New Zealand was once home to one of the highest yielding currencies and a favorite for investors seeking stable income. Before the 2008 global financial crisis, the interest rate stood at 8.25%. One financial crisis and one global epidemic later, the Reserve Bank of New Zealand slashed them by 800 basis points over twelve years to 0.25%. It now considers negative interest rates. It adds to a distinct bearish bias for the New Zealand Dollar, as the country is poised to witness a sharp increase in capital outflow, both from foreign and domestic investors. The bullish momentum breakdown in NZD/USD suggests the rally is vulnerable to a profit-taking sell-off.

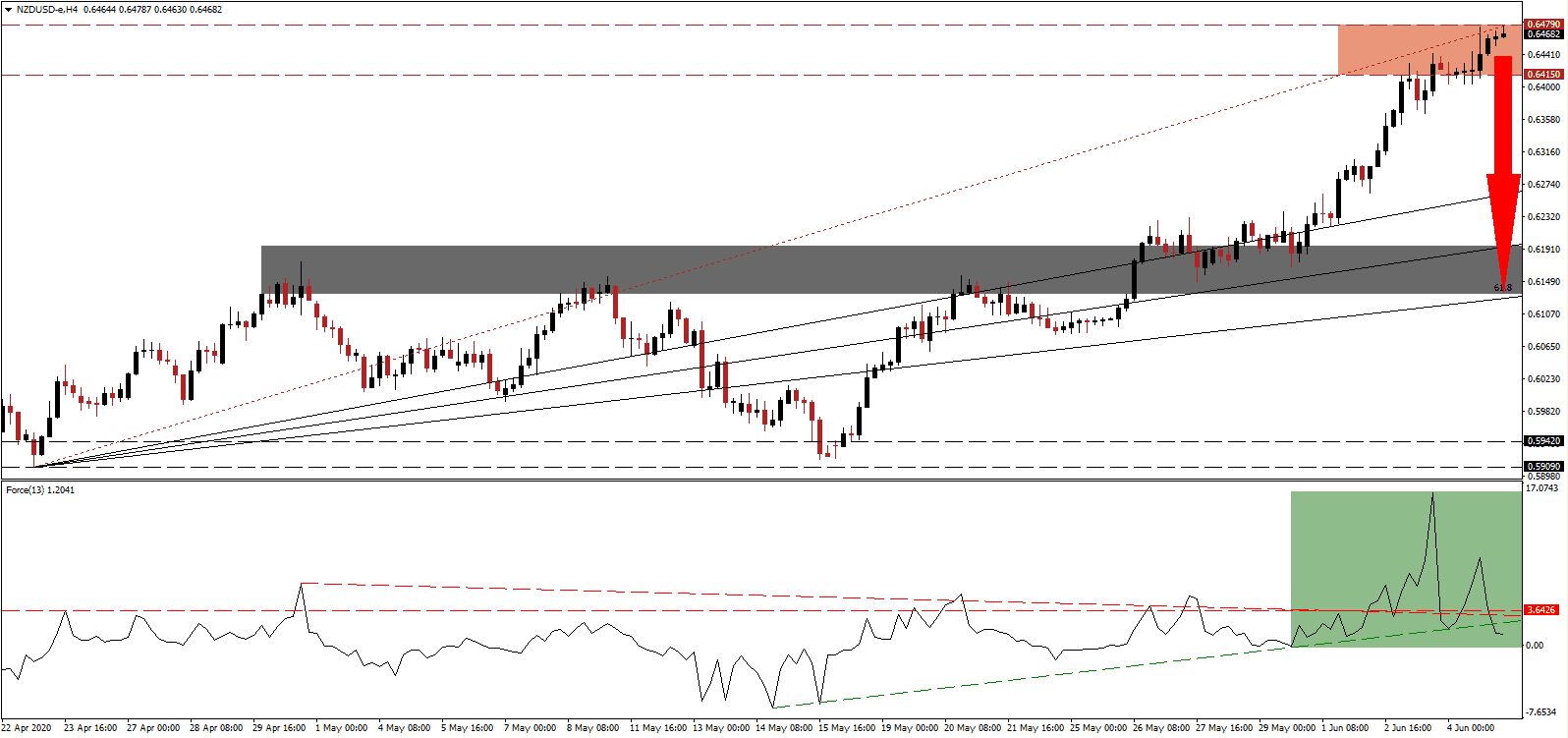

The Force Index, a next generation technical indicator, formed a significantly lower high after bouncing higher off of its ascending support level while price action drifted to the upside. A negative divergence emerged, pointing towards a pending trend reversal. Following the conversion of its horizontal support level into resistance, the Force Index moved below its descending resistance level, as marked by the green rectangle. Increasing breakdown pressures was the push below its ascending support level. Bears now wait for this technical indicator to collapse into negative territory to regain control of the NZD/USD.

Negative interest rates will squeeze capital out of cash, punish savers, and fiscally responsible consumers while forcing money into higher domestic risk assets or offshore. Asset rotation has already begun with interest rates at 0.25%. Prime Minister Ardern, currently banking on food exports, culture, domestic tourism, and government-funded infrastructure projects to lead the economy into a post-Covid-19 recovery, cannot afford capital outflows. A breakdown in the NZD/USD below its resistance zone located between 0.6415 and 0.6479, as marked by the red rectangle, is anticipated.

Without a viable economic plan, New Zealand, which led the response to contain the Covid-19 outbreak, will most likely find itself lagging any recovery moving forward. Today’s US NFP data for May could provide a brief price spike before leading to an extended sell-off. This currency pair is well-positioned to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. From there, the NZD/USD is favored to accelerate into its short-term support zone located between 0.6133 and 0.6195, as identified by the grey rectangle.

NZD/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.6470

Take Profit @ 0.6135

Stop Loss @ 0.6535

Downside Potential: 335 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 5.15

A breakout in the Force Index above its descending resistance level may lead the NZD/USD into a brief price spike. Forex traders are recommended to take advantage of it with new net short positions amid a worsening economic outlook for the New Zealand economy. While US weakness is intensifying, conditions for capital outflows out of New Zealand have superseded those risks. The next resistance zone is located between 0.6583 and 0.6629.

NZD/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.6565

Take Profit @ 0.6625

Stop Loss @ 0.6535

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00