With the beginning of this week’s trading, gold prices rose again to the level of $1700 psychological resistance after recording its lowest level in more than a month, at to the $1670 support, after the better than expected numbers of US jobs, which contributed to more investor risk appetite. The price of the yellow metal stabilized around the $1697 level in the beginning of Tuesday’s trading. The latest drop came as investors increasingly bet on hopes for more stimulus from global central banks to help get economies back on track.

The US Federal Reserve Board is due to announce its monetary policy decision on Wednesday (10 June). Although recent employment data turned out to be a big positive surprise, it is widely expected that the US central bank will release further stimulus measures. At the same time, the bank may issue a warning of some kind regarding the economic outlook in the short term due to the impact of the coronavirus pandemic.

Silver futures for July ended yesterday's trading higher by $0.414 at $17.89 an ounce, while copper futures for July settled at $2.5655 per pound. The Organization for Economic Cooperation and Development is to publish its economic forecasts on Wednesday, while Eurozone finance ministers will meet on Thursday to discuss the European Union recovery package.

European Central Bank President Christine Lagarde has urged the European Union to quickly pass the coronavirus stimulus package proposed by the European Commission to restore confidence and avoid a deeper recession.

On the economic level. The results of a survey conducted by "Syntax behavioral research” company, showed improved economic sentiment in the Eurozone in June due to the easing of measures to combat the Coronavirus pandemic. Thus, the Syntax main investor confidence index rose to -24.8 in June from -41.8 in May. The expected reading was -22.5. Syntax said there was progress to assess current conditions from May and expectations were boosted to the highest level in more than two years. At -61.5, the current situation index reached its highest level in three months at -61.5, and rose from -73.0 a month ago.

Likewise, expectations index rose to a reading of 21.8 in June from -3.0 the previous month. This was the highest result since November 2017.

According to Syntax, the survey showed that Germany reached the bottom. The forecast jumped nearly 30 points to the highest value since March 2015. The German investor confidence index improved to -17.2 in June from -35.3 in May. However, investors expect that Germany will only be able to compensate for about 64 percent of the slump in economic output within a year.

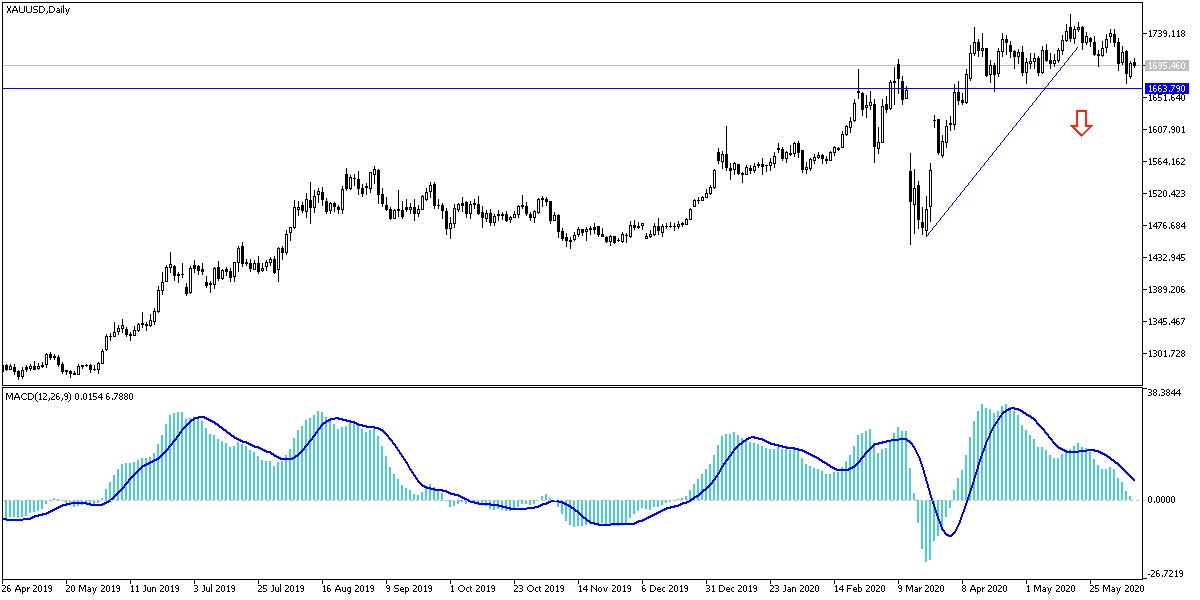

According to gold technical analysis: As I mentioned in the recent technical analysis that the price of the yellow metal may rise again towards new highs in the event of stability returning above the $1700 psychological resistance again, because it is more important for the bulls to control the performance for a longer period. Accordingly, I still prefer to buy gold from every bearish level, and the closest support levels for gold are now 1688, 1675 and 1660, respectively. Gold gain factors persist, the Coronavirus and its devastating effects, fears of a second wave with the reopening of the global economy, tensions between the United States and China and Brexit, and Trump's future with the near presidential election.