The US dollar’s strength and the rush to it as a safe haven with the return of investors’ fears from increasing pressure on the global economy from the start of the second wave of the Coronavirus outbreak, contributed to new downward pressure on the GBP/USD and the 1.2343 support and closed last week's trading at that level. What added to the technical sales, was the formation of the head and shoulders shape, and the absence of incentives for the Pound. The European failure to pass stimulus plans at their summit last Friday had a negative impact on the Pound, which is also awaiting a European response to the important Brexit dossier.

On the economic front, the change in the claimants’ number in the UK was lower than expected by 370 thousand, with a reading of 528.9 thousand. However, the unemployment rate exceeded expectations by 4.5% with a reading of 3.9%, and average wages, including and excluding bonuses, came with readings of 1% and 1.7%, respectively, while the markets were expecting 1.4% and 1.9%. The CPI for May matched expectations for 0.5%. The core output of the PPI was also in line with expectations. However, the core CPI, PPI inputs, and the retail price index came in below expectations.

The most important event was the BoE vote to keep the base rate unchanged at 0.1%. The Monetary Policy Committee, chaired by Bank of England Governor Andrew Bailey, decided to raise the size of the asset purchase program by 100 billion pounds to 745 billion pounds. Eight members, including Pelly, voted to raise the QE because they saw more easing of monetary policy to achieve goals, while chief economist Andrew Halden preferred to keep the program at 645 billion pounds. The Monetary Policy Committee expected the program to reach 745 billion pounds at the beginning of the year.

The bank's policymakers said they were ready to take further measures as required to support the British economy and ensure a steady return to inflation to the 2 percent target.

According to the technical analysis of the pair: On the short term, the GBP/USD pair appears to be trading within a bearish channel on the 60-minute chart. This indicates a short-term bearish bias in market sentiment. The pair is approaching oversold levels. This could lead to a short-term recovery. Accordingly, bulls will target short-term retracement profits at around 1.2441 or less at 1.2507. On the other hand, bears will look for extending the current drop towards 1.2325 or less at 1.2263.

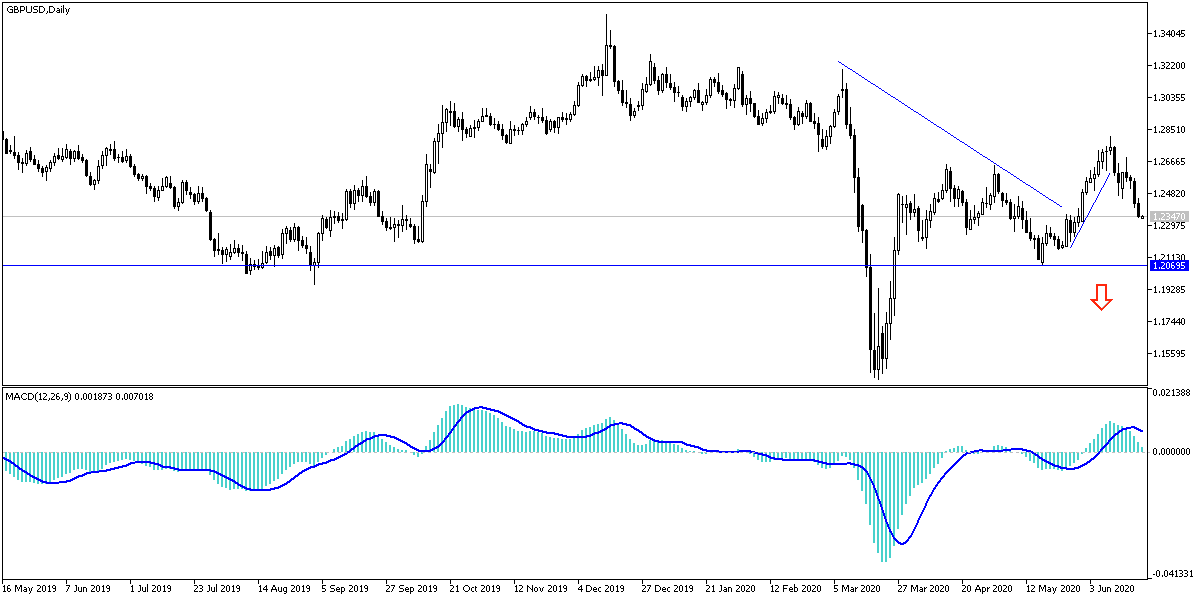

On the long-term, and according to the performance on the daily chart, it seems that the GBP/USD has recently retreated from the two-month high of 1.2750. It is now trading at 50% Fibonacci level. The pair continues to recover from its multi-year lows in March at 1.1400. Therefore, bulls’ speculators will target long-term profits at 61.80% and 76.40% Fibonacci at 1.2713 and 1.3023, respectively. On the other hand, bears will look to bounce at 38.20% and 23.60% Fibonacci levels at 1.2204 and 1.1903, respectively.

As for the economic calendar data today: There are no significant UK economic releases expected today. From the United States of America, existing home sales will be announced.