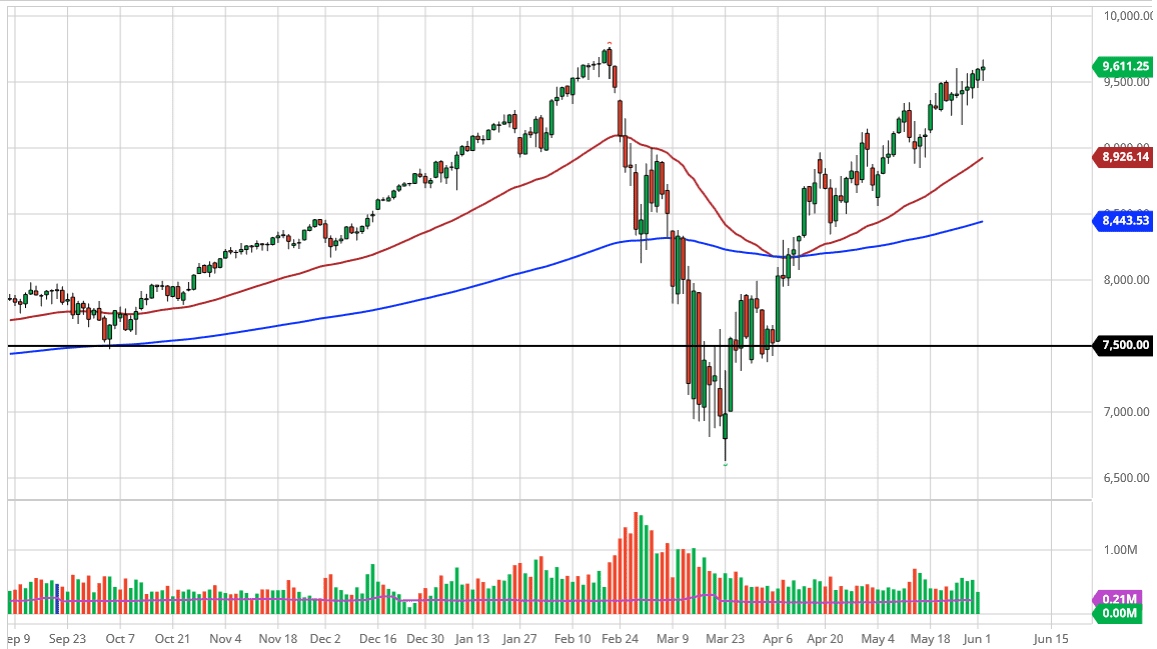

The NASDAQ 100 has had a choppy session on Tuesday, forming a neutral candlestick as we have gone back and forth. Ultimately, the market has seen the 9500 level as a massive support level, but it is worth noting that we could not take off to the upside. That does not mean that we cannot rally from here, and quite frankly I think the NASDAQ 100 is highly likely to go looking towards the all-time highs which are only about 3% from here.

However, that does not necessarily mean that we are going to have that happen immediately, so we may need to pull back just a little bit in order to build up enough momentum to go higher. The market could drop as low as 9000 and still have an opportunity to take off to the upside. The 9000 level also will have the 50 day EMA come into play, which of course is a technical indicator that a lot of people will pay attention to. The market is likely to see a “buy on the dips” type of mentality, as we have seen over time. Unless something changes drastically, it is hard to imagine that the NASDAQ 100 falls apart. Remember, the NASDAQ 100 is mainly driven by a handful of stocks, all of the “sexy stocks” that Wall Street petals on everyone. (Think Google, Facebook, Netflix, Tesla, Microsoft, and Apple.) In other words, it is the ones that everybody in the world owns. Because of this, the index is going to continue to struggle to sell off, because the main drivers of the index are the ones that everybody runs to.

As the market is full of companies that have done relatively well during the coronavirus epidemic, it makes sense that traders continue to look towards these companies in order to deal with what could be the “new normal.” Regardless, this is a market that continues to go higher, and I do not see anything to keep it from region the highs again. It does not mean that it does it today, but it does makes sense that we will find plenty of buyers based upon value if nothing else. Ultimately, I do not even have a scenario where am starting to short this index anytime soon, and quite frankly if it breaks down then it is very likely that we will see easier selling opportunities set up in the S&P 500 and the Dow Jones Industrial Average.