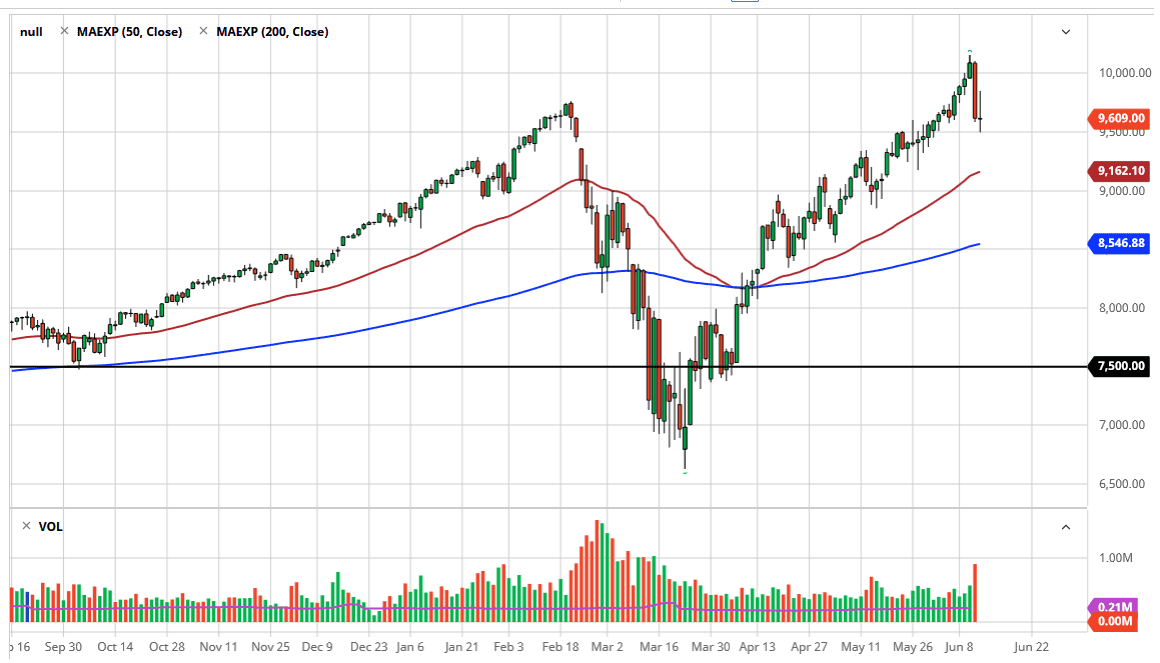

The NASDAQ 100 has gone back and forth during the trading session on Friday in a sign of uncertainty, but after the massive selloff on Thursday that in and of itself is a bit of a victory. If you remember, in Thursday's analysis I suggested that we could reach towards the 9500 level before we find buyers, and that is exactly what played out during the day on Friday. As we have gone back and forth and formed a neutral candlestick, it does suggest that we are still trying to figure out what to do next. Unfortunately, a lot of momentum could hinge on whatever news flow comes out over the weekend, and it is hard to imagine what that is going to be.

If we break down below the 9500 level, then we will go looking towards the 50 day EMA given enough time. That currently sits at the 9162 level, but it is an indicator that a lot of traders follow. On the other hand, if we break out to the upside then we will go test the highs again. I think that the market is looking for some type of narrative to follow. After all, we had gotten far ahead of ourselves, so it makes sense that we gave back some. The market had gotten far too frothy, and of course 10,000 is an area that would make quite a bit of sense to see some profit-taking.

Looking at the negative candlestick for the trading session on Thursday, it does suggest that there could be some selling pressure, but ultimately, I think we are looking at a scenario where the market participants will probably look for value at lower levels. In fact, I believe that a little bit more of a pullback at the healthy thing, not necessarily something to be afraid of. We are in an uptrend, regardless of whether or not it is justified, which of course makes trading the markets a bit on these days, but the only you can do is follow price. After all, “price is truth.” You can argue all you want about the fundamentals, but obviously they do not matter, at least not at this point in time. Overall, that is all we can do, perhaps look for value in an uptrend and take advantage of it. The lower we go, at least until we break down below the 9000 level, the more likely we are to see value hunters get involved.