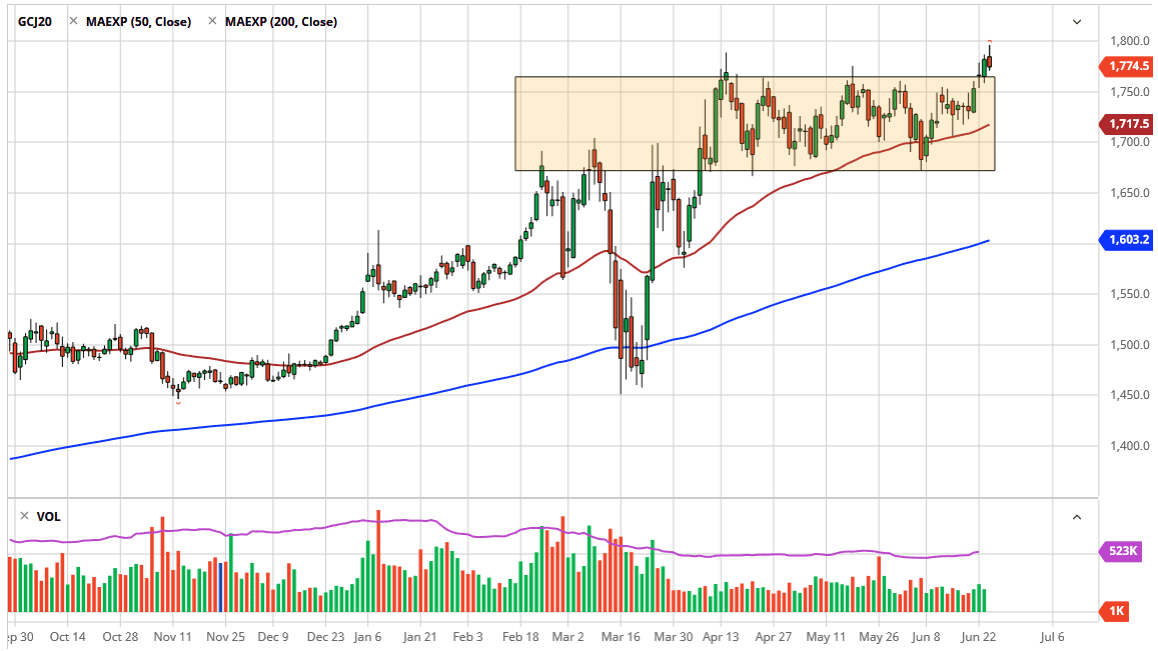

The gold markets did rally and break out to the upside during the trading session on Wednesday but gave back the gains as we get close to the $1800 level. The $1800 level of course is an extraordinarily strong barrier, not only due to the fact that it is near the recent highs but because it is a large, round, psychologically significant figure. With this in mind, I believe that the market breaking above that level is a major signal to start buying gold yet again, but we may need to back up a little bit and build up the momentum first.

On the downside, I believe that the $1750 level will continue to be crucial, as it is an area that was resistive so many times on the way up. This should now have a bit of a “market memory” fixed into it, and therefore I think it is only a matter of time before people would be looking for buyers to come in and pick up gold based upon FOMO. Underneath there, the 50 day EMA is going to reach down towards the $1717 level, and I think there should be a significant amount of support there as well. All of that being said, I think that you can look for value given enough time on pullbacks, and that is probably going to continue to be the best way to trade in the gold market.

If we were to break above that $1800 level it would not only be a bullish sign due to the fact that it is a large, round, psychologically significant figure, but it is also the market breaking above the top of a shooting star-shaped candlestick, which shows that there are a lot of sellers trapped in the position and they will have to turn around and cover.

The market will probably find plenty of reasons to go higher, not the least of which will be central banks around the world flooding the markets with liquidity. Beyond that, there are a lot of concerns when it comes to geopolitical issues and with coronavirus continuing to cause a lot of angst. It is probably going to have people looking for safety over here. The one thing that is probably working against gold more than anything else is the fact that the US dollar has had a nice run over the last 24 hours.