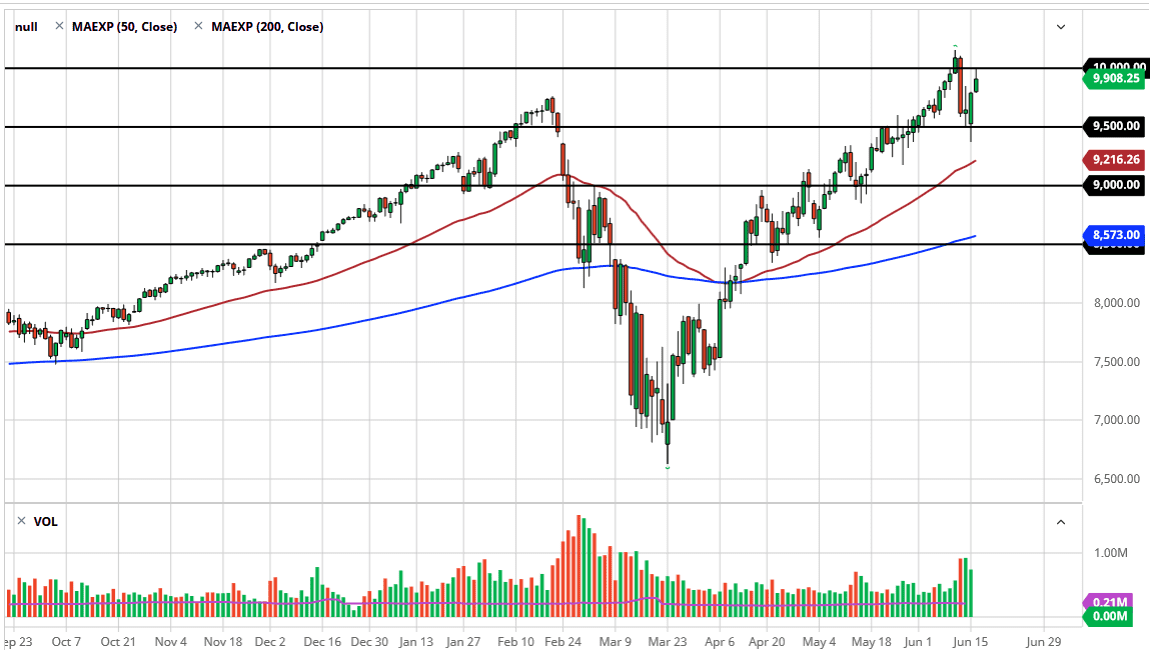

The NASDAQ 100 rallied a bit during the trading session on Tuesday, reaching towards the $10,000 level before pulling back in what was a very volatile trading session. In the 10,000 level of course is an area that has a lot of attention paid to it, as it is a large, round, psychologically significant figure. By pulling back the way it has though, it had people jumping into the market to take advantage of a bit of value. Ultimately, this is a pair that I think continues to see noisy reactions, and of course the fact that we had seen Jerome Powell testified in front of Congress during the trading session is not helping the situation.

Underneath, the 9500 level offers quite a bit of support, as we broke down below it during the trading session on Monday, buyers came in to push this market to the upside, and recover the 10,000 level, albeit just momentarily. With that being the case, the market is likely to continue seeing a lot of general noise, but it certainly is still very bullish. If we can take out the massive negative candle from the Thursday session, then we could continue to go much higher. After that massive selloff, we have seen a lot of traders coming in to pick up a bit of value. After all, this is a market that has continued to gain favor due to the fact that there only a handful of stocks driving the entire index.

Ultimately, I do think that short-term pullback should continue to offer buying opportunities, and quite frankly you should look forward to those pullbacks as an opportunity to pick up gains as the market is clearly being lifted by the Federal Reserve and all of its monetary policies. With that, it is likely that the market will continue to simply go higher to the upside. Ultimately, this is a market that I think it will chop around but continue to find buyers. If we break out to the upside, that could send the market much higher but at this point it is likely that the move would be thought of as a little overdone. The 50 day EMA underneath continues offer significant support, so if we break down below there then we would probably have to “reset” at lower levels, and as a result I think it would simply take some patients before he got another set up.