The US dollar strengthened and renewed fears about the future of Brexit and the varied economic performance of both Britain and the United States. This was a catalyst to form a bearish channel for the GBP/USD pair, which tumbled to the 1.2314 support, and this week's trading began with stability around the 1.2350 level. The pressure on the pound increased with the resumption of Brexit talks and the demand for the dollar as a safe haven, with an increased risk aversion among investors amid a rise in Covid-19 cases.

The weekly losses were the third in a row. The pound may be subject to a further decline in the coming days, especially if investors take the difficult acknowledgment the government is considering reimposing, if the market responds negatively to the latest statistics from the United States, India, and elsewhere.

Risk assets such as Sterling suffered a setback after aspects of previous efforts to reopen the American economy were reversed. Texas Governor Greg Abbott ordered the closure of all bars after a sharp rise in new cases in the state, and the governor of California considered re-enforcing the Stay Home Act. Concerns about the US-China trade agreement were also an additional pressure on market sentiment.

The strength of the US dollar may increase with an increase in Covid-19 cases in the coming days. New Jersey, which has the second-largest outbreak in the United States, increased by 8.2% in one day, while the rise in the total number of cases increased to 176,045 as of Sunda. Florida saw another strong increase in cases, although not recording more than 5%. The outbreak in the states, mainly in the south and west, has re-established the national epidemic curve, and at the same time, the virus threatens the situation in India, Mexico, South Africa, and others by replanting the global curve. Many analysts believe that the second wave in the United States will be sufficient to keep the stock markets under pressure, and in return, the demand for the dollar will increase.

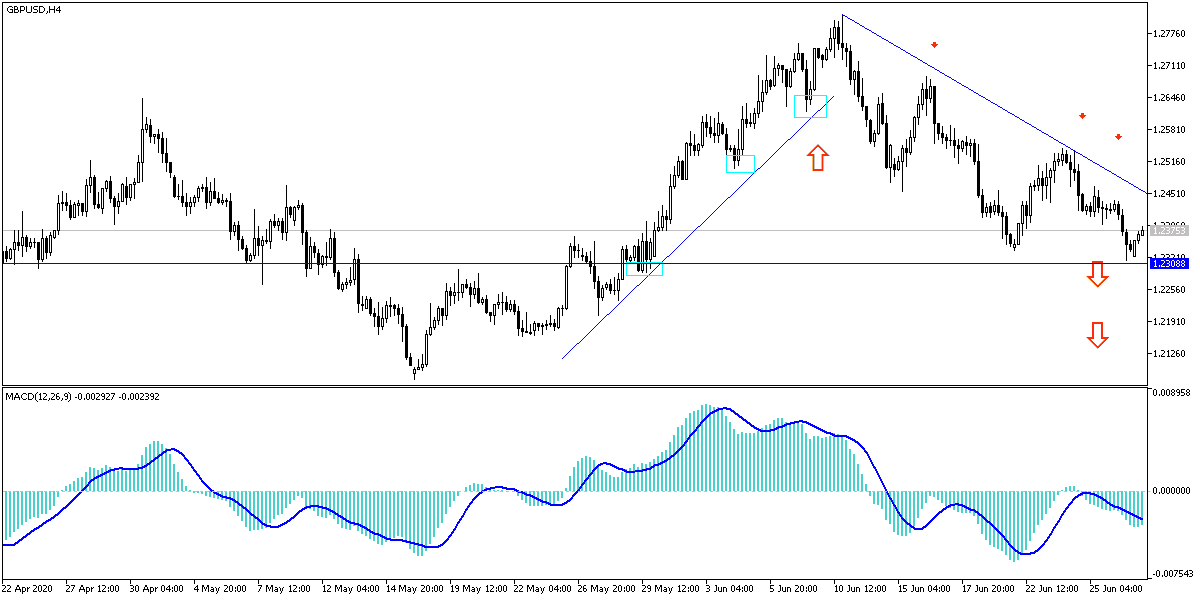

According to the technical analysis of the pair: The US dollar is still the strongest, and the second wave of Coronavirus will increase its gains, which means that the GBP/USD remains under downward pressure, and currently broke the 1.2320 support. I mentioned earlier that it will establish the strength of the bear control and push the pair towards stronger support levels, the closest ones are currently 1.2255, 1.2170, and 1.2080 respectively. On the other hand, as I mentioned before, the opportunity to rebound up will depend on the pair succeeding in surpassing the 1.2640 resistance. Stronger pressure factors on the pair’s performance in the coming days are Brexit developments between the European Union and Britain.

As for the economic calendar data, today: From the UK, the money supply, mortgage approvals, net lending to individuals, and statements by the Governor of the Bank of England will be announced. And from the United States pending home sales data will be released.