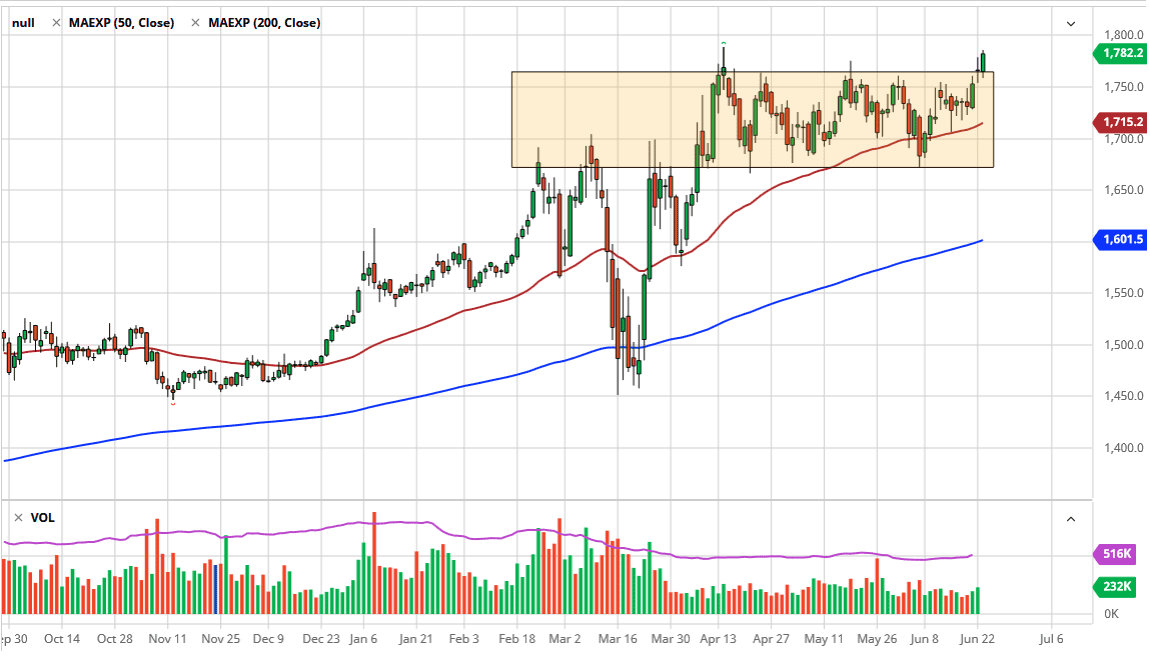

Gold markets have rallied yet again during the trading session on Tuesday, reaching towards the $1785 level towards the end of the pit session. This is a market that looks as if it is ready to go towards the $1800 level. The $1800 level being broken to the upside then opens up a flood of movement higher, as we should see market participants get aggressive at that point. Keep in mind that gold is used for a multitude of reasons, most of which has to do with the fact that the central banks around the world continue to liquefy the markets.

Pullbacks at this point should see support near the $1750 level, and then again down at the 50 day EMA. I have no interest whatsoever in trying to short this market because we have been in a long-term uptrend for some time, and of course there are plenty of reasons for gold to go higher. Central banks are just the start of the reason, but there are also concerns about the global economy, so therefore people might use gold for safety as well.

The US dollar is strengthening, so one that typically will work against the value of gold, the reality is that we could be looking at the risk appetite around the world as being stretched, and if that is the case we could see both the US dollar in the gold markets rally. Regardless, this is a market that looks highly likely to go looking towards the $1800 level. If we do break above the $1800 level, I think that it is going to be an explosive move to the upside. I have no interest whatsoever in selling gold, I think it is the trade of the year.

To the downside, the 50 day EMA is going to cause issues for sellers, and then of course the $1700 level comes into play. That is the bottom of the overall rectangle, which makes quite a bit of sense considering that we would consolidate before taking off to the upside. Quite often, you will see consolidation before continuation. Looking at this chart, it is obvious that every time we dip there are people suffering from “FOMO”, as we have so much in the way of obvious bullish pressure. At this point, we are simply looking for the next catalyst to start buying again.