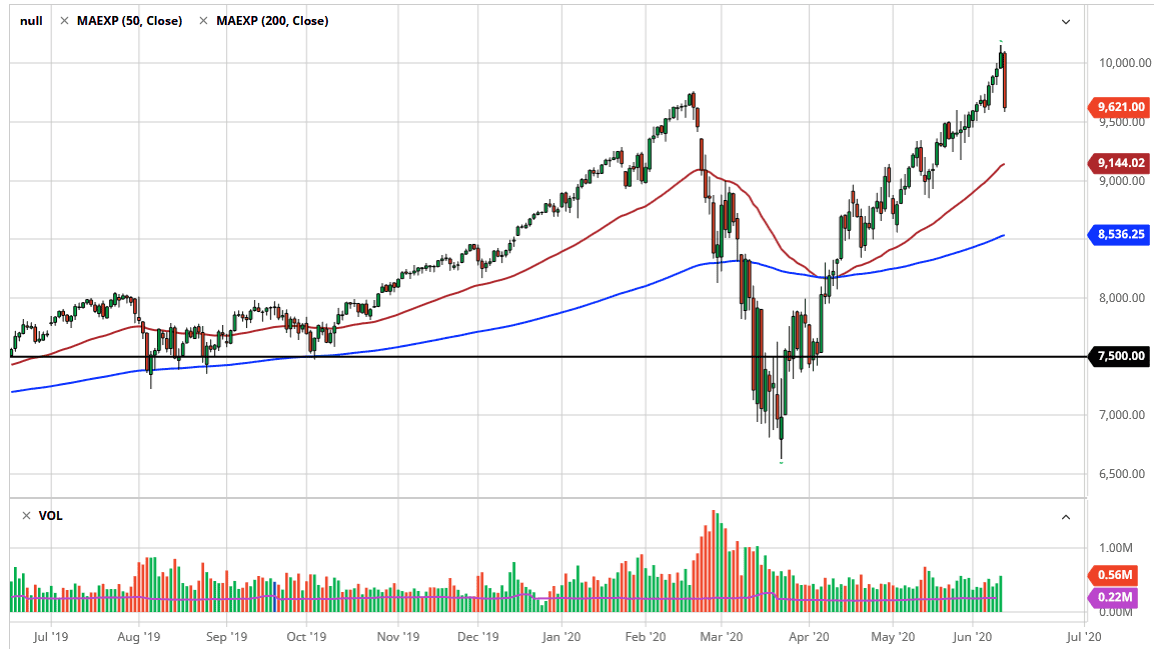

The NASDAQ 100 has broken down significantly during the trading session on Thursday, wiping out the 10,000 level like it was not even there. In fact, the NASDAQ 100 lost 4.66%, at least in the futures and the cash market lost 5.27% as a result. Remember, it is the NASDAQ 100 that has outperformed all of the other indices for so long, so a selloff like this is a relatively strong sign of bearish pressure. Having said that though, I think that the market is likely to continue seeing issues, after this type of selling. That does not necessarily mean that we are going to suddenly wipe out the overall trend, just that the market is likely to continue trying to find a little bit more firm footing.

I do not like putting on big positions going into the weekend with the news cycle being what it is, and in this environment, you can almost count on something coming out over the weekend that could cause some issues. Because of this I think a lot of traders will probably sit on the sidelines as far as the trend is concerned, waiting to see if other people come in and pick it up. If traders do defend the 9500 level, which I believe is the next major support level, then it is likely that next week will see us recover some of the gains. In fact, you could even start to make out a bit of a channel just underneath that area, so do not be surprised to see this market pierce below there and then turned around. However, if the market were to reach towards the 50 day EMA, that would be the next barrier to overcome. The 9000 level also offers support and so on.

If you get an extremely negative move in the NASDAQ 100, you are probably going to get more momentum in the S&P 500 then you will hear, and most certainly you will get more momentum in the Russell 2000. After all, they have been laggards so when we roll over and fall hard, those are going to get crushed as there are as many longer-term holders of those indices. All things being equal, I would probably stay away from this for 24 hours until we get a bit of clarity, something that we have been short of for a while and quite a few things when it comes to trading.