Gains are still facing caution and anticipation over the course of Brexit negotiations. This applies to the GBP/USD performance. The sell-offs amid fears of a new outbreak of the Coronavirus with the reopening of global economies pushed the pair towards the 1.2454 support, but with the return of trading amid cautious optimism. The pair corrected upward again to the 1.2670 level at the beginning of today’s trading. Pound gains increased after British Prime Minister Boris Johnson confirmed that the deadline for the UK to exit from the European Union is the end of July.

"I certainly do not want to see this continue until the fall/winter as Brussels wishes, I don't see any reason for that", Johnson said after a discussion with senior EU leaders. Johnson met with the President of the European Council, Charles Michel, the President of the European Commission, Ursula Von Der Lin, and the President of the European Parliament, David Sasoli, via video conference. After the talks, Johnson said the UK has a "very good opportunity" to get a business deal, provided we "start it now and do it."

The two sides recognized the UK's commitment not to request an extension of the transitional period. Consequently, the transitional period will end on December 31, 2020, in line with the provisions of the withdrawal agreement. The parties, however, agreed that new momentum was needed. They supported the plans agreed by the chief negotiator to intensify the talks in July and created the best conditions for concluding and ratifying an agreement before the end of 2020. This should include, if possible, reading a statement issued by the UK government after the talks, to gain an early understanding of the principles underlying any agreement.

The commitment to reach an agreement saw what was agreed by both sides last week, to have five other negotiating rounds. A five-week round between the week beginning June 29 and the week beginning July 27.

In general, the possibility of more negotiation rounds between the two sides will ease some of the recent pressure on the British pound, as the possibility of reaching a negotiated deal has now increased. This means that the lion's share of the issues must be dealt with by the end of July, and a few problematic points will likely require face-to-face meetings between Johnson and other EU leaders to resolve them. This move will give the financial markets a great opportunity to put forward the future expectations for the GBP against the other major currencies.

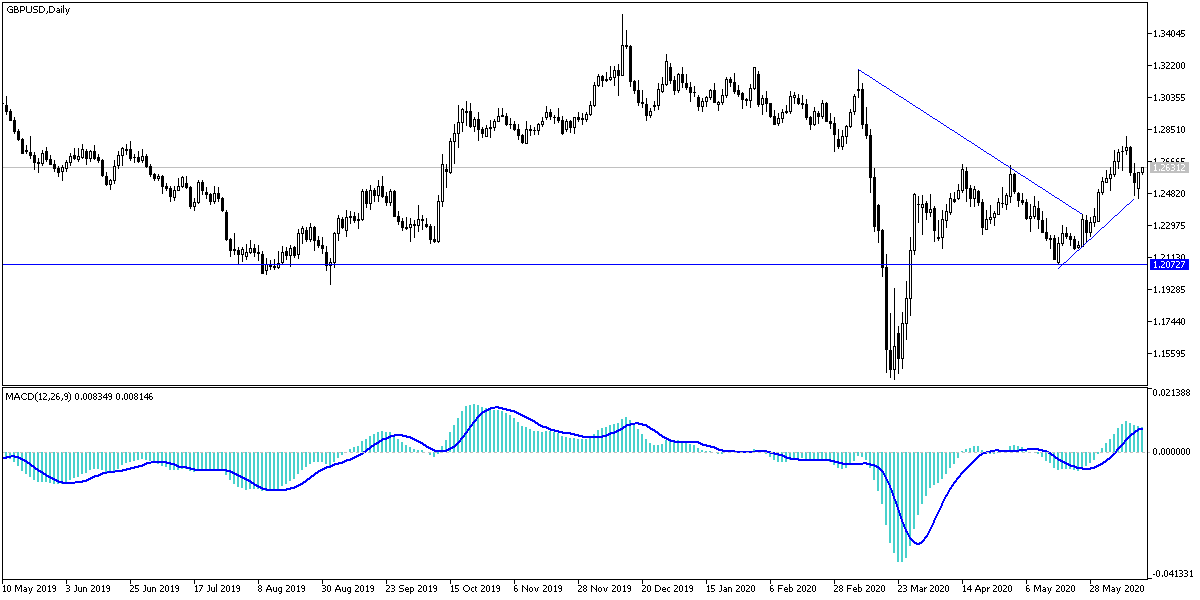

According to the technical analysis of the pair: The failure of the GBP/USD current bullish correction may support the strengthening of the head and shoulders formation on the four-hour time frame. If that happens, it will push the pair towards technical sell-offs that negatively affect the current bullish opportunity, which will be strengthened if the pair breaches the 1.2800 resistance that the pair succeeded in breaking last week. It will support the next most important move towards 1.3000 psychological resistance after that. On the downside, stability below the 1.2500 support will add to the pair's bearish momentum.

As for the economic agenda data today: From Britain, British job numbers and wages will be announced amid expectations of disappointing numbers, as the UK is the last European country that intends to reopen its economy, and today's data will be at the height of the closing period. From the United States, the focus will be on announcing retail sales figures and industrial production, and then important statements by Federal Reserve Governor Jerome Powell.