Throughout the week's trading, the price of gold was in a downward correction range amid continuing gains in global stock markets and growing investor confidence that the reopening of global economies may offset some of the catastrophic shocks caused by the Coronavirus. Markets ignored warnings of that reopening without a pandemic vaccine could lead to a second wave of disease outbreaks. Accordingly, the gold price fell to the $1670 level, the lowest for two months before closing trading around the $1685 level. The better than expected positive US job numbers contributed to support the recent bears' gains.

The yellow metal abandoned the $1700 psychological resistance with the increasing easing of monetary and financial policy globally to stimulate the economy around the world, which is facing the most serious recession since the thirties. The yellow metal recorded a weekly loss of 4%. However, gold prices are still 10% higher. And the price of silver, the sister commodity of gold, also fell with another weekly closing, as silver futures for July fell $0.546, or 3.02%, to $17.515 an ounce. The white metal ended the week's trading down 5.2%, in addition to falling by 2.15% since the beginning of the year.

On the economic side, the US economy exceeded market expectations for jobs last month. Where the Bureau of Labor Statistics (BLS) reported that the US economy has succeeded in creating 2.509 million new jobs, defying the average estimates for a loss of about eight million jobs. The US unemployment rate also fell to 13.3% in May, down from 14.7% in April. Economists had expected the unemployment rate to rise to 19.8%.

The news prompted investors to move away from safe assets - including gold - to stocks. Accordingly, all leading stock indices recorded huge gains on Friday, including the Dow Jones Industrial Average, which rose by up to 1,000 points to regain the top at the 27000. The jobs report raised the dollar after several sessions of decline. Accordingly, the US dollar index, DXY, which measures performance against a basket of six other major currencies, rose 0.25% to 96.92 from Friday's opening level of 96.74. The strength of the dollar is negative for commodities priced in dollars because it makes buying them more expensive for foreign investors.

In general, the US economy is showing signs of improvement and is emerging from the slump of the recession caused by the coronavirus pandemic. With the Fed not likely to cut back the unprecedented stimulus package of several trillion dollars, financial markets are expected to continue to recover. What could help gold is the US government reining in its massive stimulus spending plans, which also appear unlikely, after reports indicated that the White House was considering another $1 trillion stimulus package later this summer.

For other metals markets, copper futures rose to $2.5405 a pound. Platinum futures fell to $833.10 an ounce. Palladium futures rose to $1957 an ounce.

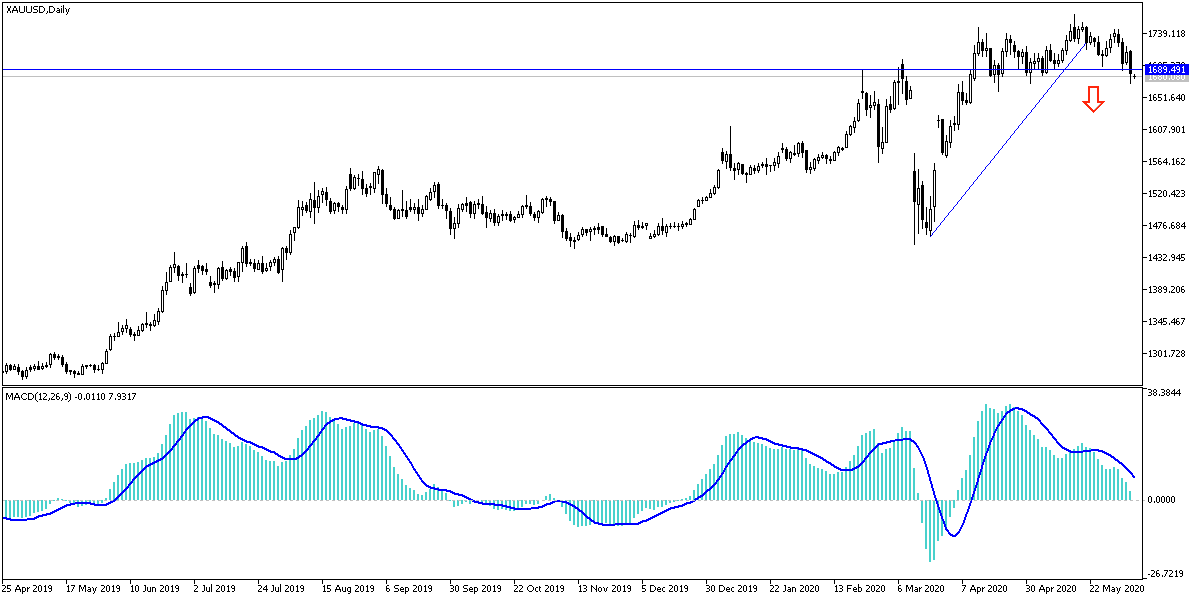

According to gold technical analysis: Continuing the gold drop may collide with good levels of purchase and the most prominent of them are currently at 1670 and 1658, respectively. Despite the recent market optimism, I still prefer to buy gold from every drop. Corona's epidemic is still standing and is still reaping a lot of human and economic losses, and the return of the global economy to the pre-epidemic levels will take many months and may even reach years, which may be a catalyst for gold in achieving record gains. Stability above $1700 psychological resistance will continue to be an incentive for investors to push prices higher. Today, the economic calendar has no important US economic releases, and accordingly, it is expected that movements in gold prices to be quiet, while monitoring the extent of investor’s risk appetite.