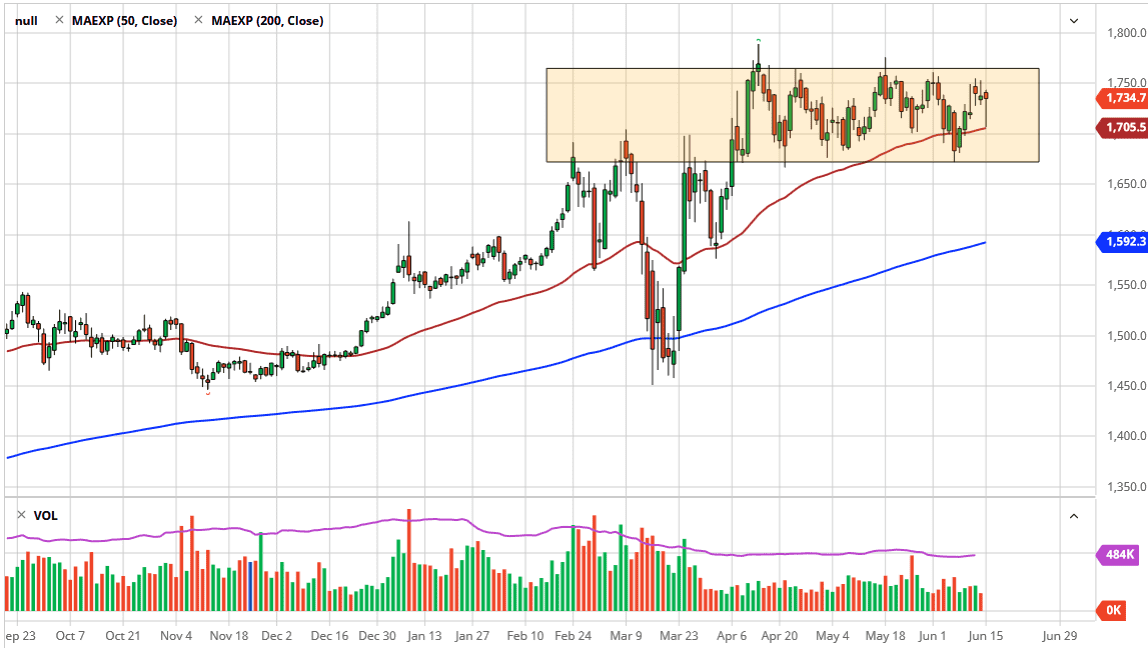

The Federal Reserve stepped out and saved the market again that was selling off a little too hard in New York trading as they announced the buying of individual corporate bonds to form portfolios. Most of these will revolve around large employment basis, but basically at this point the Federal Reserve is moving in a trajectory to kill the US dollar, and then of course start buying as many stocks as possible. Regardless of political feelings, the reality is that this is awfully bad for the US dollar, which of course is good for gold. Because of this, we have seen the market turn around completely which coincided quite nicely with the $50 level.

Underneath, there is massive support down to the $1675 level should keep that in mind as well. It is not until we break down below there that you need to be concerned. Even then, I think there is plenty of support down at the $1600 level due to the fact that the 200 day EMA is right there, and it was an area where we have seen plenty of buyers in the past. Ultimately, this is a market that has been in a long-term uptrend, and I think that it is only a matter of time before we break out.

The choppiness should continue to be a major feature of this market, and quite often “consolidation leads to continuation.” If we can break above this range, it is likely that the market then goes looking towards the $1800 level. If we break above there, then we are likely to go much higher, perhaps reaching towards the $2000 level. I have no interest in selling gold at all, as it has been an area in a bull trend for quite some time, and I think at this point we are simply just trying to consolidate and figure out where we are going next. Pullbacks at this point have to be looked at as a potential buying opportunity, as the market has shown quite a bit of resiliency and quite frankly there are plenty of risk headlines out there that could cause quite a bit of noise. After all, the world is an extremely dangerous place right now from a financial standpoint, so it makes quite a bit of sense that we would continue to see gold strengthen.