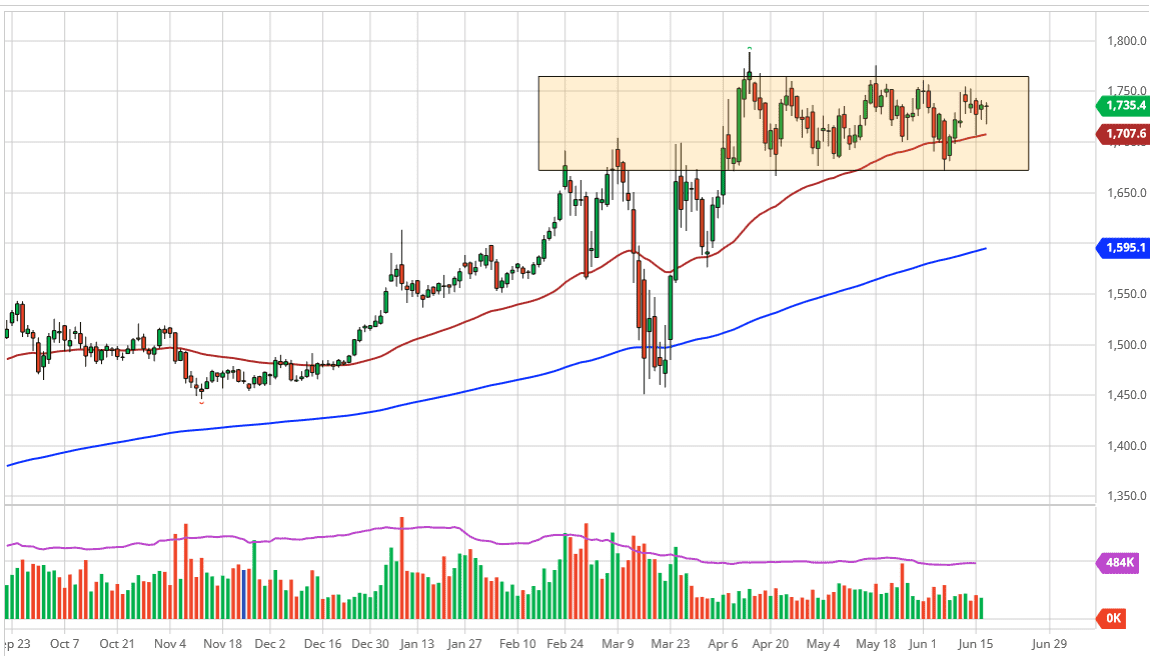

Gold markets have continued to show one thing over the last several months: that they are more than willing to step in and pick up gold every time it dips. When you look at this chart, you can see that the $1750 level has offered significant resistance, and I believe that that resistance extends all the way to the $1775 level. If we can get above there than gold will make its major move to the upside and reach towards the $1800 level in the short term.

A break above the $1800 level allows the market to go looking towards the $2000 level, which is my longer-term target in general. I think that plenty of people out there are concerned about the central banks around the world continuing to ease monetary policy, and expand it as well. Beyond that, there are plenty of negative headlines out there just waiting to happen, and therefore a lot of traders out there trying to pick up gold to get a little bit of safety. Think of all the headlines right now that could cause issues: US/China trade tensions, coronavirus shutting down parts of Beijing, Western states in the United States showing higher infection rates again, Brexit, and a whole list of other things out there.

Finally, when you look at the chart, you can see that we have been riding to the upside for some time, and even though we have gone sideways for a minute here, at the end of the day nothing has changed from a trend perspective. Quite often, when you see these types of moves after a move to the upside or downside that has been somewhat sustained, it’s simply the market consolidating and waiting for more buyers to step in and continue pushing. After all, there is a saying that has been around forever saying, “consolidation leads to continuation.” If that is the case, then we should continue to go higher. Even if we were to break down below the $1675 level, which I see as the very bottom of this rectangle, the market should have plenty of support down at the $1600 level due to the large, round, psychologically significant figure, past trading in that general area, and of course the 200 day EMA which is starting to move right through that level as well. In other words, there are plenty of “buy on the dips” scenario is that I see.