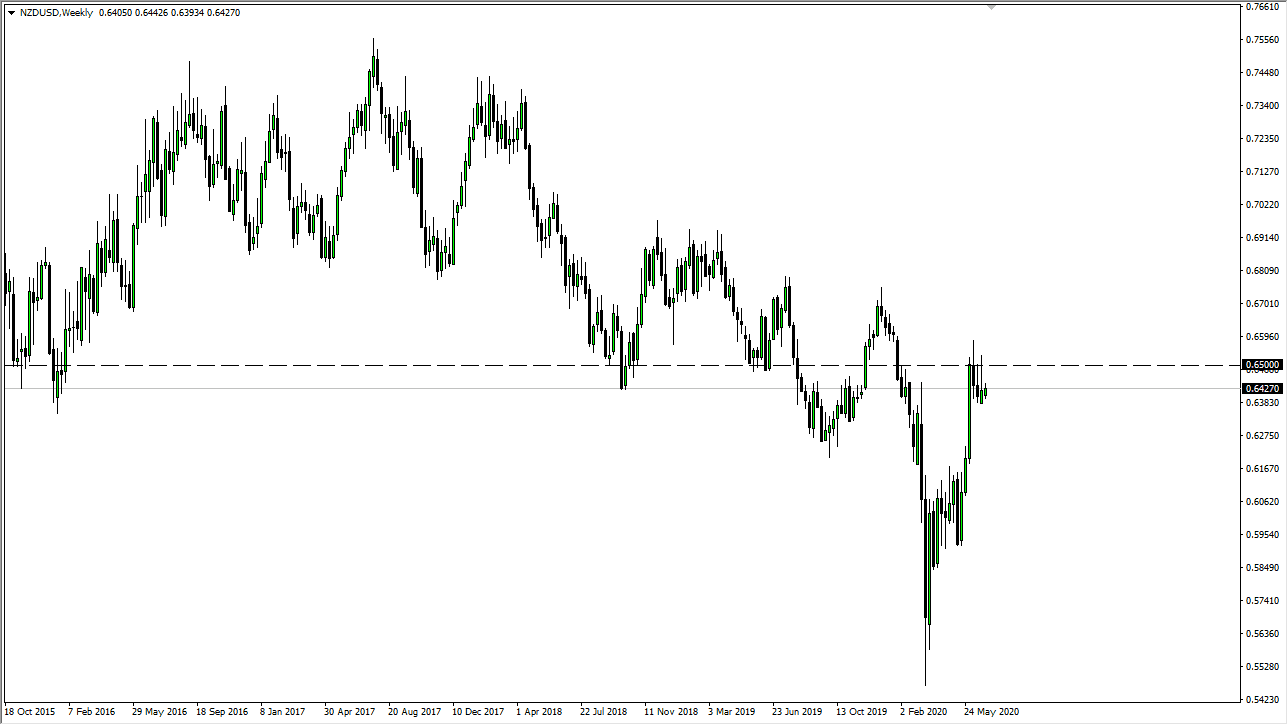

On the other side of this equation is the US dollar, which of course is very liquid, and people will go running towards the greenback when times are tough. Times are certainly tough at this moment, so this might be a reflection on global growth and coronavirus numbers around the world more than anything else. After all, if you are a large fund, there are only a few places where you can stuff money in large amounts, one of which of course is the US Treasuries market. In order to put money into the US Treasury markets, you need US dollars. That is why the US dollar is considered to be safety, and of course if you are a foreign investor you need to buy those US dollars to buy other assets as well, perhaps gold futures. With that in mind, I look at the chart and I recognize that the 0.66 level is the top of the 100 point resistance barrier that we cannot break above as of yet. The closer we get to the 0.65 handle, the more likely I will be to fade this market. If we break down below the 0.6375 handle, then we have a potential to drop all the way down to the 0.62 level.