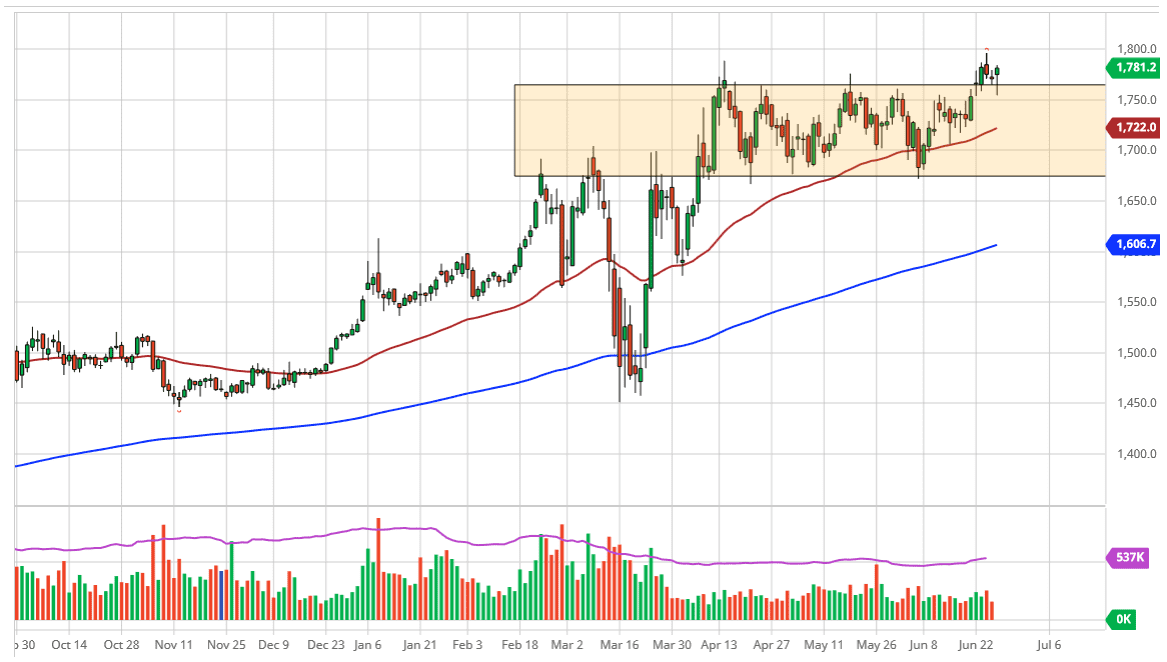

Gold markets have had a wild ride over the last 24 hours, initially dipping down towards the $1760 level before rallying significantly to form quite a bit of a hammer. The market is likely to continue to see a lot of upward pressure because the market has been in an uptrend for quite some time, and now it looks like we are going to seriously threaten the $1800 level. If that is going to be the case, then I do anticipate that the market will find plenty of momentum eventually to break out and then go looking towards the $1850 level, and then eventually the $2000 level.

Pullbacks at this point continue to see a lot of support near the $1750 level, and below there at the 50 day EMA. After that, then we have the $1700 level offering plenty of support. We have been in an uptrend for a long time, and I do not see that changing anytime soon. Central banks around the world continue to do a lot of quantitative easing, so that should continue to put a bit of a bid into the gold market beyond that, we have a lot of concerns when it comes to the geopolitical situation between the United States and China, and the negotiations about the Brexit which never seems to end. Both of those things could drive gold higher based upon some type of fear of trade.

To the issue of the pandemic, it looks as if the market is going to continue to see that as one of the bigger questions as to what happens with gold. If gold traders see the numbers continue to rise, it is highly likely that gold will continue to rise right along with it in order to provide a little bit of safety in that situation. I have no interest in shorting gold because there are so many support levels underneath and so many potential problems that it is difficult to imagine a scenario where we see the markets turn around and change completely. Gold is destined to go to the $2000 level and given enough time I see no reason why it will not happen. That does not mean that we will get there overnight but clearly every time we dip, there seems to be more than enough interest in gold to start buying yet again.