A positive but cautious start for the GBP/USD price for this week, as the pair bounced to 1.2476 after the recent sell-off that pushed it towards the 1.2335 support, its lowest level in three weeks. The cable ignored BoE Governor Andrew Pelly's comments in which he said the bank should adjust its quantitative easing program before starting to raise interest rates. Bailey wrote in an article published on Bloomberg that central bank reserves cannot be taken for granted.

"When the time comes to withdraw the monetary stimulus, in my opinion it would be best to consider adjusting the level of reserves first without waiting for interest rates to be raised on a sustainable basis,". Bailey also said, "High budgets may limit maneuverability in future emergencies." He added that he does not want high central bank holdings of government debt to become a permanent feature. The financial system must not rely on these extraordinary levels of reserves.

Last week, the British Central Bank raised its quantitative easing by 100 billion pounds to 745 billion pounds. The bank cut its benchmark interest rate to a historic low of 0.1 percent in March.

With very little exciting news expected from the Bank of England and the Brexit in the coming days, the global and local image of covid-19 will be of greater importance, as markets study some new data from the UK economy on Tuesday in addition to signs of an increase in global infection rates Covid-19.

Asian markets traded relatively choppy on Monday, but European markets appear to have poured some confidence into the performance, as it surged higher on the open, sparking a rally in the cable. The global stock markets are important for the British pound, which tends to perform poorly such as the dollar, the Euro, the Yen and the Franc when markets are sold, but it tends to advance against the New Zealand dollar and the Australian dollar under these conditions. The broader attractiveness of market trends tends to grow with local news from Brexit and Bank of England policy, and this is likely to be the case this week, as there are no significant events scheduled related to either of them.

If stock markets rise higher in the coming days, the Pound may find more support to offset recent losses. The market is cautiously monitoring new infections with the Coronavirus at the time of reopening. The new infections hitting a record high is a threat to the future of global economic recovery, with more than 183,000 infected people, including 116,000 in the Americas.

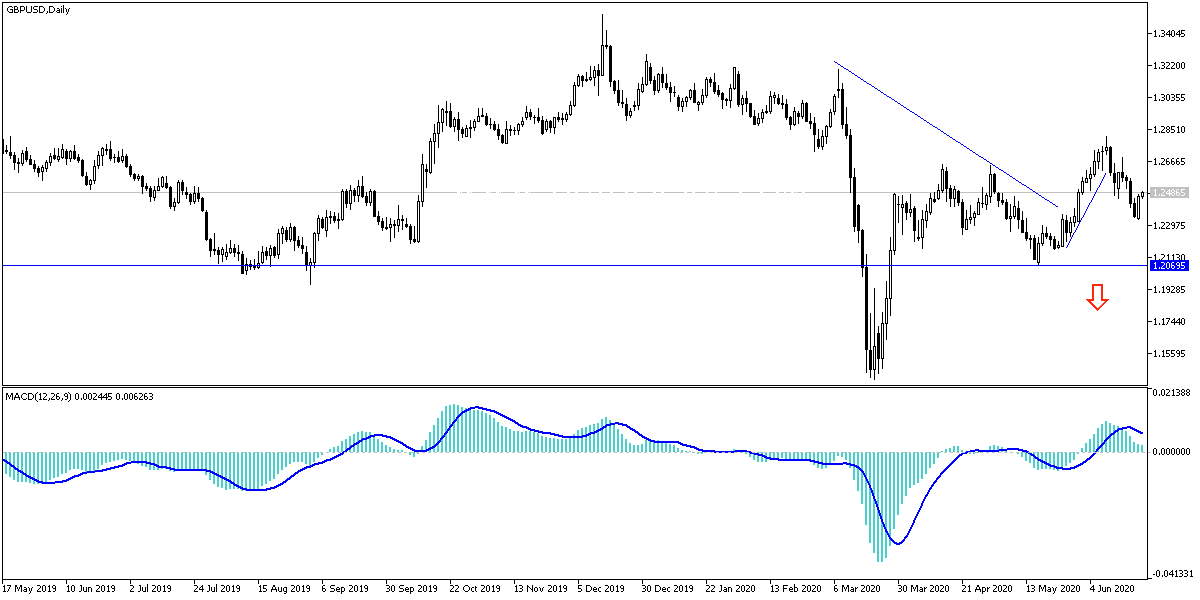

According to the technical analysis of the pair: The recent bounce did not change the GBP/USD downward momentum, as the lack of risk appetite for the markets threatens the GBP gains. As I mentioned earlier, pressure factors on the pound continue to be the Brexit file in addition to the possibility of negative interest rates from the BoE and market anxiety from a second Covid-19 wave. This confirms the trading strategy of selling from every upper level. The closest resistance levels for the pair are currently 1.2520, 1.2600 and 1.2675, respectively. On the other hand, the 1.2320 support will remain supportive for stronger bear control.

As for the economic calendar data today: From Britain, the PMI reading for the industrial and services sectors will be announced. From the United States, new homes sales and reading of the Richmond Industrial Index will be released.