A distinctive opportunity for the yellow metal to recover its gains after sharp losses at the end of last week pushed it towards the $1670 support, as the price of gold tested the $1740 resistance, amid a strong decline in the USD after the announcement of the monetary policy of the US central bank yesterday. As per expectations, the bank kept interest rates between zero and 0.25% unchanged. The bank emphasized that it may keep these rates unchanged until 2022, and against market desire, the bank did not allude to the possibility of approving negative interest rates. However, they stressed on commitment to provide more stimulus plans to revive the US economy in the face of the catastrophic shocks of the Corona epidemic.

The Fed confirmed that it would continue to purchase about $120 billion in treasury and mortgage bonds per month to maintain low-term borrowing rates over the long term in an effort to stimulate spending and growth. Bank Governor Jerome Powell, on his part, said he is ready to do more to help support a fragile economy that faces great uncertainty. Powell admitted that he and other Fed policy makers have a blurry outlook about how the economy will improve in the coming months.

On the other hand, the US government posted a budget deficit of $1.88 trillion for the first eight months of this fiscal year, which is greater than any annual deficit in US history. The deficit increased as government spending increased to deal with the Coronavirus pandemic and tax revenue diminishing when millions lost their jobs. The deficit in the period from October to May was more than twice the amount of 738.6 billion dollars that was booked for the same period last year, according to US Treasury figures.

The Congressional Budget Office predicts that this year’s deficit will reach $3.7 trillion, which will be more than double the record deficit of $1.4 trillion recorded in 2009. This previous record was set when the government was dealing with a financial crisis that pushed the country into the deepest stagnation since the thirties. The country is now in another recession that started in February. This deflation has already seen much larger job losses, and is expected to be much worse than the 2007-2009 contraction.

The deficit in May was only $398.8 billion, a record number for that month and almost double the deficit in May 2019.

May US government spending increased 30.2% to 572.7 billion dollars. As legislators approved a temporary increase of $600 per week in unemployment benefits and economic stimulus payments, which amounted to $1,200 per person, and a salary protection program to provide droppable loans to small companies that kept their workers ’salaries.

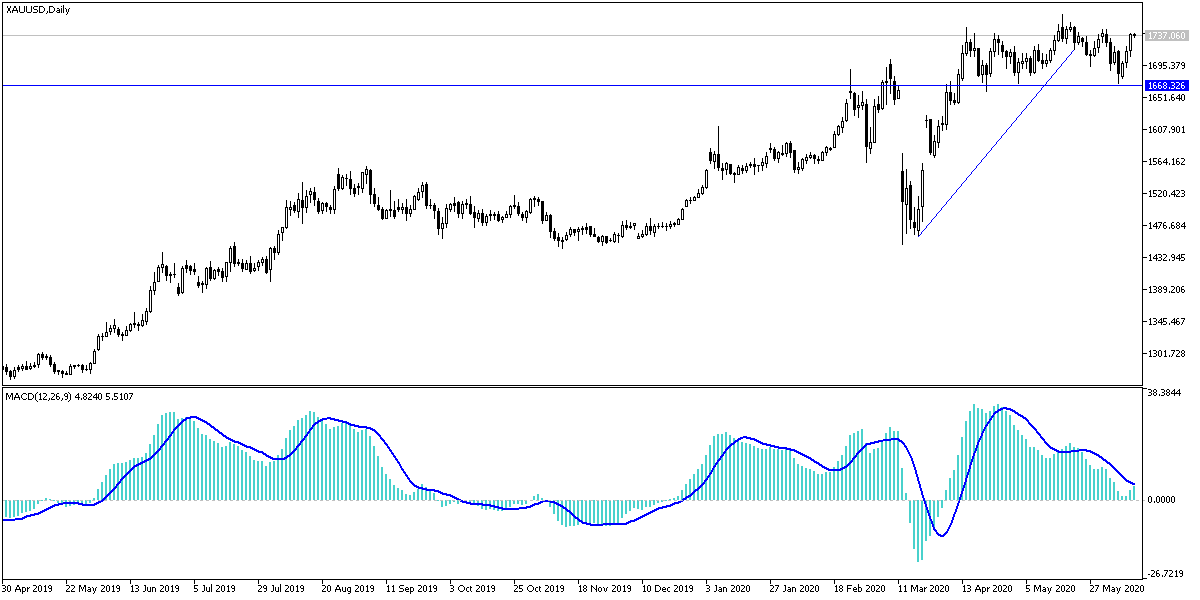

According to gold technical analysis: As expected in recent technical analyzes, the price of gold may get sufficient momentum to correct upward if it stabilizes at the highest psychological resistance level at $1700 an ounce as is the case now. However, it must be emphasized that the movement of gold price towards 1742, 1754, and 1765 will support the technical indicators move towards strong overbought areas, from which investors may think to reverse deals by selling to take profits. On the other hand, any move below that resistance will push the bears controlling performance. Concerns about the future of the global economy in the Corona era and the tensions between the United States and China, and Brexit, remain factors supporting gold gains for a longer period.

Gold will react today with the announcement of US producer prices and weekly jobless claims.