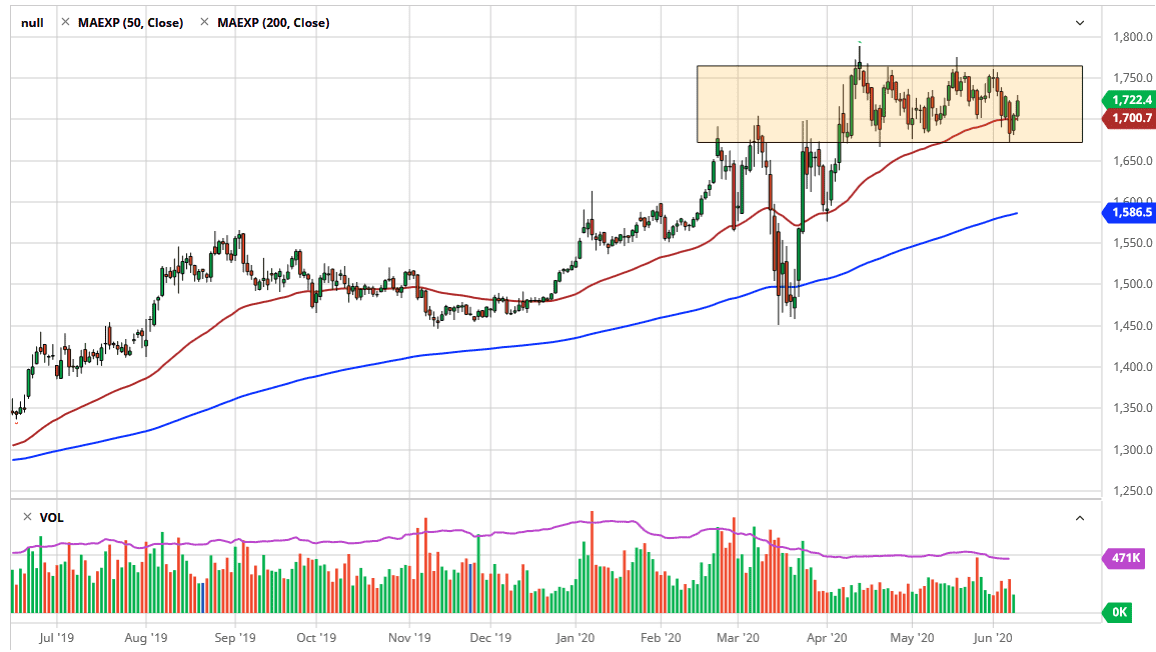

Gold markets have shown themselves to be somewhat resilient in the sense that we have bounced from the 50 day EMA recently and have broken above the $1700 level. The $1750 level above is a significant resistance barrier that extends to the $1760 level. I think at this point, it is likely that the market will probably continue to go back and forth as we wait to see what happens between now and the end of the Federal Reserve meeting on Wednesday. If Jerome Powell suggests that more quantitative easing is coming, it is highly likely the gold will take off.

I do think that longer-term the market will continue to go much higher, especially as the $1800 level would come into play. If we can break above the $1800 level, then it is likely that the market will move towards the $2000 level.

On the downside, I think that the $1675 level continues to offer enough support to keep this market afloat, and thereby I believe it is only a matter of time before buyers would come in on a pullback. I would be a bit surprised if the Federal Reserve statement with anything remotely close to hawkish, and unless that is the case I have a hard time believing that the Federal Reserve is certainly going to shift to that type of stance. If that is the case, it is only a matter of time before we continue higher.

A breakdown below the $1675 level could send this market looking towards the $1650 level, followed by the crucial $1600 level that is not only a large, round, psychologically significant figure, but it is also where the 200 day EMA would come into play. Because of this, I think it should have more than enough support. Ultimately, this is a market that is going to go higher, longer term, and gold will be a better longer-term investment. I have no scenario in which I’m willing to short this market, because it would take a significant amount of shift when it comes to the way central banks around the world behave, and a significant shift in all of the risks that are found. Look at pullbacks as potential value, I know I certainly will, as it has worked so far.