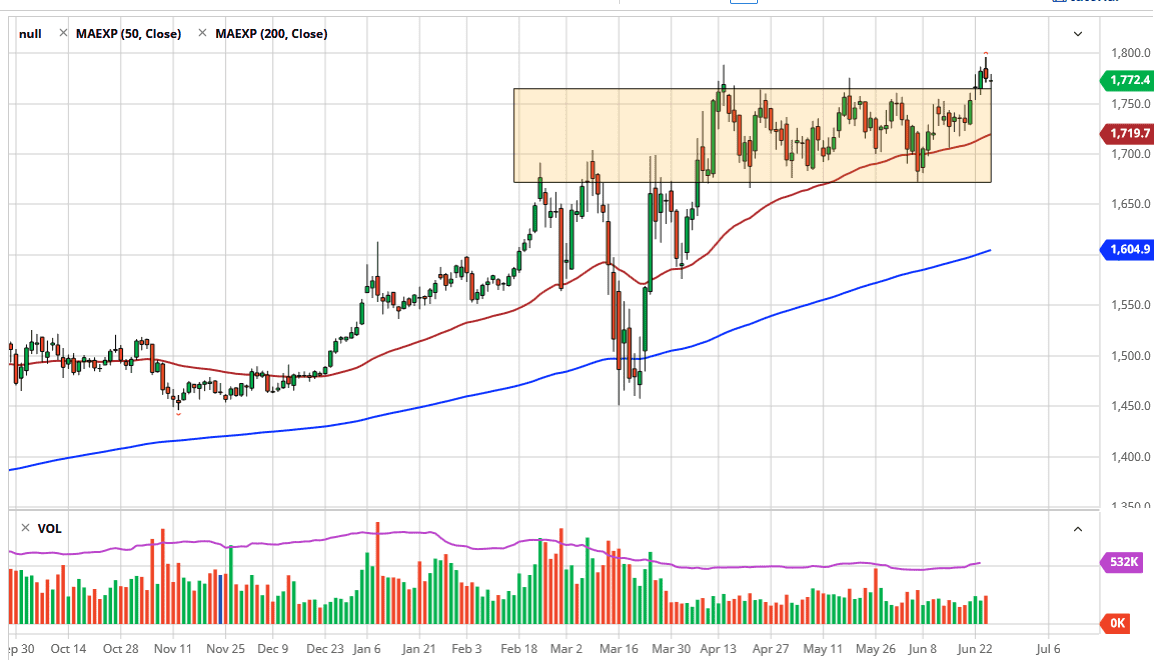

Gold markets went back and forth during the trading session on Thursday as we continue to see a lot of volatility. The $1800 level above is a massive barrier that is going to be difficult to break through, and as a result it is not a huge surprise to see that the market has pulled back from that $1800 level. That is an area that is going to catch a lot of attention, and therefore I think the markets will take out to the upside. In the meantime, I believe we are going to pull back in order to find value hunters jumping into the marketplace. The $1750 level should be an area that continues to be supportive, and I think if we break down below there then we go looking towards the 50 day EMA.

When you think about the state of affairs around the world it makes quite a bit of sense that there is a safety trade heading into the gold market. This has people buying gold for safety in the face of the coronavirus levels rising, the US/China trade tensions perking up, and of course the central bank devaluation of currency around the world. Gold is a great way that most traders will try to fight devaluation of currency, and as the Federal Reserve, European Central Bank, Bank of Japan, Bank of England, and several other ones around the world continue to engage in quantitative easing, this will lift the value of gold in all currencies, not just the US dollar.

In fact, gold has broken out against most other currencies and now we are sitting in this market waiting to see whether or not we will do the same. At this point I think it is only a matter of time before the market does break out here as well, and thereby sending the market towards the $2000 level. Underneath, there will be more than enough people out there looking to pick up a bit of value, as gold will suddenly become “cheap.” In fact, I do not even have a scenario where I am willing to short gold, at this point it is essentially a market that you are either buying or sitting on the sidelines. I believe that the $1700 level underneath is a massive support barrier that will be exceedingly difficult to break through, as it extends for at least $25 at that point.