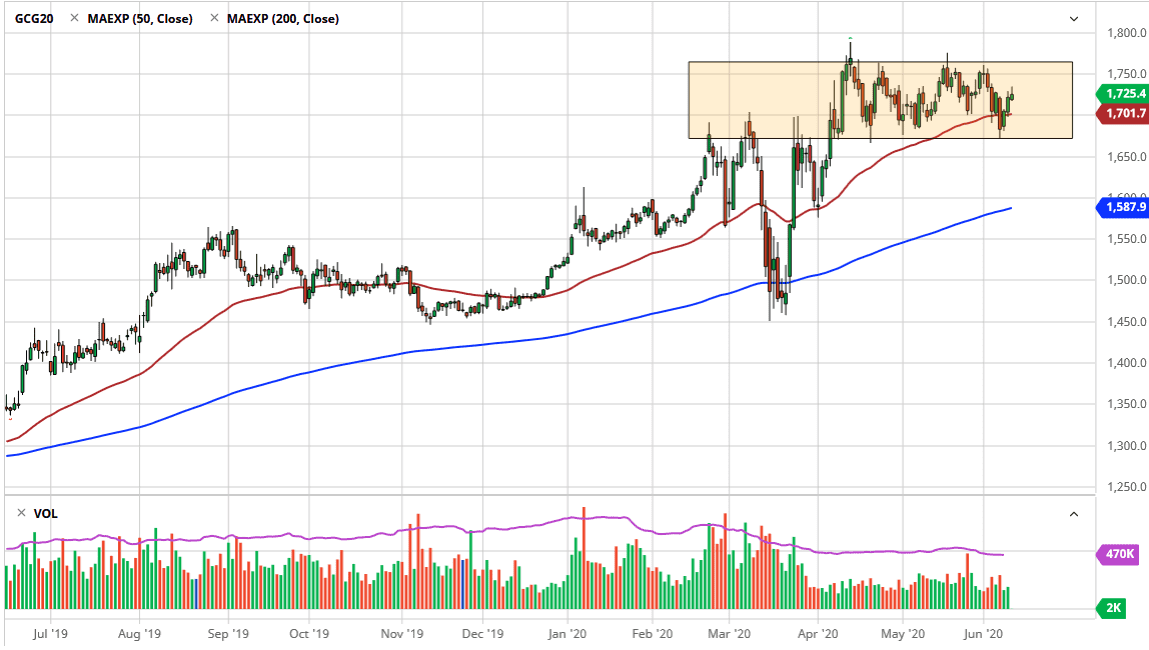

Gold markets have rallied a bit during the trading session again on Wednesday as the Federal Reserve sounds dovish yet again. Looking at the market, you can see that we have seen quite a bit of consolidation over the last three months. The candlestick for the session on Wednesday is rather bullish, and the reality is that we did not break out so I think at this point we are simply looking at the market through the same lens that we were looking at it before the announcement.

On the downside, I recognize the $1675 level as support, while I see resistance at the $1750 level above. That resistance level is “$25 thick”, meaning that it ends in the $1775 level. If we can break above there then I think it is pretty much a straight shot to the $1800 level, and we could be looking at the $2000 level longer-term. That obviously is a longer-term call, but I do think that with central banks around the world in such a dovish mode, and of course the long slew of potential negative headlines that could come out, gold certainly looks likely to continue going higher regardless.

Another thing to look at is the fact that we are consolidating in a huge rectangle, which quite often “consolidation leads to continuation”, as the saying goes. That typically means that will consolidate like this, and eventually break out in favor of the previous trend, which in this case was most decidedly to the upside. I can give you 100 reasons why gold might rally in the short term and cannot think of many as to why it would not. With that in mind, I think that buying dips continues to work, at least until we break out for a longer-term move. If we did somehow break down below the bottom of the rectangle, then I think there is massive support down at the $1600 level, which has the 200 day EMA sitting just below it. In that area, it would be more or less saving the trend, so I think there would be a lot more effort by the bulls to push this thing higher. If the US dollar continues to get hammered, I think that will be fairly good for gold as it typically is, but we also have plenty of potential economic shocks out there just waiting to happen, which could also lift gold.