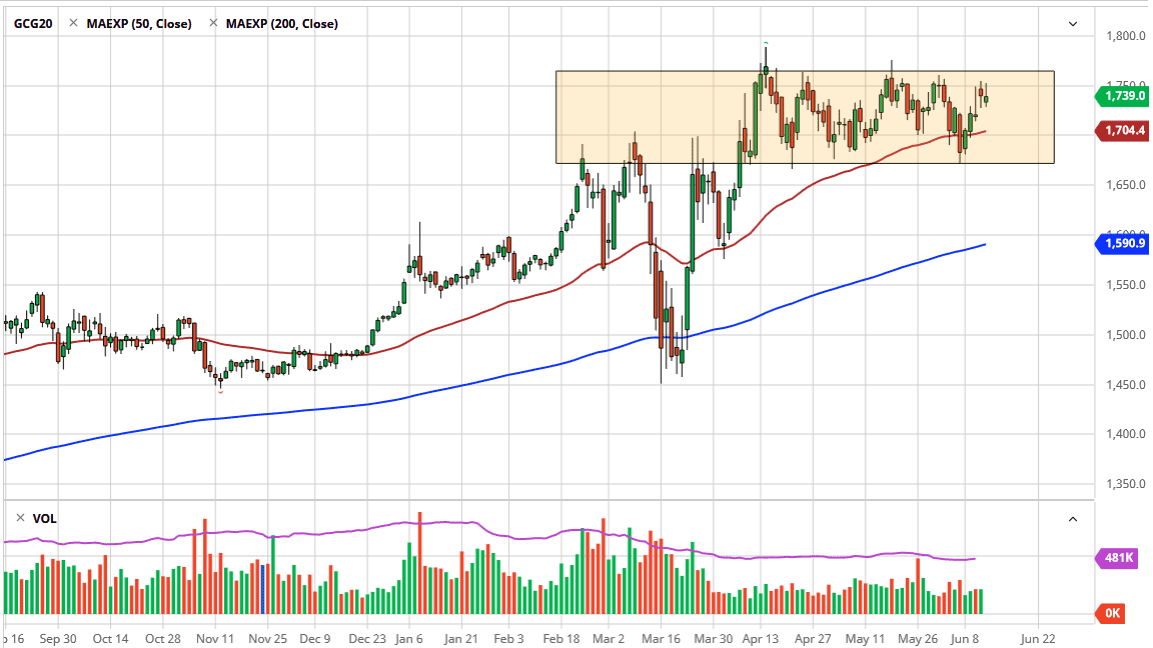

The gold market initially tried to rally during the trading session on Friday but found the $1750 level to be resistant, which I think extends all the way to the $1775 level. Pulling back from here makes sense, considering that we have been consolidating for quite some time, we were reaching into the weekend. The gold trade has been a bit quiet, which is truly interesting considering that with the way the stock markets are acting, you would assume that it would be a major “risk off” type of scenario, which should be bad for gold, but you can see we are still hanging out in the same area.

On the downside, I believe that there is a significant amount of support in the $1700 level, extending down to the $1675 level. The 50 day EMA is sitting right at the $1700 level, so I suspect that we are going to continue to see a lot of buyers in that area. The trend has been higher for some time, although the last couple of months have been more of consolidation than anything else.

Most of the time, when you see consolidation it tends to lead to more continuation of the overall trend, so this is a technical analysis tenant that we are paying attention to. If we can break out above the $1775 level, it is likely that the market then goes to $1800, and then to the $2000 level. I do believe that the $2000 level is the longer-term target, so I continue to look at little pullbacks as a buying opportunity. Even if we were to break down below the support level, I think it is only a matter of time before we go down to the $1600 level, which ties and quite nicely with the 200 day EMA.

With central banks around the world continuing to prop up economies with cheap and easy money, the gold markets will continue to get a bit as traders are worried about preserving wealth. These inflationary possibilities continue to help gold, not to mention the fact that there is a whole slew of potential issues when it comes to the global economy and geopolitical issues. Ultimately, this is a market that has plenty of reason to continue going higher, so I like the idea of buying value when it occurs, and therefore it is likely that we see a repeat of what has been going on.