First-quarter export volume out of New Zealand increased, defying calls for a marginal contraction. Most of the period was before the nationwide lockdown imposed to prevent the Covid-19 pandemic from spreading across the island nation. While Prime Minister Ardern’s government was praised for it from a healthcare perspective, she is being criticized economically. Adding to concerns for New Zealand, ranking last in multi-factor productivity growth among OECD countries, is the absence of a viable recovery plan moving forward. The NZD/CHF is under increasing breakdown pressures after reaching its resistance zone.

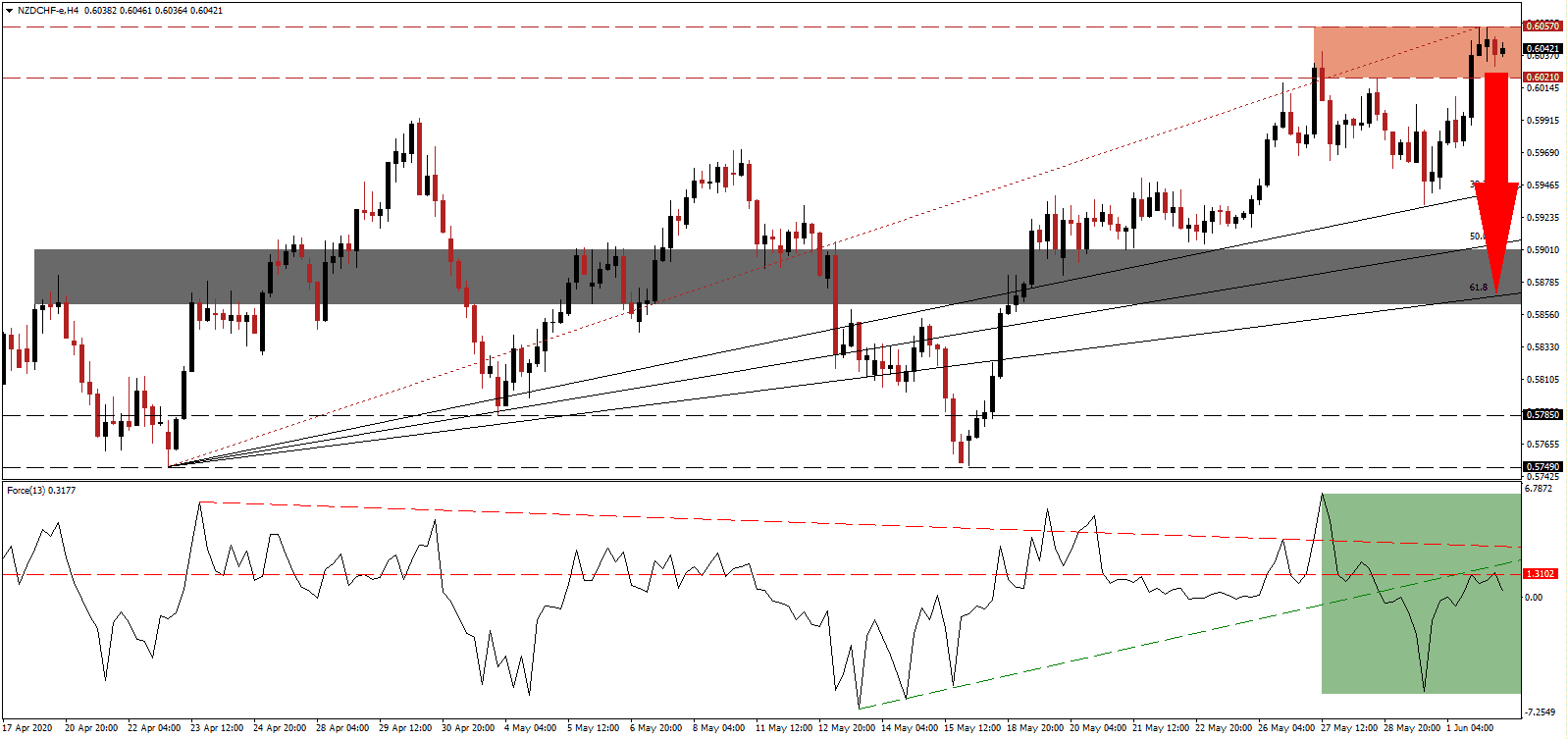

The Force Index, a next-generation technical indicator, collapsed from a multi-week peak to a multi-week low before partially retracing back into its horizontal resistance level. Rejection followed, and it remains below its ascending support level, as marked by the green rectangle. Adding downside pressure is the descending resistance level, which is favored to force this technical indicator below the 0 center-line, allowing bears to regain control of the NZD/CHF.

New Zealanders' confidence in their government remains near a record high, and Prime Minister Ardern’s Labour Party stands at 56.5%, three months before elections. While confidence in the government expands, consumer confidence collapsed. Three months in politics is ample of time for conditions to change. Present economic plans are centered on government-funded infrastructure programs, food exports, and domestic tourism. It makes the NZD/CHF vulnerable for a violent profit-taking sell-off, led by a breakdown below its resistance zone located between 0.6021 and 0.6057, as marked by the red rectangle.

Switzerland is home to the most active central bank in the Forex market with direct interventions. The balance sheet of the Swiss National Bank exceeds CHF800 billion, more than the economic output of the wealthy Alpine nation. Despite attempts to devalue the Swiss Franc, to support its essential export sector, the Swiss Franc remains a primary safe-haven asset. With the KOF Leading Indicator plunging to an all-time low, the US is rumored to apply tariffs on Swiss pharmaceutical exports. In the short-term, the collapse in bullish momentum is anticipated to lead to a correction in the NZD/CHF until it can challenge its support zone located between 0.5863 and 0.5901, as marked by the grey rectangle. It is enforced by the ascending 61.8 Fibonacci Retracement Fan Support Level.

NZD/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.6040

Take Profit @ 0.5875

Stop Loss @ 0.6090

Downside Potential: 165 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.30

A breakout in the Force Index above its descending resistance level is likely to encourage the NZD/CHF to extend its rally. Due to more tremendous economic challenges for the New Zealand economy as compared to the Swiss, Forex traders are advised to view any advance from current levels as a secondary short-selling opportunity. Price action will face its next resistance zone between 0.6215 and 0.6247.

NZD/CHF Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 0.6140

Take Profit @ 0.6240

Stop Loss @ 0.6090

Upside Potential: 100 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.00