Despite recent GBP/USD bullish correction attempts the pair, these gains are very cautious, in anticipation of the future of the fateful negotiations between the two sides of Brexit. The pair's recent gains were capped by testing the 1.2615 resistance, the highest level in a month before settling around the 1.2570 level at the beginning of Thursday's trading. The gains made by the pound sterling face pessimism that has accumulated over the status of trade negotiations between the European Union and the United Kingdom, and the fourth round, which is taking place this week, is the last before the mid-year assessment by European Union leaders.

Markets expect both sides to report on Friday that while some areas of negotiations have been resolved, important issues remain pending, which increases the possibility of the European Union and the United Kingdom failing to control trade within the framework of the World Trade Organization in early 2021.

Despite Brexit concerns, the Sterling is rising, this is due to the fact that the markets have more than enough time to absorb the inevitable lack of progress in these first rounds of trade negotiations, and in return, it is clear that there is still a lot of time and opportunity to conclude a deal. In fact, a deal will only be reached in the end as is usual in such negotiations, and therefore it may be unwise for traders to rush into short positions.

It now appears that the focus of the Forex currency market will be on a meeting between Prime Minister Boris Johnson and European Commission President Ursula von der Leyen later this month, as they will make efforts to prevent the failure of trade negotiations. The current sterling gains could increase if the prospective meeting increases the possibility of a trade deal between the European Union and the United Kingdom by the end of the year. In this regard, British officials told the Financial Times that they hope Johnson and Von der Leyen will inject "political momentum" into the talks, which have been stalled in disputes over fishing rights and European Union demands for common standards on state assistance, labor rights and the environment. One official said: “We need a broad agreement by the summer. We can still make this deal in September or October. ”

On the optimistic side, European Union chief negotiator Michel Barnier told European ambassadors that he believed the UK government wanted to make progress in the next few weeks. David Frost, the British Prime Minister's negotiator, is keen to counter the perception that negotiations have reached a dead end and that a free trade agreement with the European Union cannot be concluded this year.

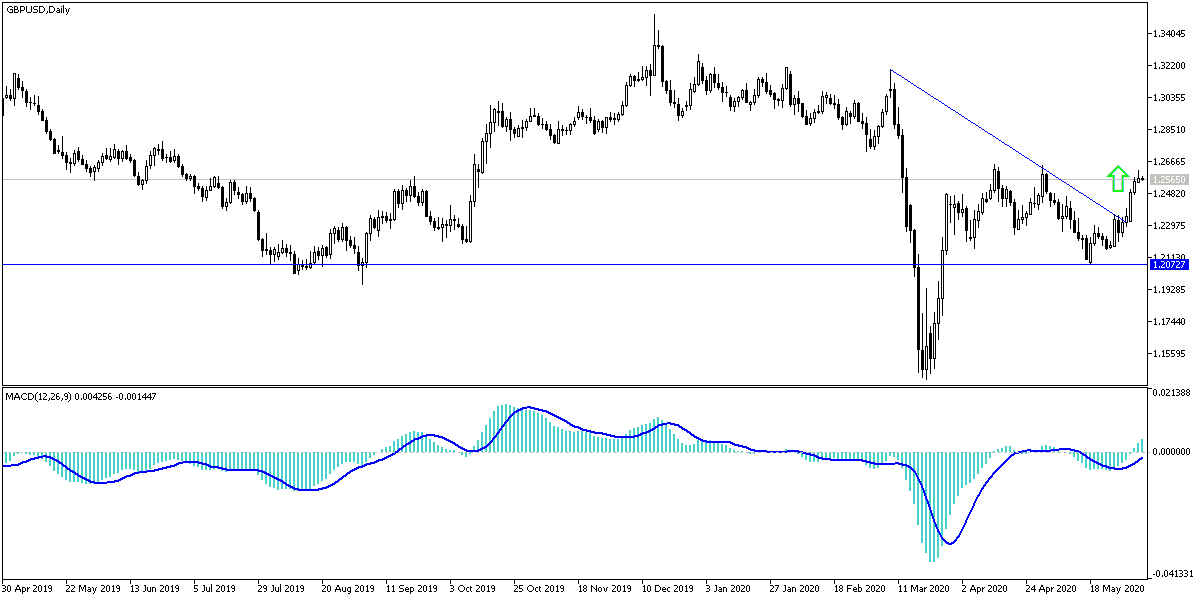

According to the technical analysis of the pair: If there are positive signs for the future of the agreement between the two sides of Brexit, GBP/USD gains may increase more than the current gains, and the closest resistance levels for the pair are currently 1.2620 and 1.2700 which are areas that stimulate the strength of bulls control and the bullish reversal. On the other hand, I still hold that the 1.2325 support is supportive of the recent collapse of optimism and the return of the bear's control over the performance.

As for economic calendar data today: From Britain, the PMI index for construction will be announced. The US economic data includes claims for the unemployed, the trade balance, non-farm productivity and unit labor costs.