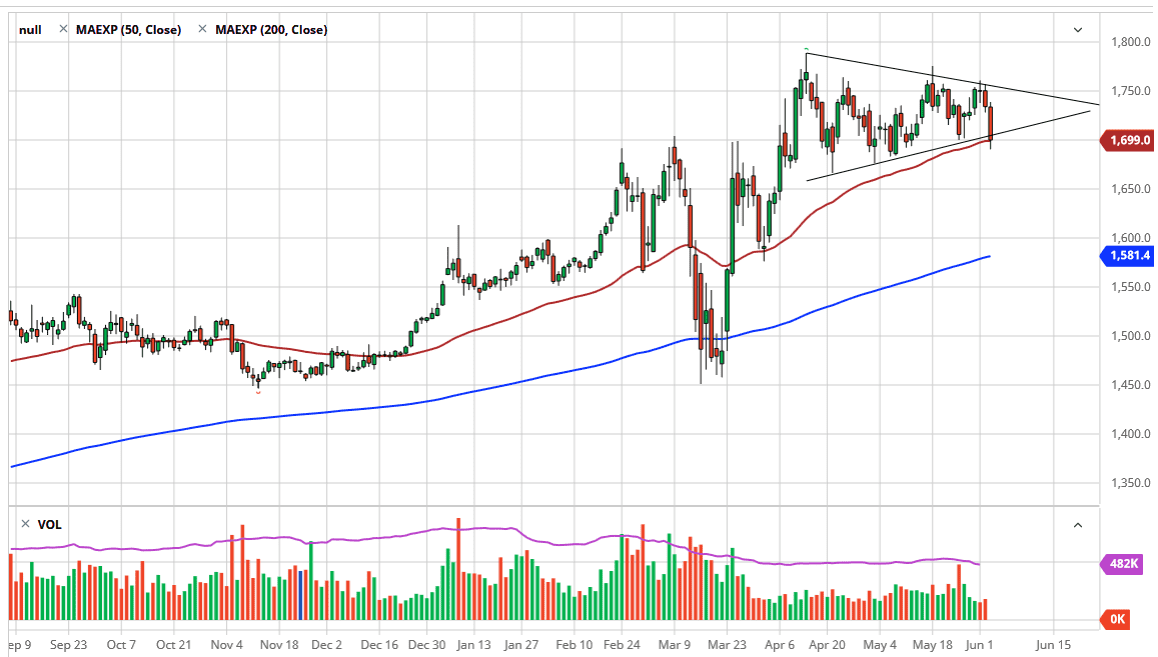

The gold markets have broken down significantly during the trading session on Thursday, but are clearly hanging around the $1700 level, an area that should cause a bit of psychological support. The 50 day EMA is right there as well, so from a technical standpoint it makes sense that gold should bounce from here. The triangle is a symmetrical triangle, so it does not necessarily tell which direction we are going but typically “consolidation equals continuation.”

The candlestick is rather negative, but the trend is higher. I think it is only a matter of time before the market starts taking off to the upside. Even if we were to break down from here, I believe that there is plenty of support near the $1650 level, and then possibly even down at the $1600 level where the 200 day comes into play. Gold has been in an extraordinarily strong uptrend so there is no real reason to think about selling it, even though it has broken down a bit.

This is one of those markets you need to be looking at from the perspective of finding value, as we have been going higher for quite some time. Ultimately, if we break above the top of the triangle, it should open up a move to the $1800 level, and then possibly even the two who thousand dollars level longer-term. This is a market that I think you can add to longer-term positions as it is a cyclical situation. With central banks around the world loosening monetary policy as fast as they can, the devaluing of currencies should continue to lift precious metals in general, specifically gold.

After that, there are plenty of headlines out there that could cause issues, not the least of which would be riots in the United States, coronavirus, Brexit, US/China trade relations deteriorating, and of course the economy running at about half speed. With all of that going on, what could go wrong? I feel it is only a matter of time before we see plenty of buying pressure. The candlestick was rather negative for the day, but we have seen this more than once so a bit of bouncing seems to be the main way this market has been moving for some time. I believe this market will find its way to $2000 one way or another, but it does not necessarily need to get there overnight.