At the beginning of this week’s trading, gold price fell to the $1704 support, with a positive shift in the performance of global financial markets, which increased the profit-taking sell-offs. Adding to the pressure on the yellow metal, the US Central Bank announced surprisingly that it would start buying bonds of individual companies. However, with the Chinese announcement that many areas were closed due to a new outbreak of the Corona pandemic. They officially announced the start of the second wave of the pandemic, and it was natural to have a rapid rebound of the gold price to reach again to the $1732 resistance. Gold price settled around the $1728 level at the time of writing, ahead of the announcement of important and influential data today.

Gold price increased by 2% last week, which increased its gains so far to just under 14% since the beginning of this year’s trading.

Silver, the sister commodity of gold, is trading relatively steadily at the beginning of this week's trading. July silver futures fell $0.042, or 0.24%, to $17.44 an ounce. The white metal fell 3% last week, adding to the 2.5% decrease since the beginning of the year.

The precious metals market fell as investors took some profits after the latest jump in gold prices. The matter did not help the possibility of some margin calls as well, which prompted traders to participate in the forced sell-offs. Gold has seen this before, most notably during the market turmoil in March. Investors were forced to liquidate their gold holdings to cover their margin calls.

Suddenly, the Federal Reserve announced that it would start purchasing individual corporate bonds, in addition to collecting corporate debt in the secondary market through exchange-traded funds (ETFs). According to a press release, the Fed said that it will purchase individual bonds with remaining five-year maturities or less and have credit ratings for BBB- or Baa3 as of March 22 to buy corporate debt, but it has shown it is willing to give up its self-imposed caps.

In the bank’s statement, they stressed that they wanted to develop a “corporate bond portfolio that is based on a wide and diversified market index of US corporate bonds”. This index consists of all bonds in the secondary market that have been issued by US companies that meet the minimum enterprise rating, maximum maturity, and other criteria. The indexing approach will complement the facility's current purchases of money traded on the exchange.

The decline in the US dollar limited gold losses yesterday. The US dollar index DXY, which measures the performance of the greenback versus a basket of currencies, fell 0.61% to 96.73, from the opening of 97.09. The dollar fell 3% last month, eliminating almost all of its gains in 2020. As is well known, the weaker dollar is good for dollar-denominated goods because it makes them cheaper for foreign investors to buy.

Relative to other metals prices, copper futures in July fell $0.0315, or 1.21%, to $2.5685 a pound. Platinum futures for July rose by $3.70, or 0.45%, to $822.70 an ounce. Palladium futures for July fell $1.80, or 0.09%, to $1936.70 an ounce.

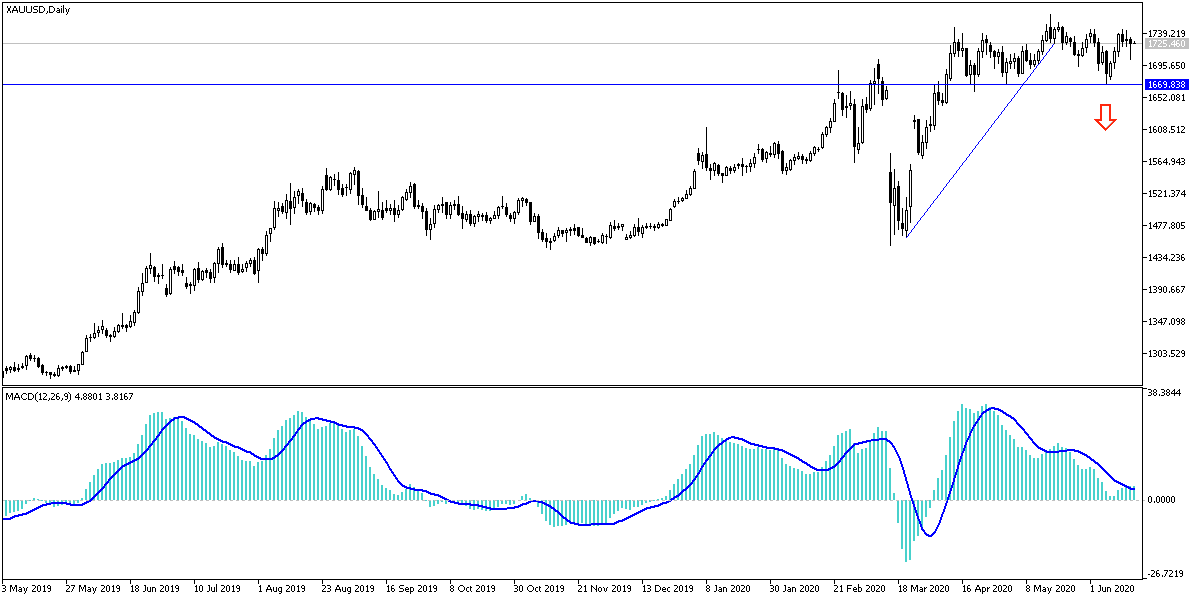

According to gold technical analysis: No change in my technical view of the gold prices, as they will remain in an upward environment as long as it is stable above the $1700 psychological resistance, and stability above the $1733 resistance will support the upward movement towards higher resistance levels at 1742, 1755 and 1763 respectively. This may happen if fears of the number of pandemics cases increase, coinciding with the reopening of global economies. There will be no reversal of the current bullish outlook for the pair without a break below the $1700 level.

Gold price will react today with the announcement of the Japanese central bank monetary policy, British job numbers, the German ZEW, and the U.S retail sales figures, industrial production, and important statements by Federal Reserve Governor Jerome Powell.