The NASDAQ 100 sold off initially during the trading session on Friday and did get a little bit spooked during the Donald Trump press conference. That being said, it appears that “everything is awesome” again, and now it looks like we are going to reach towards the all-time highs. This should not be a huge surprise to anybody who has been paying attention to the NASDAQ 100 as it is essentially an ETF of everything Wall Street owns and lobs. Remember, the first 35% of the NASDAQ 100 is Microsoft, Amazon, Alphabet, Google, and Facebook. Tesla is not far behind, so you have the makings of cult stocks in an ETF.

The biggest problem of course is that someday these companies may selloff, and if they do it is going to absolutely pummeled this market. However, in the meantime it is obvious that the only thing that Wall Street trusts are the sample stocks, because when you look at the breadth of the market, it is more often than not these handful of stocks that are rallying. There is a reason these indices are set up so heavily weighted towards a handful of stocks, they are designed to go higher.

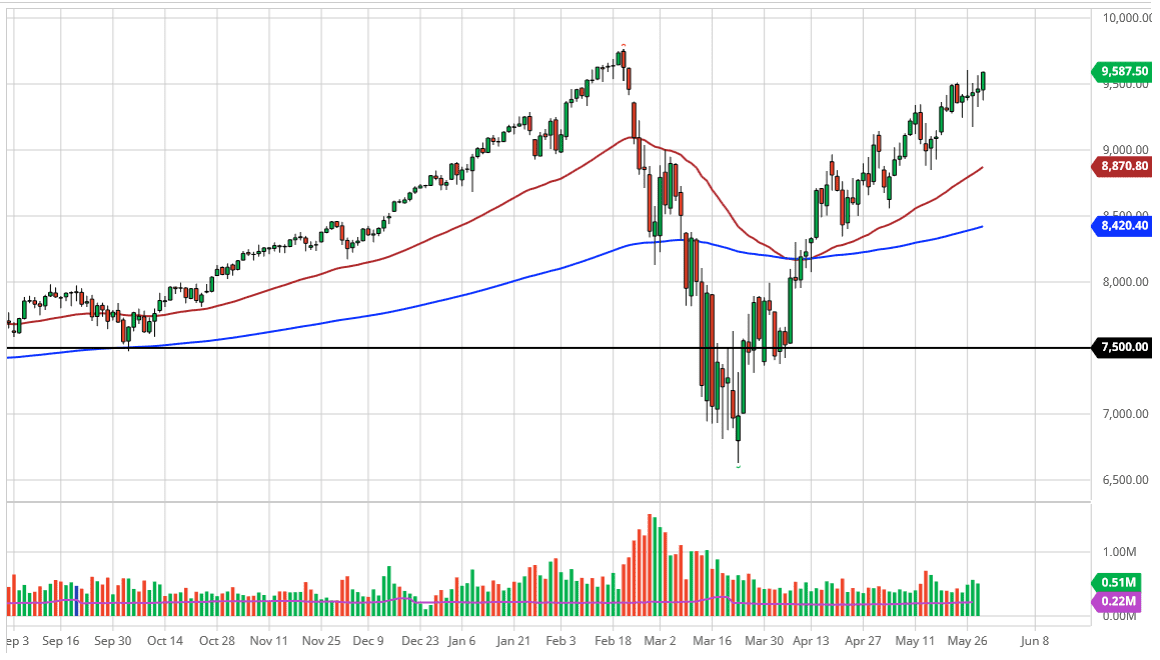

With that in mind, I think the “floor” is at the 9000 handle, with the 50 day EMA reaching towards it. I would be rather surprised to see this market break down below there, especially considering that we are almost 600 points from there but that is where I see the bottom. Pullbacks at this point will continue to offer buying opportunities more likely than not, as it seems to be liquidity induced more than anything else. Those handful of darling stocks all have one major thing in common: they are all stocks that can be attributed to the “work at home” situation that the world finds itself in. Even as economies open up, each one of these companies will still have high demand for their products and services. In other words, it basically cannot fail at this point.

Adding to the fact that Donald Trump did not put the hammer down on China like they thought he could, that also had the market breathing a sigh of relief. When he first started speaking, we were actually negative and therefore most of the buying was late in the day, which is quite typical for Wall Street as that is when huge institutions get involved.