GBP/USD attempts to bounce back upward are still weak despite the decline in the US dollar, as gains did not exceed 1.2542 before settling around 1.2520 at the time of writing. The pair's gains are from a bounce at the 1.2335 support, and the weak correction is due to the fact that the GBP still faces more risks despite the recent stimulus from the Bank of England, as the Brexit file is still the most influential. The future of trade relations between the two sides of Brexit - the European Union and the UK - is still an uncertainty to the markets after the end of the transitional period by the end of this year 2020.

The British economy appears to have reached its lowest level in June, according to PMI data. The data showed that the manufacturing sector has already begun to grow again, but the services sector - which is the largest component of the British economy - is still in contraction. The Markit/CIPS manufacturing PMI reading was 50.1, higher than last month's expectations at 40.7 and above expectations of 45. The Services PMI reading was at 47, against expectations of 40 and amid a marked improvement from the previous month's reading of 29.

The Composite PMI reading - which groups the manufacturing and services sectors together - was at 47.6, higher than the market expectation for 41 and the previous month's reading of 30. The rise since May (+17.6 points) was the largest for the Composite PMI since the beginning of the series in January 1998, which highlighted the decisive shift in momentum according to IHS.

PMI data is the most closely watched survey for the economy because it provides such insight at the right time, and any reading below the 50 level represents a contraction, while a reading above that level represents growth in performance. Consequently, yesterday's data showed that only the manufacturing sector is growing again, but the scene is poised to recover at all levels in July, especially as UK closures are further eased.

Meanwhile, private sector firms also pointed to a rebound in business prospects for next year, with confidence hitting a four-month high in June. According to IHS Markit, survey respondents mainly indicated that easing restrictions related to the Corona Virus Pandemic (COVID-19) had a positive impact on economic activity, with commercial operations gradually resuming in a number of sectors and staff returning from leave.

However, there were also widespread reports that basic demand was still very weak and that cuts in customer spending were equivalent to continuing drag on general business.

Looking ahead, manufacturers noted a rise in business optimism to the highest level since September 2018. The expectations of higher output in the next 12 months reflected hopes for a sustainable recovery in manufacturing operations from the stagnation in production volumes seen during the initial phase of the COVID-19 epidemic Economists at IHS Markit predicted that the UK economy would contract - 11.9% this year before growing by 4.9%, a relatively modest proportion in 2021, which is much more cautious than the 15% increase expected in 2021 by the Bank of England.

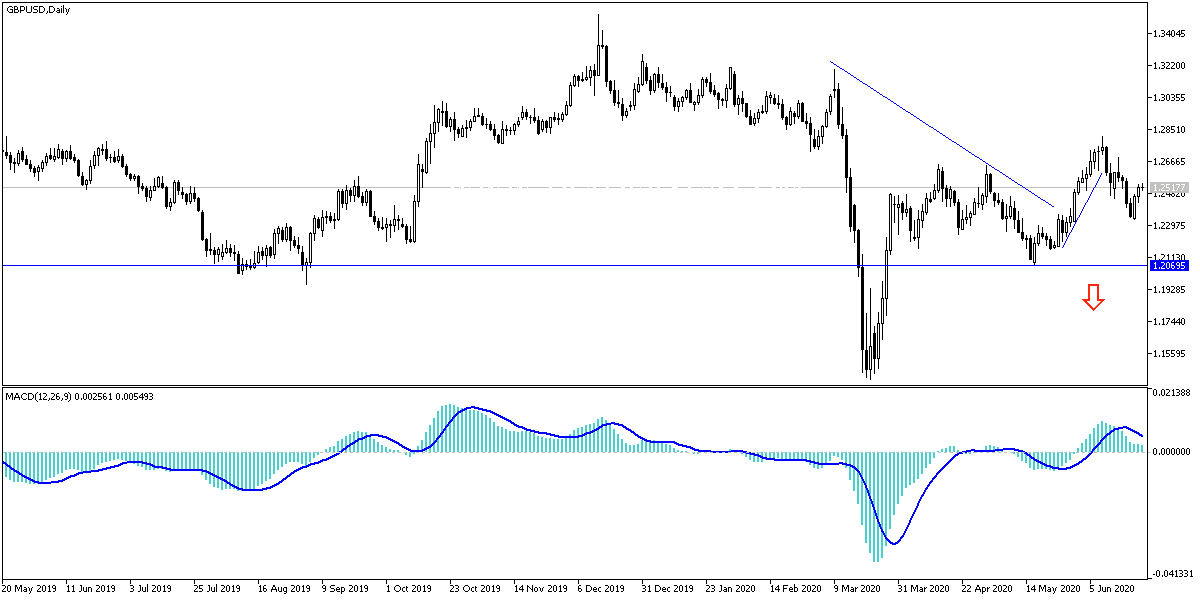

According to the technical analysis of the pair: On the daily chart, the GBP/USD is still in the range of a breaking the recently formed bullish channel and still needs to breach the 1.2670 resistance to return to the range of that channel again. On the other hand, the bears will gain more performance by moving towards 1.2470 and 1.2390 support levels respectively. I still prefer to sell the pair from every higher level. The pair is not expecting any important economic releases, whether from the U.S or the U.K today.