For the first time in three months, the GBP/USD price is moving towards the 1.2812 resistance, amid a strong retreat of the US dollar against other major currencies. The pair is holding around the 1.2750 level in early Thursday trading. The pressure on the US currency increased after the US central bank kept its monetary policy and interest rate close to zero and said it may remain the same until 2022.

In its monetary policy statement, the Fed also favored emergency lending programs to revive the flow of credit to families and companies, after the financial markets were closed in March when investors sold a huge array of securities to boost their cash holdings. The US central bank indicated that the outbreak caused a decline in economic activity and an increase in job losses in historical proportions. US central bank officials estimate that the economy will contract - 6.5% this year, in line with other expectations, before growing at 5% in 2021. They expect the unemployment rate to reach 9.3%, near the height of the last recession, and the rate is now 13.3%.

Projections indicate that the Fed does not expect the US economy to fully recover from the recession until 2023.

"I assume that there will be a significant portion - in millions - of people who are not returning to their old jobs," Powell said at his press conference. And “it may take a few years” before they find a job.

On the British side, the Brexit negotiators agreed to continue trade talks over the summer of last week, and the talks did not produce anything new stimulating the markets, and with the end of the markets' interaction with what the Federal Reserve announced, attention could quickly shift to the British economy and the Bank of England policy.

British GDP data will be released for April, the first full month of "closure" to counter the Corona effects, on Friday at 07:00 and the market is looking for a slowdown of - 18% on a monthly basis. The data will come as the government struggles to reopen schools in the country, and regarding plans for a full return for all children to schools by September is in question this week.

As for the BoE policy, the BoE Governor Billy's comments indicate that the possibility of negative interest rate approval is under review. At least it was not explicitly excluded, as was the case with his predecessor. The Bank of England is widely expected to increase its QE target next Thursday to maintain pressure on government bond yields and help absorb the growing supply that is due to hit the debt market this year as a result of coronavirus-linked borrowing.

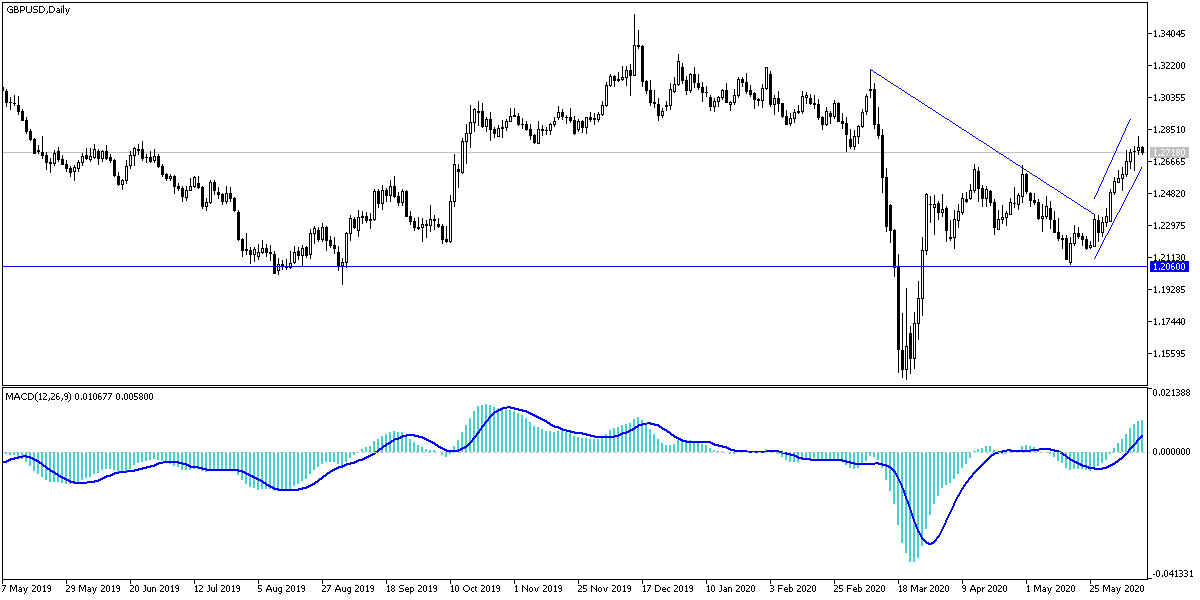

According to the technical analysis of the pair: I still commit to the GBP/USD trading strategy of selling from each upside level as noted in the performance on the daily chart with all strong gains followed quickly by profit-taking sales. The closest resistance levels to do this are now 1.2790, 1.2855 and 1.2930, respectively. On the other hand, the collapse of the pair towards the 1.2580 support will support the start of the bear's move again strongly. Pound pressures remain from Brexit future and that the BoE monetary policy may bring negative interest.

As for today's economic calendar data: All focus will be on the results of the US economic data, which are producer price index, and jobless claims.