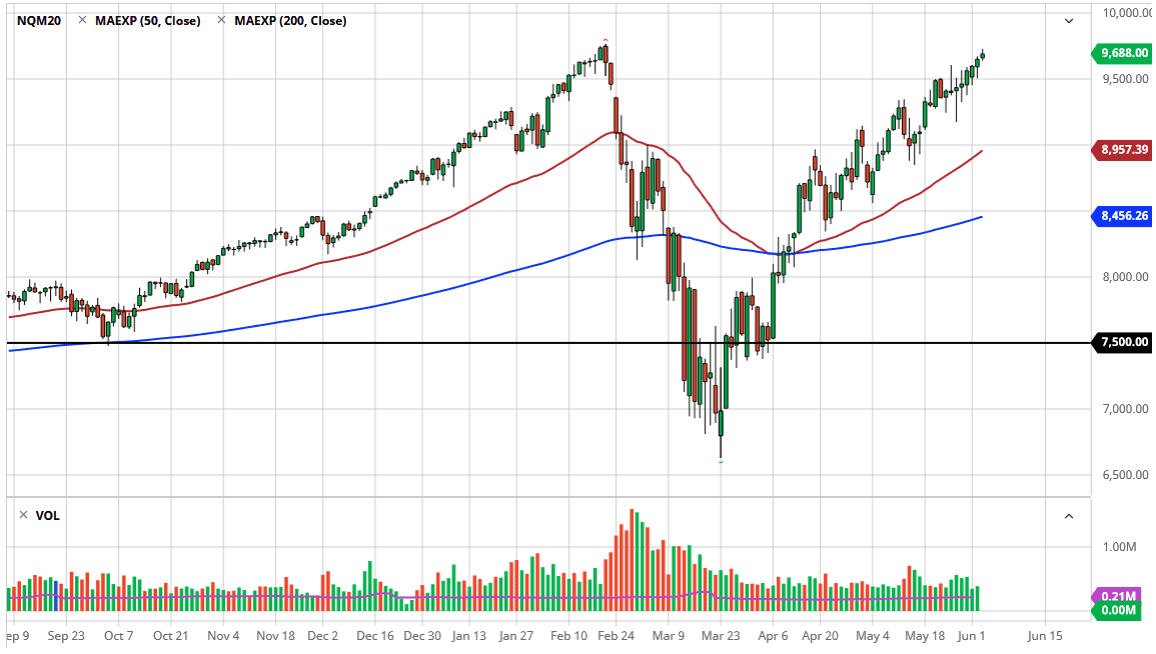

The NASDAQ 100 continues to elevate to the upside, reaching towards the all-time highs again on Wednesday. If we did pull back just a bit, but at the end of the day this is a market that simply cannot fall for any significant amount of time. Ultimately, I believe that the market is going to break out to the upside, but a short-term pullback makes quite a bit of sense as we have been a bit overextended. The 9500 level underneath should offer plenty of support, and I do think that the 9000 level will as well. The market is overdone, but quite frankly the market has been overdone for ages.

Keep in mind that the NASDAQ 100 is comprised of a handful of major stocks that Wall Street always runs to, including the likes of Alphabet, Facebook, Microsoft, Tesla, Netflix, and of course Amazon. Looking at this chart, it is easy to see that we are overextended and quite frankly the idea of the stock market being as bullish as it is would be overdone by just about any metric you can imagine. However, it is what Wall Street does, blows up bubbles and it looks like the Wall Street traders have done it again. That being said, if we can break out to the area above the all-time highs, it is likely that we will then go to the 10,000 level.

If we can break above the 10,000 level, then we will simply continue to go much higher. At this point, it probably makes a bit of a “blow off top.” Ultimately, if we do get that then the market probably rolls over. I doubt it though, because this is all about liquidity, and not really anything to do with the economy itself, because quite frankly if it was about the economy, we would be much lower with all of the writing, economic distractions and desolation, the US/China trade situation melting down, we would be closer to about 8000. However, price is price and by extension price is truth. Because of this, you cannot be a seller, at least not until we get some type of major breakdown. In other words, let the market show that it is ready to pull back before you get short. On the other hand, if we make a fresh, new high it is only a matter of time before we get the 10,000 which is probably the safer bet.