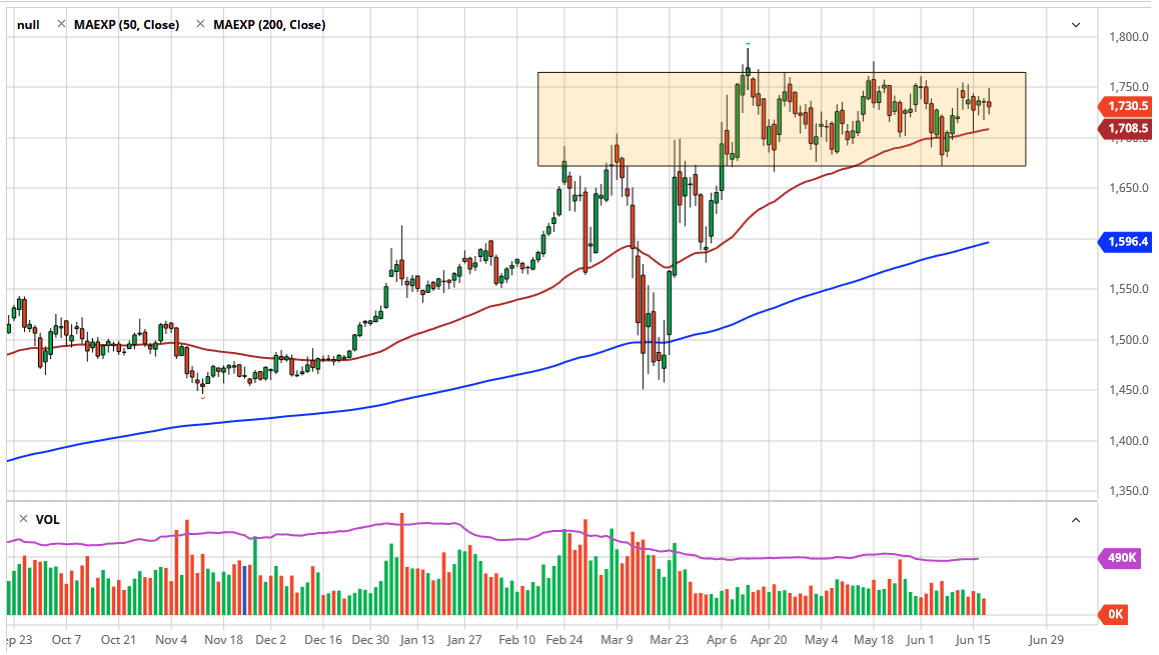

Gold markets were very volatile during the trading session on Thursday, as we reached towards the $1750 level, but then pulled back rather significantly. At that point, they then broke down a bit before turning around again. Quite frankly, gold markets continue to be very choppy and difficult to navigate, at least from a patient perspective. The $1750 level above is resistance and that extends all the way to the $1760 level, if not the $1775 level.

On the downside, the market should see plenty of support at the $1700 level, assuming that weaving gets that low. We have seen quite a bit of noise, and I think that continues to be the case due to the fact that the gold market offers safety, but at the same time, we are starting to see a lot of the US dollar strength coming out in fear as well. If that is going to be the case, then it makes sense that the strengthening the US dollar may occasionally cause a bit of resistance for the gold market.

For some time, we have been bouncing around in this general vicinity that extends all the way down to the $1675 level, and even though it has been difficult to navigate the last couple of days, the market is essentially dragging out in a long rectangle. Rectangles tend to cause quite a bit of choppy behavior, but you should keep in mind that there is the old adage “consolidation tends to lead to continuation.” If that is going to be the case, and typically it is, then we could go higher and reach towards the $1800 level. Breaking above the $1800 level should send this market looking towards the $2000 level, which I will say is the longer-term target. This does not mean that we can get there overnight, and I do think that it is going to take a lot of work to make happen. However, once we do break out to the upside, I think that the move will be rather quick, which we typically see in this market, a lot of choppiness followed by sudden impulsive moves. With that in mind, I like the idea of buying gold on dips because this marketplace tends to move suddenly, and then consolidate as people try to measure the next risk event or other such geopolitical issues.