Despite strong gains in global stock markets, amid increasing optimism among investors about the reopening of the global economy, the price of gold continued to move upward, and gains reached the $1745 resistance in the beginning of this week's trading, near its highest level in more than seven years before stabilizing around $1740 an ounce at the time of writing. Global stock gains were offset by concerns that supported the appetite towards gold as a safe haven, against the backdrop of U.S protests at A national level after the death of a black man in Minneapolis during police custody, the latest developments related to US-China tensions over Hong Kong, and some data indicating an improvement in the global economy.

Economists believe that the protests in the US and the conditions of the trade war could have positive and negative effects on gold prices. It can have a negative impact on the economy and reduce physical demand for gold, but it also boosts demand for the metal as a safe haven. At the same time, American protests may lead to a second wave of the deadly Corona epidemic and increase US numbers, which top the global figures for cases and deaths.

Civil unrest erupted across major cities from Los Angeles to New York, where anger sparked these demonstrations after the death of George Floyd in police custody last Monday.

On the economic side, the US economy has shown some signs of recovery while lifting some of the COVID-19 closure policy. The Institute of Supply Management announced that the ISM Manufacturing Index rose to a reading of 43.1 last month from an 11-year low of 41.5 in April, while the Commerce Department reported that spending on US construction projects fell less than expected by - 2.9% in April.

Trade frictions between the two largest economies in the world will begin to weaken the optimism that has prevailed in global financial markets recently, which will provide gold with more support. On Monday, Bloomberg News reported that China is ready to halt purchases of some US farm imports, including soybeans. This is followed by the decision of the US State Department that Hong Kong is no longer independent from China and that President Donald Trump is moving towards ending the special trade relations between the United States and Hong Kong.

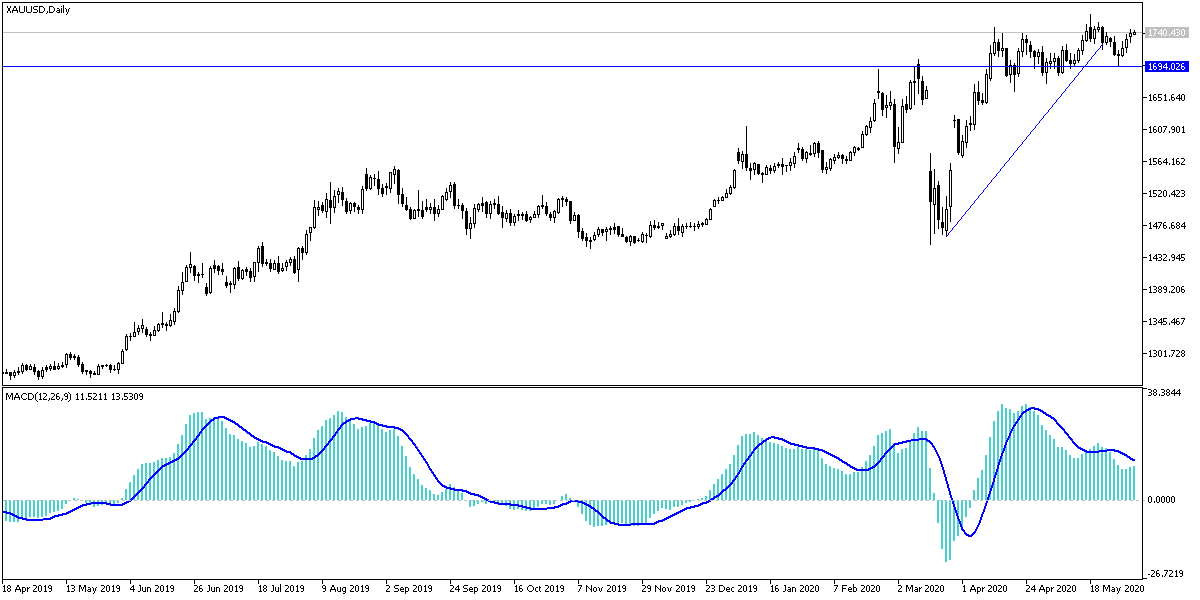

According to gold technical analysis: The bulls control over gold price path grows stronger with the increase of global geopolitical tensions and the continuing dispute between the two largest economies in the world, along with the devastating effects of the Coronavirus outbreak. Accordingly, trading strategy of buying from each lower level will remain the best for gold investors in the coming days. The closest support levels for gold are currently 1733, 1725 and 1710, respectively. If the resistance above 1765 is broken, we may see the next psychological resistance of $1800 soon.

With the economic calendar devoid of important US economic releases, investor sentiment will be the most influential on the gold track.