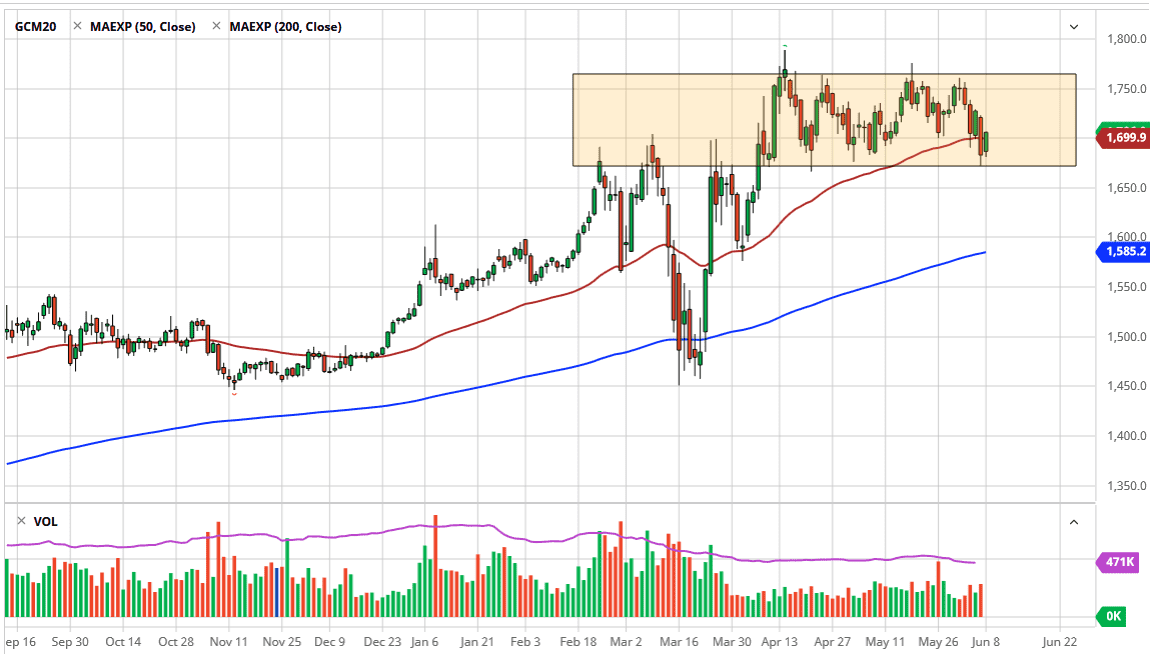

Gold markets have bounced a bit during the trading session on Monday to kick off yet another week of choppy sideways trading. The fact that we rallied during the open and shot through the 50 day EMA later in the day suggests that we are in fact going to continue the overall consolidation. The market has been in a range for some time, and now that we are closing towards the top of the range for that session, which suggests that we are in fact going to continue to go higher. I believe given enough time we may go back towards the $1750 level.

The $1675 level looks especially important, as it has been an area that offered support more than once. After all, there are plenty of reasons to suspect that gold should rally, not the least of which is going to be that the central bank continues to print currency as fast as it can. The Federal Reserve is extraordinarily loose with monetary policy, and it is also worth noting that there is a meeting this week that could provide more headlines.

On the downside, if the market were to break down below the $1675 level, it is possible we may go to the $1650 level, possibly even the $1600 level after that. The $1600 level should offer plenty of support, not only due to the fact that it is a large, round, psychologically significant figure, but it is also an area where the 200 day EMA is approaching rapidly. If the market were to reach all the way down there, one would have to think that a lot of bullish long-term traders will be picking up gold as quickly as possible.

On the upside, if we were to break above the $1775 level, we will have broken through the overall consolidation area that has been so crucial for quite some time. By doing so, we threaten the $1800 level, and then possibly the $2000 level, longer term. With the way central banks continue to print currency, it makes quite a bit of sense that we will see gold pick up a bit of a bid due to the fact that fiat currencies will lose strength overall. Beyond that, there are a lot of negative headlines out there just waiting to happen, and of course that can push gold higher in a bit of a safety bid.