For 4 consecutive sessions, the GBP/USD is trying to maintain recent risk on gains, which pushed it towards the 1.2755 resistance, the highest level in 3 months, but the Brexit file continues to be a pressure factor on any Pound gains. The pair quickly returned to the 1.2616 support during yesterday’s session before stabilizing around the 1.2730 level at the beginning of Wednesday trading ahead of the announcement from the Fed Reserve of their monitory policy. Contributing to the pair’s losses yesterday was the caution in the markets ahead of the Fed’s announcement, which will be crucial in determining whether the loud recovery in the stock markets will continue or not.

Markets are looking forward to the commitment by Chairman Jerome Powell to continue strong pressures on monitory policy for further easing to face the Coronavirus shocks.

In recent updates regarding losses from the epidemic, WHO officials increased their remarks of fears regarding a second infection wave. They stated that the global situation is getting worse despite containing the situation currently in Europe and North America. Meanwhile, the tension between China and the rest of the world conatus to escalate. It was reported that Chinese fighter jets entered the Taiwanese Air Field, and the South China Morning Post Newspaper published pictures of soldiers deployed at the borders where there is a conflict on the land between the two nuclear countries. In addition to that, fears continue about the future of the “Phase 1 deal”, signed on Jan, which to a large extent ended the trade war between the world 2 largest economies.

As for the US economy. American employers laid off 7.7 million workers in April - a sign of the depth of the economic gap after thousands of offices, restaurants, stores, and schools were closed during the epidemic. And the US Department of Labor said in its report yesterday that job vacancies have declined, and almost all jobs disappeared in April. The number of jobs available fell 16% from March to 5 million. Salaries decreased by 31% to 3.5 million.

The bleak April month - which followed a darker March with 11.5 million layoffs - suggests that the US economy can take some time to recover nearly a decade of gains that have disappeared in about 60 days. In this regard, the US government said in a report last Friday that employment had recovered in May, adding 2.5 million jobs. However, these gains appear to reflect the laid-off employees who are returning to work and an increase in people with part-time jobs, rather than the economy at full capacity.

Yesterday's report showed how employers quickly responded to the epidemic by removing or laying off workers in March, although this slowed the following month as consumer spending seemed to hit bottom and even recovery was slight. The JOLTS survey shows employment figures and layoffs in general, while monthly job data reflects net changes.

The next several months could present a challenge as monthly employment was only 60% of the 2019 average. There were 4.6 unemployed workers per vacant job, meaning that it would likely take the economy some time until it returns to its health before the period of the Corona pandemic.

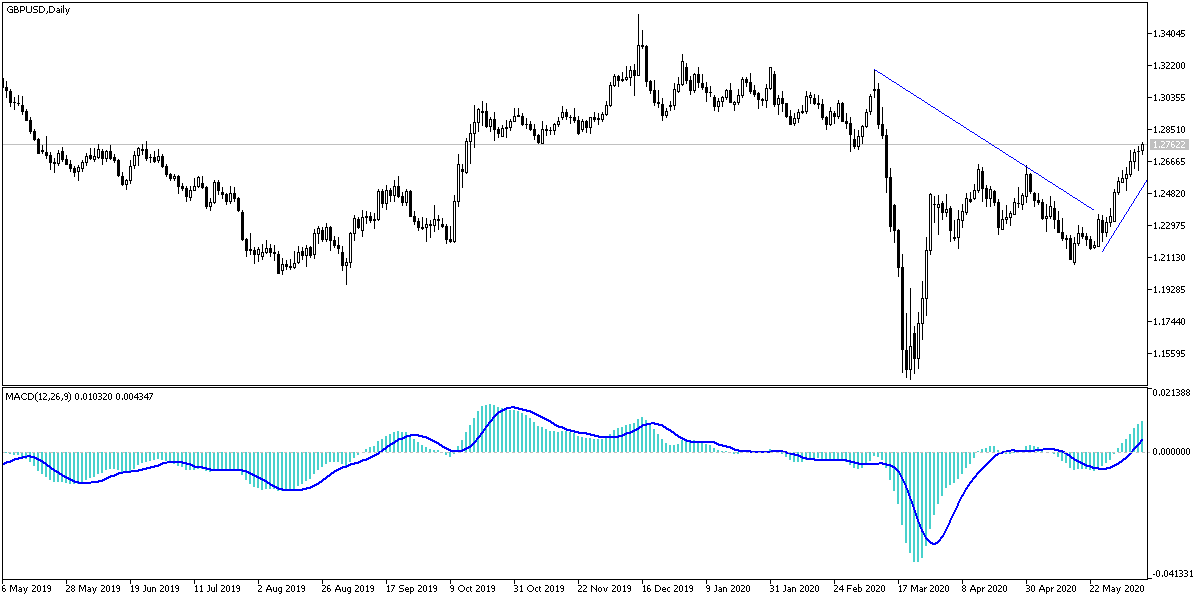

According to the technical analysis of the pair: On the daily GBP/USD chart, the pair still has the opportunity for upward correction as long as it is stable above the 1.2700 resistance and the current reversal of the trend will be strengthened with exceeding the 1.2855 resistance barrier and the bulls may give up the reins in the event of an update to the negative track of the negotiations between the two sides of Brexit, the European Union and the U.K. This will be possible at any time, which supports our trading strategy by selling the pair from every upper level. On the other hand, the 1.2485 support will remain very important for the bears to move the pair back to the swamp of its previous losses.

As for today's economic calendar data: There are no significant UK economic releases. All focus will be on US data, with the announcement being made first for a reading of the US consumer price index, then the announcement of monetary policy decisions by the US Federal Reserve, and later the press conference of Governor Jerome Powell.