After three trading sessions in which the price of gold rose to the $1745 level, the downward correction returned to the $1721 support, amid investors strong risk appetite, ignoring the internal turmoil in the United States and focus more on optimism of reopening the global economy. The yellow metal is stable around the $1731 level in the beginning of Wednesday’s trading. Generally speaking, investors are still concerned about the escalation of Sino-US trade tensions even with the reopening of economies and the abandonment of forced closures due to the COVID-19 pandemic, which has softened some of the gold luster as a safe haven. What halted gold losses, was the drop of the DXY dollar index, which moves opposite to the metal. At the same time, some experts argue that the Fed's economic stimulus measures, including near zero interest rates, and fiscal stimulus around the world, have generally supported the purchase of gold bars.

Going back to the Coronavirus, which has been affecting markets for months drawing the image of the global economy for years to come, the number of Americans who have been confirmed with COVID-19 has risen above 1.8 million, amid concerns that protests over George Floyd's death last week, and people who gather in groups with the lifting of the closure, will spark a new wave of epidemic infections. Health care experts have warned that Americans need to continue the social distancing and monitor other public safety measures to prevent the spread of the virus. The best way to avoid getting infected is to keep a distance of at least 1 meter, wear face masks and protect the eye, according to the review of the COVID-19 infection protection items.

Dr. Anthony Fossey, an infectious disease expert and member of the White House team to tackle the epidemic, has repeatedly warned against reopening the economy very quickly at a time when we do not have a vaccine, warning that it may cause unnecessary suffering and death. Fauci told the Stat News for healthcare news that he was no longer in frequent contact with President Donald Trump, as team meetings were not held as they had been in the past.

Meanwhile, Trump threatened to mobilize the military to restore security in troubled US states, after days of protests over Floyd’s unarmed death by a white police officer, and violence, looting, and vandalism included several U.S. states, mostly in New York, Los Angeles, Detroit, Atlanta, and Washington, D.C.

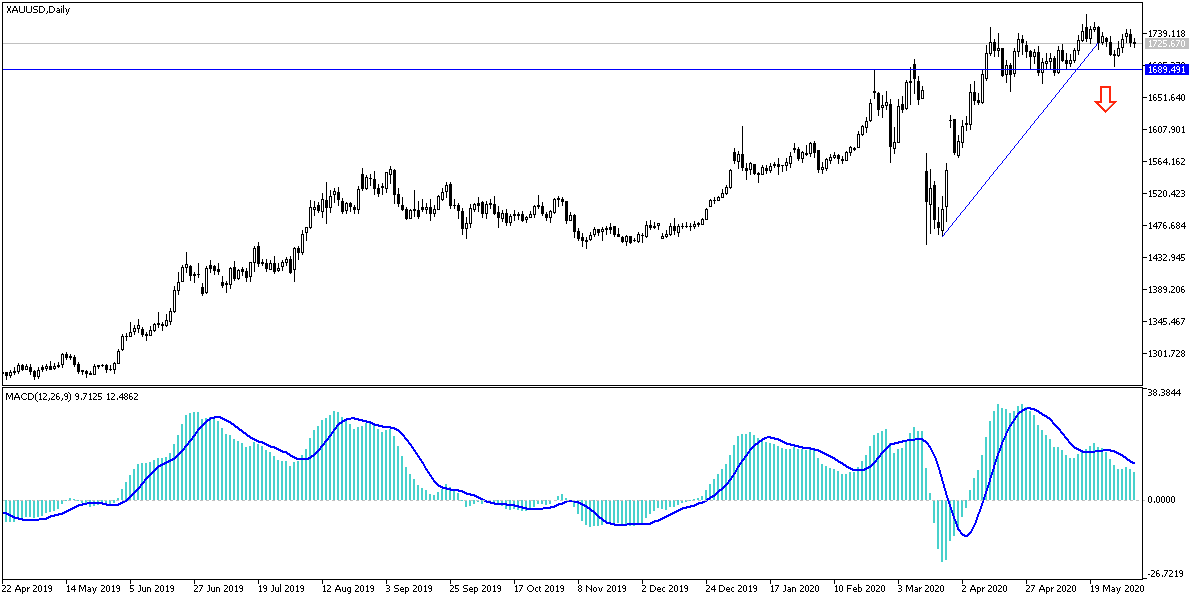

According to gold technical analysis: Gold bullish path will remain with its stability above the $1700 psychological resistance. The global situation from the US-China conflict and the impact of the Coronavirus pandemic will continue to motivate gold investors to buy from every bearish level. The most appropriate buying levels are currently 1717, 1705 and 1685, respectively. Bulls pushing gold towards the resistance levels of 1745 and 1766 will push the price to the next psychological resistance at $1,800 an ounce.

Gold price will react today with the announcement of the US ADP data to measure the change in the numbers of US non-agricultural jobs and then the ISM PMI for American services and factory orders data.